Global Dielectric Materials for Display Market - Key Trends & Drivers Summarized

Why Are Dielectric Materials Integral to the Functionality and Advancement of Modern Display Technologies?

Dielectric materials are foundational to the performance and reliability of modern display technologies, acting as key insulating and charge-managing components in a wide variety of screen types, including LCDs, OLEDs, QLEDs, MicroLEDs, and emerging flexible or foldable displays. These materials are crucial in ensuring the precise control of electric fields, managing charge distribution, and maintaining signal integrity within thin-film transistor (TFT) arrays that form the core of display panels. In advanced displays, dielectric layers serve as gate insulators, interlayer dielectrics, and encapsulation barriers, each with strict requirements for dielectric constant, thermal stability, optical transparency, and moisture resistance. Their role is especially critical in high-resolution displays, where pixel density continues to rise and electrical crosstalk must be minimized to maintain image clarity and color accuracy. As displays become thinner, more energy-efficient, and more sophisticated in terms of touch responsiveness and brightness, the performance of dielectric materials directly influences metrics such as refresh rate, contrast ratio, and device longevity. With consumers demanding ever-larger screens, ultra-HD resolution, and seamless form factors in devices ranging from smartphones and tablets to televisions and automotive dashboards, dielectric materials have evolved into strategic enablers of display innovation and user experience enhancement.How Are Material Science Innovations Reshaping Dielectric Layers in Display Manufacturing?

Cutting-edge advances in materials science are revolutionizing the landscape of dielectric materials used in displays, enabling manufacturers to develop thinner, more reliable, and higher-performing screens. Traditional dielectrics like silicon dioxide and silicon nitride are being replaced or enhanced by high-k materials such as hafnium oxide, aluminum oxide, and various polymer-based composites that provide superior insulation and better electric field control at smaller geometries. Flexible and foldable displays, which are now gaining market share, require novel dielectric formulations that maintain performance even under mechanical stress and repeated bending - prompting the use of elastomeric or nanocomposite dielectric layers. In OLED and MicroLED displays, dielectric materials must also be optically transparent and chemically stable under high temperatures and UV exposure to prevent color degradation and ensure long-term performance. Advanced deposition methods such as atomic layer deposition (ALD) and inkjet printing are allowing for the precise application of ultra-thin dielectric films, reducing defect rates and enabling high-resolution, large-area panel production. Moreover, self-healing dielectric films and moisture-resistant encapsulation layers are emerging to extend device lifespan, especially in high-humidity or high-wear environments. These material innovations are not only boosting performance but also improving production yields and energy efficiency, helping display manufacturers meet the increasingly complex demands of next-generation electronics.Why Is Demand for Dielectric Materials Growing Across the Consumer Electronics and Automotive Sectors?

The accelerating adoption of advanced display technologies in consumer electronics and automotive systems is driving a significant surge in demand for high-performance dielectric materials. Smartphones, tablets, laptops, and wearable devices continue to evolve toward ultra-thin, bezel-less, and foldable designs, necessitating flexible yet durable dielectric layers that can maintain performance despite space constraints and mechanical deformation. Smart TVs and gaming monitors with 4K, 8K, and high dynamic range (HDR) capabilities demand displays that can manage higher voltages and power loads without signal interference, highlighting the importance of superior dielectric insulation. In the automotive sector, digital dashboards, infotainment systems, and heads-up displays are becoming central to the in-vehicle experience, requiring dielectric materials that perform reliably in extreme temperatures, vibrations, and prolonged operational cycles. Electric vehicles (EVs) further intensify these requirements as their displays must integrate with battery management and autonomous driving systems, demanding robust thermal and electrical insulation. Additionally, public information displays, interactive kiosks, and commercial signage are pushing display technologies into outdoor and high-traffic environments, where durable, weather-resistant dielectric encapsulation becomes critical. As digital interfaces become more immersive, interconnected, and integral to daily life, the demand for sophisticated dielectric materials to support these display innovations is expanding rapidly across multiple high-growth sectors.What Are the Key Drivers Fueling Global Growth in the Dielectric Materials for Display Market?

The growth in the dielectric materials for display market is being propelled by a synergy of technological evolution, consumer demand, supply chain expansion, and manufacturing innovation. One of the core drivers is the ongoing miniaturization and diversification of display form factors - from rigid flat panels to curved, foldable, rollable, and stretchable screens - all of which require specialized dielectric materials capable of maintaining stability under new physical and electrical stresses. The surge in global display panel production, particularly in Asia-Pacific regions such as China, South Korea, and Taiwan, is fostering a competitive supply chain ecosystem that supports rapid innovation and localized sourcing of advanced materials. Concurrently, the rise of smart cities, connected devices, and augmented/virtual reality (AR/VR) interfaces is fueling the need for responsive, high-resolution displays that rely on low-loss, high-k dielectrics to optimize performance. Environmental regulations and sustainability initiatives are also influencing material choices, encouraging the development of eco-friendly and recyclable dielectric compounds. Moreover, the integration of artificial intelligence and machine learning into display diagnostics and manufacturing quality control is improving dielectric material utilization and reducing production waste. Strategic partnerships between chemical companies, display manufacturers, and semiconductor fabricators are accelerating the commercialization of next-gen dielectric technologies. Together, these drivers are positioning dielectric materials as a pivotal enabler of display innovation and are supporting a strong upward trajectory in global market demand.Report Scope

The report analyzes the Dielectric Materials for Display market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (LCD, LED, OLED, TFT-LCD); Application (Transparent, Conventional, 3D, Flexible Display, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the LCD Technology segment, which is expected to reach US$31.7 Billion by 2030 with a CAGR of a 7.2%. The LED Technology segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $14.1 Billion in 2024, and China, forecasted to grow at an impressive 9.4% CAGR to reach $14.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Dielectric Materials for Display Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Dielectric Materials for Display Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Dielectric Materials for Display Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abracon LLC, API Technologies Corp., AVX Corporation, CaiQin Technology Co., Ltd., CTS Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Dielectric Materials for Display market report include:

- Applied Materials, Inc.

- Asahi Glass Co., Ltd.

- BASF SE

- Corning Incorporated

- DIC Corporation

- Dongjin Semichem Co., Ltd.

- DuPont de Nemours, Inc.

- ENF Technology Co., Ltd.

- Honeywell International Inc.

- Idemitsu Kosan Co., Ltd.

- Kolon Industries, Inc.

- LG Chem Ltd.

- Merck KGaA

- Nitto Denko Corporation

- Novaled GmbH

- SAKAI CHEMICAL INDUSTRY CO., LTD.

- Samsung SDI Co., Ltd.

- Schott AG

- Sumitomo Chemical Co., Ltd.

- Universal Display Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Applied Materials, Inc.

- Asahi Glass Co., Ltd.

- BASF SE

- Corning Incorporated

- DIC Corporation

- Dongjin Semichem Co., Ltd.

- DuPont de Nemours, Inc.

- ENF Technology Co., Ltd.

- Honeywell International Inc.

- Idemitsu Kosan Co., Ltd.

- Kolon Industries, Inc.

- LG Chem Ltd.

- Merck KGaA

- Nitto Denko Corporation

- Novaled GmbH

- SAKAI CHEMICAL INDUSTRY CO., LTD.

- Samsung SDI Co., Ltd.

- Schott AG

- Sumitomo Chemical Co., Ltd.

- Universal Display Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

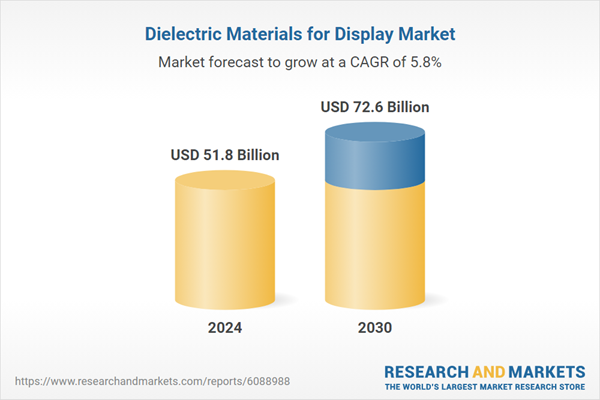

| Estimated Market Value ( USD | $ 51.8 Billion |

| Forecasted Market Value ( USD | $ 72.6 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |