Speak directly to the analyst to clarify any post sales queries you may have.

Introduction to Advanced Manganese Oxide Catalysts Driving Breakthroughs in Clean Energy, Emission Control, and Sustainable Industrial Processes

Manganese oxide catalysts have emerged as pivotal enablers in the transition toward greener industrial processes, offering high reactivity and cost-effective performance across a spectrum of applications. As environmental regulations tighten and industries pursue carbon reduction, these catalysts play an increasingly central role in reducing harmful emissions and improving energy efficiency. With versatility across diverse chemical pathways, manganese oxide-based materials present a compelling case for both established petrochemical operations and cutting-edge battery technologies.Given their unique electronic and surface properties, manganese oxide catalysts facilitate redox reactions with remarkable selectivity, making them indispensable in automotive emission control and wastewater treatment. Throughout this report, readers will discover the multifaceted advantages that position manganese oxide as a cornerstone in the global shift toward sustainable solutions. Moreover, the nuanced interplay between material science advancements and regulatory imperatives underscores the catalyst's strategic importance in driving long-term value.

This executive summary distills the latest industry developments, strategic challenges, and emerging opportunities, providing a cohesive foundation for decision-makers seeking to harness the full potential of manganese oxide catalysts. Through an integrated analysis of technology trends, market drivers, and competitive landscapes, stakeholders will be equipped with actionable insights to navigate an evolving market with confidence.

Unveiling Major Transformative Shifts in Catalyst Technology, Regulatory Landscapes, and Supply Chain Dynamics Revolutionizing Manganese Oxide Applications

Over the past decade, transformative shifts in catalyst technology have redefined performance benchmarks and sustainability goals. Breakthroughs in nanoscale synthesis and surface engineering have enabled manufacturers to tailor manganese oxide structures for optimized activity and durability. Concurrently, digital process optimization and predictive maintenance platforms are enhancing operational reliability, reducing downtime, and maximizing catalyst lifetime.In parallel, regulatory landscapes have evolved, imposing stricter emission limits and incentivizing low-carbon technologies. Governments worldwide are accelerating funding for green chemistry initiatives and enforcing guidelines that favor environmentally benign catalysts. These policy changes are reshaping the competitive environment, compelling organizations to accelerate R&D collaborations and strategic partnerships to remain compliant and capitalize on emerging incentives.

Supply chain resilience has also become a key focal point, as raw material availability and geopolitical tensions introduce new uncertainties. Stakeholders are now diversifying procurement strategies, exploring alternative feedstocks, and investing in regional production capabilities. Taken together, these developments signify a pivotal shift toward integrated innovation, where technological excellence, regulatory alignment, and supply chain agility converge to define market leadership.

Assessing the Cumulative Impact of Evolving United States Tariff Policies on Manganese Oxide Supply Chains and Competitive Market Dynamics

The introduction of heightened United States tariff policies has exerted significant pressure on manganese oxide import channels and pricing structures. These measures have prompted global suppliers to reassess their sourcing models and pivot toward domestic production or favorable trade partnerships. As a result, cost structures have been reconfigured, driving innovation in processing techniques to maintain competitive margins.Furthermore, evolving tariff landscapes have catalyzed strategic alliances between chemical producers and downstream end users. Companies are developing joint ventures to localize catalyst manufacturing, thereby mitigating the impact of import duties and ensuring consistent supply. These alliances have fostered technology transfers, enabling faster adoption of advanced formulations within North American markets.

In response to the tariff-induced volatility, organizations are adopting agile procurement frameworks that integrate real-time data analytics and risk assessment tools. This adaptive approach allows stakeholders to anticipate policy shifts, optimize inventory levels, and adjust pricing strategies proactively. Consequently, the catalyst market is witnessing a newfound emphasis on flexibility and strategic foresight, elements that will shape competitive dynamics in the years ahead.

Deep Dive into Market Segmentation Insights Uncovering Key Trends by Type Form Application and End Use Industries Shaping Future Opportunities

A detailed segmentation analysis reveals distinct value propositions inherent in each catalyst type and form factor. In the realm of material classification, manganese oxide, manganese(II) oxide (MnO), manganese(III) oxide (Mn₂O₃), and manganese(IV) oxide (MnO₂) each offer unique redox characteristics and thermal stabilities. These differences translate into tailored solutions for specific reaction pathways, from low-temperature oxidation to high-temperature reforming.Form influences performance as well, with granular, pellet, and powdered grades delivering variable surface area profiles and mass transfer rates. Granular formulations excel in fixed-bed configurations, whereas pelletized forms achieve robustness under high-pressure conditions. Powdered catalysts, by contrast, maximize active surface exposure, making them ideal for slurry reactors and fine chemical production.

When examining application-driven demand, the spectrum spans automotive emission control and battery production to chemical synthesis, environmental catalysis, petrochemical processes, and wastewater treatment. This breadth underscores the catalyst's adaptability to diverse reaction environments and regulatory requirements. Moreover, end-use industries such as agriculture, automotive, chemical and petrochemical, electronics, energy and power, environmental protection, and pharmaceuticals and fine chemicals each exhibit unique performance criteria. By mapping these segments, this report highlights emerging growth corridors and alignment opportunities for strategic investment and innovation.

Comprehensive Regional Analysis Highlighting Unique Growth Drivers across the Americas Europe Middle East Africa and Asia Pacific Landscapes

Regional dynamics are driving differentiated growth trajectories across the globe. In the Americas, established chemical hubs and robust automotive sectors are spearheading demand for high-performance manganese oxide catalysts. This region's emphasis on stringent emission standards and advanced manufacturing capabilities underscores its strategic importance for catalyst adoption.Europe, the Middle East, and Africa present a diverse regulatory and economic mosaic. Western Europe's progressive environmental policies and Middle East initiatives to diversify away from hydrocarbons are creating new project pipelines. North African and sub-Saharan markets are gradually augmenting industrial infrastructures, thus broadening the scope for environmental catalysis and emission control solutions.

Asia-Pacific is characterized by rapid industrialization, expanding power generation capacity, and an accelerating shift toward electric mobility. Strong government subsidies for clean energy technologies and rising environmental awareness are fueling investment in advanced catalyst systems. As a result, Asia-Pacific remains a focal point for both global manufacturers and local innovators seeking to capture emerging opportunities.

Key Competitive Company Insights Revealing Strategic Innovations Partnerships and Growth Initiatives in the Manganese Oxide Catalyst Market

Leading companies in the manganese oxide catalyst space are differentiating themselves through strategic investments in R&D, collaborative alliances, and operational excellence. Many organizations are establishing specialized innovation centers to advance catalyst design, leveraging computational modeling and high-throughput screening techniques to accelerate material discovery. Strategic partnerships with academic institutions and technology startups are further enriching the innovation pipeline and facilitating rapid commercialization.On the production front, major players are optimizing manufacturing footprints to enhance supply chain resilience. Investments in modular processing units and quality-control automation are reducing lead times and ensuring consistent product quality. In parallel, firms are deploying digital twins and predictive maintenance programs to monitor catalyst performance in real time, thereby extending product lifecycles and minimizing unplanned downtime.

Market participants are also engaging in forward-looking collaborations with end users, co-developing customized catalyst formulations for specialized applications. By embedding technical support and service offerings within commercial agreements, these companies are reinforcing customer loyalty and unlocking new revenue streams through performance-based contracting models.

Actionable Recommendations for Industry Leaders to Capitalize on Technological Advances and Evolving Market Dynamics in Manganese Oxide Catalyst Sector

To capitalize on emerging opportunities, industry leaders should intensify investment in advanced synthesis methods that yield tailored catalyst morphologies and enhanced active sites. Establishing cross-functional teams that integrate materials science, digital analytics, and regulatory expertise will accelerate innovation cycles and improve time to market. Moreover, forging strategic partnerships with end users and research institutions can facilitate co-development of next-generation catalysts aligned with specific performance requirements.Leaders must also diversify supply networks to mitigate geopolitical risks and tariff exposure. Pursuing localized production facilities or joint ventures in key markets will enhance supply chain agility and reduce dependency on volatile import channels. Additionally, adopting data-driven procurement strategies, powered by real-time market intelligence and risk modeling, will enable proactive decision-making and cost optimization.

Finally, embedding sustainability metrics into product development and commercialization strategies will differentiate offerings and align with evolving customer expectations. By demonstrating lifecycle impacts, carbon footprints, and circular economy considerations, organizations can secure long-term contracts and benefit from emerging green incentive programs.

Rigorous Research Methodology Outlining Data Collection Expert Validation and Analytical Frameworks Ensuring Reliability and Industry Relevance

This study integrates both primary and secondary research methodologies to ensure comprehensive and reliable insights. Secondary research involved an extensive review of industry publications, regulatory filings, patent databases, and technical journals to establish a foundational understanding of catalyst technologies, market dynamics, and competitive activity.Primary research was conducted through in-depth interviews with key opinion leaders, including process engineers, R&D directors, supply chain managers, and regulatory experts. These dialogues provided nuanced perspectives on operational challenges, innovation roadmaps, and evolving customer requirements. Quantitative data points were cross-validated against proprietary transaction databases and trade statistics to confirm accuracy.

Analytical frameworks such as SWOT, Porter's Five Forces, and scenario analysis were employed to interpret qualitative and quantitative findings. The research approach emphasizes iterative validation, leveraging multiple data sources to triangulate insights and minimize bias. This rigorous methodology ensures that conclusions are both actionable and aligned with real-world industry conditions.

Conclusive Perspectives on the Strategic Implications of Manganese Oxide Catalysts in Shaping Future Clean Technology and Industrial Competitiveness

In conclusion, manganese oxide catalysts stand at the intersection of technological innovation and sustainability, offering versatile solutions for emission control, energy storage, and chemical processing. The convergence of advanced material science, tightening environmental regulations, and evolving supply chain dynamics is reshaping the competitive landscape, creating opportunities for agile and forward-thinking organizations.Stakeholders that proactively invest in tailored catalyst development, localized production strategies, and collaborative partnerships will be best positioned to capture emerging growth corridors. Additionally, embedding digital capabilities and sustainability imperatives into core business models will unlock new value propositions and reinforce market leadership.

As the industry continues to evolve, continuous monitoring of regulatory shifts, technological breakthroughs, and regional demand patterns will be essential. This report empowers decision-makers with a cohesive understanding of market forces, enabling strategic alignment and long-term resilience in a rapidly changing environment.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Type

- Manganese Oxide

- Manganese(II) Oxide (MnO)

- Manganese(III) Oxide (Mn₂O₃)

- Manganese(IV) Oxide (MnO₂)

- Form

- Granular

- Pellet

- Powdered

- Application

- Automotive Emission Control

- Battery Production

- Chemical Synthesis

- Environmental Catalysis

- Petrochemical Industry

- Wastewater Treatment

- End-Use Industry

- Agriculture

- Automotive

- Chemical & Petrochemical

- Electronics

- Energy & Power

- Environmental Protection

- Pharmaceuticals & Fine Chemicals

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- American Elements

- BASF SE

- Borman Specialty Materials

- Celtic Chemicals Ltd

- Eramet S.A.

- GoodEarth

- HMP Minerals Private Limited

- Honeywell International Inc.

- KANTO CHEMICAL CO.,INC.

- Lorad Chemical Corporation

- Manmohan Minerals & Chemicals

- Merck KGaA

- MnChemical Georgia LLC

- Sahjanand Group

- Santa Cruz Biotechnology, Inc.

- Shanghai Xinglu Chemical Technology Co., Ltd

- South Manganese Investment Limited

- Thermo Fisher Scientific Inc.

- Tosoh Corporation

- Universal Chemicals And Industries Private Limited

- Vibrantz Technologies Inc.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Manganese Oxide Catalyst market report include:- American Elements

- BASF SE

- Borman Specialty Materials

- Celtic Chemicals Ltd

- Eramet S.A.

- GoodEarth

- HMP Minerals Private Limited

- Honeywell International Inc.

- KANTO CHEMICAL CO.,INC.

- Lorad Chemical Corporation

- Manmohan Minerals & Chemicals

- Merck KGaA

- MnChemical Georgia LLC

- Sahjanand Group

- Santa Cruz Biotechnology, Inc.

- Shanghai Xinglu Chemical Technology Co., Ltd

- South Manganese Investment Limited

- Thermo Fisher Scientific Inc.

- Tosoh Corporation

- Universal Chemicals And Industries Private Limited

- Vibrantz Technologies Inc.

Table Information

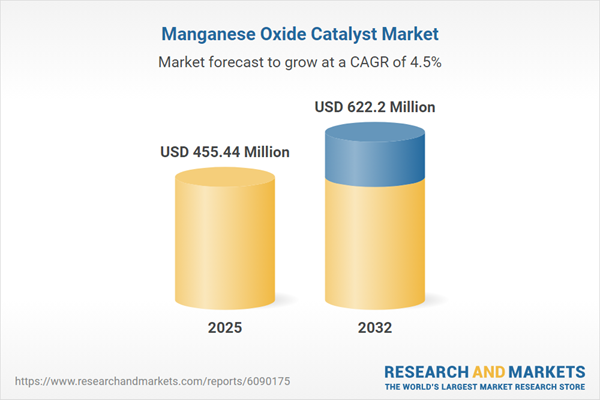

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 455.44 Million |

| Forecasted Market Value ( USD | $ 622.2 Million |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |