Global Dry Etching Equipment Market - Key Trends & Drivers Summarized

Why Is Dry Etching Equipment Pivotal in Advanced Semiconductor Manufacturing?

Dry etching equipment plays a critical role in semiconductor fabrication, enabling the precise removal of material layers from silicon wafers using plasma or reactive gases, rather than the wet chemicals used in traditional etching processes. As chip architectures grow increasingly complex and miniaturized - pushing toward nodes below 5nm - dry etching becomes essential for achieving the high-resolution patterning, anisotropic profiles, and atomic-level accuracy required for advanced device performance. This equipment is indispensable for processes such as gate etching, contact hole formation, and hard mask patterning in the production of DRAM, NAND flash, and logic chips. Unlike wet etching, which lacks directional control, dry etching enables highly controlled, vertical etch profiles crucial for fabricating multi-layered, three-dimensional structures like FinFETs and 3D NAND. With the growing adoption of EUV lithography and the move toward heterogeneous integration, demand for dry etching systems is surging across foundries and integrated device manufacturers (IDMs). Furthermore, as electronics power everything from smartphones and servers to electric vehicles and quantum computers, dry etching equipment forms the technological backbone of progress in computing power, data storage, and energy efficiency. Without it, the semiconductor industry would be unable to meet the geometric scaling and performance requirements of next-generation electronics.How Are Technological Innovations Enhancing the Capabilities of Dry Etching Equipment?

Technological advancements are transforming dry etching equipment into highly sophisticated tools capable of atomic-scale precision and integration with automated fabrication workflows. Plasma-enhanced etching systems, which use reactive ion etching (RIE) or inductively coupled plasma (ICP), are now being developed with high-density plasma sources, advanced gas distribution systems, and multiple bias controls to allow finer tuning of etch rates, selectivity, and uniformity across large wafer sizes. Atomic Layer Etching (ALE), a next-generation dry etching technique, is gaining momentum for enabling ultra-thin material removal one atomic layer at a time, which is essential for patterning high-aspect-ratio features and minimizing surface damage. In addition, artificial intelligence and machine learning are being integrated into etching systems to provide real-time process monitoring, predictive maintenance, and autonomous parameter adjustments. Equipment manufacturers are also enhancing vacuum chamber design, temperature control, and residue management to improve yield and tool uptime. The introduction of hybrid etch-deposition systems allows simultaneous etching and passivation, enhancing profile control and reducing process steps. These innovations are not only pushing the boundaries of semiconductor scalability but also improving process reliability, throughput, and total cost of ownership - making advanced dry etching equipment an enabler of both technical progress and manufacturing efficiency in the semiconductor sector.Why Do Application-Specific Demands and Regional Trends Shape Dry Etching Equipment Usage?

The usage and specification of dry etching equipment vary significantly by application type - such as logic chips, memory devices, image sensors, and power semiconductors - as well as by regional industry dynamics. Logic devices at advanced nodes require highly selective, damage-free etching to preserve nanoscale features and maintain transistor performance, while memory devices like NAND and DRAM demand deep, high-aspect-ratio etching for dense vertical structures. Compound semiconductors such as GaN and SiC, used in RF and power devices, present unique material challenges requiring specialized etching chemistries and hardware configurations. Geographically, Asia-Pacific leads the global dry etching equipment market, with Taiwan, South Korea, China, and Japan hosting the world's largest semiconductor fabs and contributing the majority of capital equipment spending. In particular, Taiwan's TSMC and South Korea's Samsung are heavily investing in advanced etch tools to support their aggressive scaling roadmaps. In North America, companies like Intel and GlobalFoundries are expanding capacity in response to supply chain security initiatives and chip act legislation, which is boosting domestic equipment demand. Europe focuses on automotive-grade semiconductors and specialty applications, contributing to demand for etching tools tailored to power electronics and MEMS. These regional variations, combined with the diversity of chip technologies, make flexibility, customization, and localized service support essential factors for success in the dry etching equipment industry.What Are the Key Drivers Fueling Growth in the Global Dry Etching Equipment Market?

The growth in the dry etching equipment market is being propelled by a convergence of semiconductor innovation, expanding device complexity, and escalating global demand for electronics across industries. One of the most significant growth drivers is the continual push for smaller, faster, and more energy-efficient chips, which require ever more precise pattern transfer technologies achievable only through advanced dry etching. The rise of 5G networks, AI computing, cloud data centers, autonomous vehicles, and the Internet of Things (IoT) is accelerating the need for high-performance semiconductors, thereby increasing investment in front-end fabrication equipment. Additionally, the shift from planar to 3D architectures - like FinFETs and Gate-All-Around (GAA) transistors - has elevated the complexity of etch steps, leading to higher demand for multi-function etching platforms. Government-backed initiatives such as the U.S. CHIPS Act and Europe's IPCEI (Important Projects of Common European Interest) are also driving semiconductor sovereignty and spurring domestic investments in fabs and tooling. Moreover, global supply chain disruptions have prompted chipmakers to diversify production and invest in more geographically distributed capacity, expanding the customer base for etching equipment providers. Environmental considerations are influencing equipment design as well, with energy efficiency and process gas recycling becoming important differentiators. With strong capital expenditure cycles and technological momentum, the dry etching equipment market is set to grow in tandem with the semiconductor industry's march toward next-generation computing and connectivity.Report Scope

The report analyzes the Dry Etching Equipment market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Inductively Coupled Plasma, Capacitive Coupled Plasma, Reactive Ion Etching, Deep Reactive Ion Etching, Other Types); Application (Logic & Memory, MEMS, Power Device, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Inductively Coupled Plasma segment, which is expected to reach US$6 Billion by 2030 with a CAGR of a 5.4%. The Capacitive Coupled Plasma segment is also set to grow at 7.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.9 Billion in 2024, and China, forecasted to grow at an impressive 5.7% CAGR to reach $2.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Dry Etching Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Dry Etching Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Dry Etching Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A&P Group, Abu Dhabi Ship Building (ADSB), Asyad Drydock, BAE Systems Ship Repair, Caddell Dry Dock & Repair Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Dry Etching Equipment market report include:

- Advanced Micro-Fabrication Equipment Inc.

- Applied Materials, Inc.

- DISCO Corporation

- EV Group (EVG)

- GigaLane Co., Ltd.

- Hitachi High-Technologies Corporation

- Lam Research Corporation

- Mattson Technology, Inc.

- Meyer Burger Technology AG

- NAURA Technology Group Co., Ltd.

- Oxford Instruments plc

- Panasonic Corporation

- Plasma-Therm LLC

- Samco Inc.

- SPTS Technologies Ltd.

- SÜSS MicroTec SE

- Suzhou Delphi Laser Co., Ltd.

- Tokyo Electron Limited

- ULVAC Technologies, Inc.

- Veeco Instruments Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Micro-Fabrication Equipment Inc.

- Applied Materials, Inc.

- DISCO Corporation

- EV Group (EVG)

- GigaLane Co., Ltd.

- Hitachi High-Technologies Corporation

- Lam Research Corporation

- Mattson Technology, Inc.

- Meyer Burger Technology AG

- NAURA Technology Group Co., Ltd.

- Oxford Instruments plc

- Panasonic Corporation

- Plasma-Therm LLC

- Samco Inc.

- SPTS Technologies Ltd.

- SÜSS MicroTec SE

- Suzhou Delphi Laser Co., Ltd.

- Tokyo Electron Limited

- ULVAC Technologies, Inc.

- Veeco Instruments Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | February 2026 |

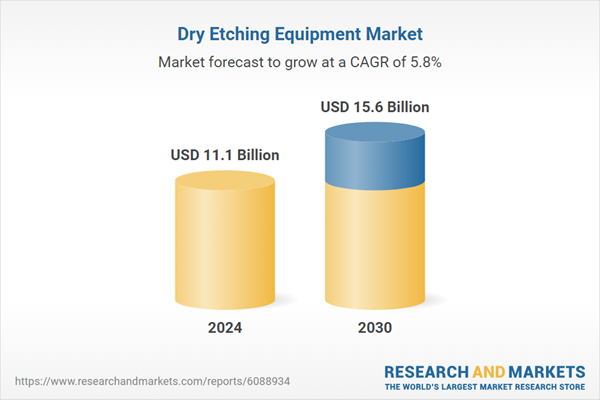

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.1 Billion |

| Forecasted Market Value ( USD | $ 15.6 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |