Global Oral Typhoid Vaccines Market - Key Trends & Drivers Summarized

Can Oral Vaccination Strategies Revolutionize Typhoid Control in Endemic Regions?

Oral typhoid vaccines, primarily based on live attenuated strains like Salmonella Typhi Ty21a, are playing a transformative role in the global strategy to combat enteric fever, particularly in low-resource, high-burden regions of Asia and sub-Saharan Africa. Unlike injectable Vi polysaccharide or conjugate vaccines, oral formulations offer the advantages of needle-free administration, mucosal immunity stimulation, and ease of deployment in mass immunization campaigns. As global public health efforts intensify to curb typhoid morbidity and mortality, oral vaccines are gaining renewed attention for their scalability and acceptability, especially in children and adolescents.The World Health Organization (WHO) has endorsed oral vaccines for travel-related and endemic typhoid control, recognizing their potential to complement parenteral options in diverse population segments. Moreover, the increasing prevalence of multi-drug resistant (MDR) and extensively drug-resistant (XDR) typhoid strains has elevated the importance of preventive vaccination. Oral typhoid vaccines serve as a critical first line of defense in regions where antibiotic treatment options are becoming increasingly limited or ineffective.

Why Are Vaccine Compliance and Cold Chain Advantages Driving Oral Adoption?

In contrast to injectable vaccines, oral typhoid vaccines such as Vivotif® eliminate the need for trained healthcare workers for administration and reduce the risk of needle-stick injuries or infections. This makes them particularly effective in rural and peri-urban areas with limited medical infrastructure. Oral vaccines also promote higher compliance, especially in school-based vaccination programs or travel clinics, where multi-dose schedules can be administered with fewer logistical barriers.Moreover, oral vaccines typically have better cold chain resilience compared to their parenteral counterparts. Some formulations demonstrate stability across a wider temperature range, simplifying storage and transportation during field campaigns. These features are critical for outreach in remote or disaster-prone regions where electricity and refrigeration are unreliable. Such operational flexibility is positioning oral typhoid vaccines as an integral part of emergency response toolkits and humanitarian health interventions.

How Are Policy Shifts and Public Health Programs Expanding Vaccine Uptake?

International donor agencies and national immunization programs are increasingly recognizing the role of oral typhoid vaccines in integrated disease control. Public health partnerships supported by Gavi, the Vaccine Alliance, and UNICEF are promoting vaccine introduction in endemic regions with a dual approach: deploying injectable conjugate vaccines for infants and oral vaccines for older age groups or travelers. Countries such as India, Bangladesh, Nepal, and Kenya are incorporating oral vaccines into travel advisories, military health protocols, and refugee health programs.Post-vaccination surveillance data is strengthening the case for broader oral vaccine inclusion in routine immunization. Studies show that Ty21a-based vaccines not only reduce typhoid incidence but also confer moderate cross-protection against Salmonella Paratyphi B, further enhancing their epidemiological value. Pharmaceutical manufacturers are responding by improving shelf stability, extending dosage intervals, and developing reformulations targeted at pediatric use and wider strain coverage.

What's Driving the Rising Global Demand for Oral Typhoid Vaccines?

The growth in the oral typhoid vaccines market is driven by rising awareness of typhoid burden, global travel resumption post-pandemic, and strategic investments in disease prevention infrastructure. A key growth driver is the increasing recognition of oral vaccines as an efficient, cost-effective solution in regions where healthcare access is fragmented. Global travel advisories and university immunization programs also continue to support demand for oral vaccines among travelers and expatriates to typhoid-endemic zones.In addition, urbanization, poor sanitation, and climate-linked water contamination are sustaining typhoid transmission risks in densely populated regions - necessitating preventive public health measures. Regulatory approvals and WHO prequalification of key oral vaccines are enabling procurement through international supply chains, further expanding market accessibility. As typhoid re-emerges as a public health priority amid rising antimicrobial resistance, oral vaccines will continue to gain traction as both a standalone and complementary solution in global immunization strategies.

With ongoing innovations in vaccine delivery, expanded policy endorsement, and robust supply chain integration, the oral typhoid vaccines market is positioned for sustained growth. These vaccines will remain vital tools for achieving typhoid control and elimination goals across high-risk geographies and mobile populations.

Report Scope

The report analyzes the Oral Typhoid Vaccines market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hospital Pharmacies Distribution Channel segment, which is expected to reach US$142.6 Million by 2030 with a CAGR of a 9.4%. The Retail Pharmacies Distribution Channel segment is also set to grow at 11.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $37.7 Million in 2024, and China, forecasted to grow at an impressive 13.8% CAGR to reach $50.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Oral Typhoid Vaccines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Oral Typhoid Vaccines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Oral Typhoid Vaccines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., Amneal Pharmaceuticals LLC, Aurobindo Pharma Ltd., BioCryst Pharmaceuticals Inc., Bristol-Myers Squibb Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Oral Typhoid Vaccines market report include:

- Bavarian Nordic

- Bharat Biotech

- Bio Farma

- Biological E. Limited

- Crucell (a Johnson & Johnson company)

- Emergent BioSolutions

- GlaxoSmithKline plc (GSK)

- Haffkine Bio-Pharmaceutical Corporation Ltd.

- Indian Immunologicals Ltd.

- Merck & Co., Inc.

- Panacea Biotec Ltd.

- PaxVax (now part of Emergent BioSolutions)

- PT Bio Farma

- Sanofi Pasteur

- Serum Institute of India

- Shanta Biotechnics Ltd.

- SK Bioscience

- Takeda Pharmaceutical Company

- Valneva SE

- Zydus Cadila

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bavarian Nordic

- Bharat Biotech

- Bio Farma

- Biological E. Limited

- Crucell (a Johnson & Johnson company)

- Emergent BioSolutions

- GlaxoSmithKline plc (GSK)

- Haffkine Bio-Pharmaceutical Corporation Ltd.

- Indian Immunologicals Ltd.

- Merck & Co., Inc.

- Panacea Biotec Ltd.

- PaxVax (now part of Emergent BioSolutions)

- PT Bio Farma

- Sanofi Pasteur

- Serum Institute of India

- Shanta Biotechnics Ltd.

- SK Bioscience

- Takeda Pharmaceutical Company

- Valneva SE

- Zydus Cadila

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

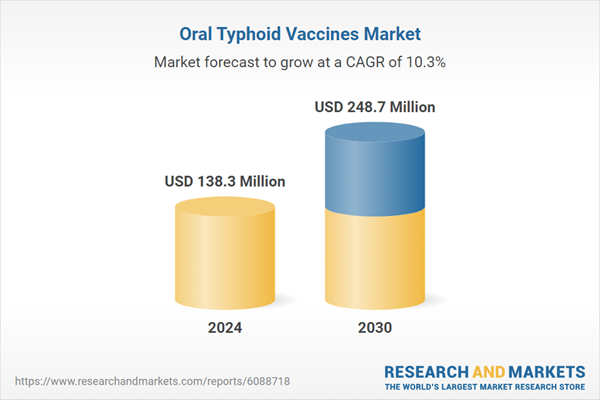

| Estimated Market Value ( USD | $ 138.3 Million |

| Forecasted Market Value ( USD | $ 248.7 Million |

| Compound Annual Growth Rate | 10.3% |

| Regions Covered | Global |