Global Cross Domain Solutions Market - Key Trends & Drivers Summarized

Why Are Cross Domain Solutions Becoming Critical in Modern Defense, Intelligence, and Enterprise IT Environments?

Cross Domain Solutions (CDS) are rapidly becoming indispensable across sectors that require the secure transfer of data between different security domains - especially in defense, intelligence, critical infrastructure, and highly regulated industries. Traditionally, networks operating at different classification levels (such as unclassified, secret, or top secret) have remained segregated to prevent unauthorized access and data leakage. However, the growing need for real-time data sharing, operational coordination, and integrated situational awareness has led to the increased deployment of CDS technologies that facilitate controlled, policy-enforced data exchanges between domains. These solutions provide a critical cybersecurity layer that enables multi-domain interoperability while maintaining data confidentiality, integrity, and availability. In military and intelligence settings, CDS plays a pivotal role in battlefield awareness, coalition operations, and secure mission planning, where different entities operate on networks of varying clearance levels. In the enterprise and government sectors, CDS is used to protect sensitive financial, legal, or healthcare data, ensuring secure collaboration without compromising regulatory compliance. As digital transformation drives organizations to operate across cloud, on-premises, and hybrid environments, CDS has evolved into a core cybersecurity architecture component, offering granular control, deep inspection, and rigorous enforcement of data flow policies. The importance of these solutions continues to rise in tandem with the complexity of global threats and the criticality of safeguarding sensitive information across interconnected systems.How Are Threat Landscapes and Regulatory Demands Accelerating the Adoption of Cross Domain Solutions?

The global increase in cyber threats, data breaches, and nation-state attacks is a major catalyst driving demand for robust and scalable Cross Domain Solutions. Organizations operating in high-risk environments, such as defense contractors, intelligence agencies, aerospace firms, and critical infrastructure operators, face continuous threats from sophisticated adversaries seeking to exploit vulnerabilities across network boundaries. CDS technologies act as gatekeepers, enforcing stringent access control and data sanitization protocols to prevent the unauthorized flow of malware, classified information, or malicious payloads between networks. The rise of advanced persistent threats (APTs) and supply chain attacks has further highlighted the necessity of separating operational networks and tightly managing data exchanges. In addition to the evolving threat landscape, regulatory frameworks such as the U.S. National Institute of Standards and Technology (NIST) cybersecurity standards, DoD Risk Management Framework (RMF), and European GDPR regulations require secure information sharing and robust auditability - both of which are facilitated by well-implemented CDS infrastructures. Furthermore, many countries have developed national cross domain guidelines and accreditation processes that mandate CDS deployment for certain operational scenarios, especially in defense and intelligence sectors. These dual pressures of escalating threat complexity and regulatory scrutiny are prompting both public and private organizations to invest in cross domain technologies as a proactive security and compliance strategy. As a result, CDS adoption is transitioning from a niche requirement to a mainstream cybersecurity priority.What Technological Innovations Are Enhancing the Capabilities and Versatility of Cross Domain Solutions?

Technological advancement is significantly broadening the functionality, flexibility, and user-friendliness of Cross Domain Solutions, making them more adaptive to diverse operational contexts. One key innovation is the integration of AI and machine learning to enhance automated policy enforcement, anomaly detection, and dynamic content filtering - enabling systems to intelligently assess risk and make real-time decisions about data transfer requests. Advanced data diodes, which allow one-way information flows, are being combined with high-assurance guards and content filters to facilitate bi-directional transfers where necessary, without compromising security. Virtualization and containerization technologies are also being employed to isolate processes and applications, allowing CDS platforms to operate more efficiently across cloud, on-prem, and hybrid environments. Meanwhile, zero trust architectures are being adopted to refine CDS policies, emphasizing verification, segmentation, and least privilege principles even within trusted domains. Secure multi-domain collaboration tools and cross-platform interoperability features are improving usability for end-users, enabling faster, safer communication between mission-critical teams. Additionally, automated auditing, logging, and forensics capabilities are being built into modern CDS platforms to support compliance and incident response. These innovations are transforming CDS from static, hardware-bound appliances into dynamic, software-defined solutions that can scale with evolving IT and operational technology landscapes. As these tools become more modular and integrated with broader cybersecurity ecosystems, their adoption will accelerate across not only defense and government sectors, but also in high-assurance commercial environments.What Are the Primary Drivers Fueling the Global Growth of the Cross Domain Solutions Market?

The growth in the global Cross Domain Solutions market is being propelled by a convergence of strategic, technological, and geopolitical drivers. A major force is the increasing need for secure data exchange between disparate networks - especially in military coalitions, multinational operations, and cross-jurisdictional organizations where collaboration spans multiple security levels. The expanding threat landscape, driven by cyber warfare, ransomware attacks, and digital espionage, has highlighted the risks of unmanaged data flows and forced security-conscious organizations to prioritize CDS deployment. At the same time, rapid digital transformation across defense, intelligence, energy, and finance sectors is generating complex IT environments where legacy systems coexist with modern cloud infrastructures, necessitating secure and policy-driven interoperability. Government mandates and defense modernization programs - such as Joint All-Domain Command and Control (JADC2) in the U.S. - are further driving investment in CDS as a core enabler of secure command, control, and communication (C3) systems. The increasing emphasis on cyber resilience, data sovereignty, and national security is also encouraging sovereign nations to build domestic CDS capabilities, fueling international market expansion. Meanwhile, innovations in automation, AI, and virtualization are lowering the cost and complexity of CDS deployment, making these solutions more accessible to mid-sized organizations and non-traditional sectors such as healthcare, utilities, and legal services. As data sharing becomes indispensable across classified and sensitive operations, the need for robust cross domain controls will continue to rise - cementing CDS as a critical component of the modern security infrastructure.Report Scope

The report analyzes the Cross Domain Solutions market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Transfer Solutions, Access Solution); Application (Aerospace & Defense, Law Enforcement & Security Agencies, Critical Infrastructure).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Transfer Solutions segment, which is expected to reach US$2.2 Billion by 2030 with a CAGR of a 8%. The Access Solution segment is also set to grow at 12.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $587.3 Million in 2024, and China, forecasted to grow at an impressive 12.8% CAGR to reach $744.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cross Domain Solutions Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cross Domain Solutions Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cross Domain Solutions Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Beam Therapeutics, Caribou Biosciences, CRISPR Biotech Engineering, CRISPR Therapeutics, Editas Medicine and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Cross Domain Solutions market report include:

- 4Secure Ltd

- Advenica AB

- Amazon Web Services (AWS)

- BAE Systems plc

- Cisco Systems, Inc.

- Crossdomain Solutions Pvt Ltd

- Cubic Corporation

- Everfox Inc.

- Forcepoint LLC

- General Dynamics Corporation

- Google LLC

- IBM Corporation

- Infodas GmbH

- Lockheed Martin Corporation

- Microsoft Corporation

- OPSWAT Inc.

- Owl Cyber Defense Solutions

- Probity, Inc.

- Raytheon Technologies Corp.

- Symantec Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 4Secure Ltd

- Advenica AB

- Amazon Web Services (AWS)

- BAE Systems plc

- Cisco Systems, Inc.

- Crossdomain Solutions Pvt Ltd

- Cubic Corporation

- Everfox Inc.

- Forcepoint LLC

- General Dynamics Corporation

- Google LLC

- IBM Corporation

- Infodas GmbH

- Lockheed Martin Corporation

- Microsoft Corporation

- OPSWAT Inc.

- Owl Cyber Defense Solutions

- Probity, Inc.

- Raytheon Technologies Corp.

- Symantec Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 202 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

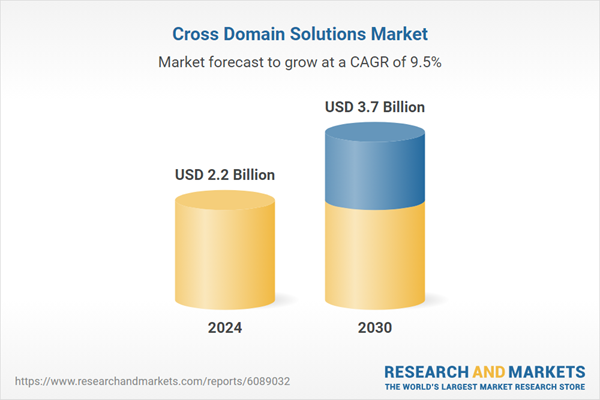

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |