Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Stage for Enhanced Body Mass Solutions in a Competitive Landscape Where Consumer Preferences and Scientific Innovations Shape Weight Gain Strategies

The weight gain supplement arena is undergoing a period of remarkable evolution, driven by a convergence of shifting consumer priorities and breakthroughs in nutritional science. Traditionally perceived as a niche category, these formulations have expanded to address a broad spectrum of wellness goals, from aiding undernourished patients in regaining healthy body mass to supporting athletes in maximizing lean muscle development. Alongside this widening scope, regulatory frameworks are maturing, which elevates product quality and safety standards and further legitimizes the category.Meanwhile, consumer demand is increasingly informed by digital channels, with social media influencers and health communities shaping perceptions of efficacy and ingredient transparency. This trend has prompted manufacturers to deepen their engagement with end users, gathering real-time feedback to refine formulations and packaging. In parallel, supply chain innovations are improving access to premium raw materials, enabling smaller brands to compete against established players. The result is a more dynamic, competitive environment where agility and consumer centricity define market leadership.

As the industry continues to mature, stakeholders must balance technological advances and regulatory compliance with authentic consumer dialogue. In doing so, they will lay the foundation for robust growth and sustainable differentiation in a sector that is poised for both consolidation and diversification.

How Disruptive New Ingredient Technologies and Consumer Wellness Trends Are Catalyzing Major Transformations Across the Weight Gain Supplement Landscape

Innovation in the weight gain supplement sector has accelerated at an unprecedented pace, fueled by novel ingredient delivery systems and evolving wellness paradigms. The rise of microencapsulation techniques, for instance, has improved the bioavailability of key nutrients, while customized flavor profiles have enhanced consumer compliance. At the same time, insights from gut microbiome research are inspiring prebiotic and probiotic additions to support digestive health, forging a more holistic approach to mass building.Beyond formulation, distribution models have shifted dramatically. Direct-to-consumer subscriptions now account for an expanding share of sales, making it easier for manufacturers to collect usage patterns and iterate on product design. Experiential retail concepts and pop-up activations are forging personal connections and gathering qualitative feedback that informs future innovation. Moreover, the integration of artificial intelligence in recipe optimization has reduced R&D timelines, allowing brands to respond rapidly to emerging trends.

Taken together, these developments are transforming the weight gain landscape into a hotbed of disruptive competition. Early movers who harness these technologies and capitalize on shifting consumer behaviors will establish meaningful brand loyalty. As the market evolves, adaptability and foresight will determine which companies lead in delivering cutting-edge, science-backed solutions to diverse consumer segments.

Assessing the Far Reaching Effects of United States Tariff Policies Enacted in 2025 on Import Dynamics and Industry Profitability for Weight Gain Supplements

The introduction of new tariff measures in the United States during 2025 has reshaped the importation dynamics for key weight gain supplement ingredients. As levies on dairy-derived proteins and micronutrient additives increased, manufacturers faced rising landed costs, prompting many to reevaluate sourcing strategies. Some companies shifted production closer to raw material origins, while others negotiated long-term contracts to lock in favorable pricing and mitigate volatility.In addition, packaging and labeling components experienced parallel tariffs, further driving up operational expenses. Businesses responded by streamlining their supply chains, consolidating shipments, and exploring alternative materials that maintained performance without triggering additional duties. These shifts required close collaboration with logistics partners and a robust understanding of tariff classifications to ensure compliance and avoid penalties.

Although some of the cost pressures have been passed on to end users, many brands absorbed a portion of the increases to preserve price positioning and maintain consumer loyalty. Others turned to lean manufacturing practices, optimizing batch sizes and reducing waste through advanced process control. Collectively, these adaptations underscore the industry's resilience and capacity to navigate complex trade environments. Future success will hinge on proactive tariff risk management and agile sourcing networks that can respond to regulatory changes with precision.

Uncovering Deep Consumer and Market Variations Through Product Form Source Application End User and Distribution Channel Analysis for Weight Gain Supplements

A detailed examination of the weight gain supplement market reveals distinct consumer and product niches that demand tailored strategies. Based on product type, creatine remains a cornerstone for muscle recovery, mass gainers appeal to those seeking comprehensive caloric support, meal replacements bridge nutritional convenience gaps, and protein supplements sustain consistent post-workout replenishment. Each category attracts unique user motivations and benefits from differentiated marketing narratives.Form preferences also inform purchasing behavior. Bars serve on-the-go needs, capsules and tablets offer precise dosing convenience, liquids deliver rapid absorption, and powders provide cost efficiency and versatility in recipe integration. These variations underscore the importance of packaging innovation and flavor development to enhance consumer adherence.

Source considerations further segment the market, with animal-based proteins retaining a strong following for their amino acid profiles, mixed sources balancing performance and value, and plant-based alternatives gaining traction among those pursuing sustainable and allergen-free solutions. Application segments highlight bodybuilding enthusiasts focused on maximal gains, medical scenarios prioritizing safe nutritional rehabilitation, and sports nutrition users seeking performance optimization in endurance activities.

End-user distinctions shape communication strategies. Athletes and bodybuilders respond to performance-driven claims, the general public seeks balanced wellness assurances, and patients require clinical validation. Finally, distribution choices-offline retail environments offering tactile experiences and online platforms providing seamless subscription services-demand distinct merchandising and digital engagement tactics. Together, these segmentation insights enable precision targeting and innovation prioritization.

Consumer Preferences Supply Chain Dynamics and Regulatory Landscapes Across Americas Europe Middle East Africa and Asia Pacific Weight Gain Markets

Regional dynamics exert a profound influence on the weight gain supplement sector, as local consumer preferences and regulatory frameworks vary significantly. In the Americas, a robust fitness culture paired with widespread retail infrastructure facilitates rapid product adoption, while manufacturers leverage targeted promotions and sports partnerships to build brand equity. Supply chain resilience remains a priority, with companies investing in domestic blending facilities to sidestep logistical disruptions.Europe Middle East Africa presents a complex mosaic of regulatory regimes and consumer expectations. Stricter labeling requirements and ingredient approvals necessitate rigorous compliance processes. Nonetheless, growing awareness of nutritional rehabilitation and athletic performance is nurturing demand in both Western European markets and emerging Middle Eastern hubs. Companies are collaborating with regional distributors to navigate local certification pathways and capitalize on premium-positioned offerings.

In Asia Pacific, shifting dietary patterns and rising disposable incomes are fueling an appetite for functional nutrition. Markets across East and Southeast Asia are witnessing increased affinity for plant-based formulations, while Australia and New Zealand favor scientifically validated animal protein sources. Online marketplaces dominate distribution, enabling brands to engage digitally savvy consumers and scale rapidly. Overall, regional strategies that harmonize global best practices with local nuances will deliver sustained competitive advantage.

Profiling Leading Industry Players Strategic Collaborations and Innovation Pipelines Driving Competitive Advantage in the Weight Gain Supplement Sector

Leading companies in the weight gain supplement industry are forging new paths through strategic innovation and collaborative ventures. Several top-tier manufacturers have invested heavily in proprietary ingredient research, partnering with academic institutions to validate efficacy and differentiate their portfolios. Others have pursued acquisitions of boutique brands to capture niche audiences and broaden their appeal.Digital engagement strategies further distinguish front runners. By deploying data analytics and customer relationship platforms, they personalize outreach and strengthen loyalty. Subscription models and targeted sampling initiatives bolster retention, while influencer collaborations amplify brand narratives across social channels. Sustainability commitments are also gaining prominence, as eco-friendly packaging and responsibly sourced proteins enhance corporate reputation.

Operationally, these players are optimizing global supply chains, leveraging regional manufacturing hubs to reduce lead times and credential complexity. They are implementing automated quality control systems and investing in traceability technologies to maintain transparency from farm to finished product. In this evolving competitive landscape, companies that integrate R&D, marketing, and operational excellence will secure the strongest positioning for long-term growth.

Strategic R and D Investment Marketing Partnerships and Regulatory Engagement to Capitalize on Emerging Weight Gain Supplement Opportunities

Companies seeking to lead in the weight gain supplement space should prioritize a rigorous R and D agenda, targeting high-impact proteins and bioactive compounds that resonate with specific consumer needs. By forging alliances with research institutions and leveraging clinical trials, they can substantiate performance claims and secure premium pricing.Simultaneously, marketing partnerships with fitness influencers and healthcare practitioners will amplify credibility and extend market reach. Tailoring messaging to each segmentation layer-whether emphasizing rapid recovery for athletes or safe caloric support for medical patients-will drive relevance and conversion. Investment in digital platforms that harness machine learning can refine targeted campaigns and optimize resource allocation.

Supply chain agility is equally vital. Establishing dual-sourcing frameworks and regional blending operations will insulate businesses from tariff fluctuations and logistical chokepoints. On the regulatory front, proactive engagement with authorities and participation in industry associations can accelerate approvals and preempt compliance risks.

Ultimately, a cohesive approach that aligns innovation, marketing, and operational resilience will unlock sustainable growth. Organizations that act swiftly on these recommendations will be best positioned to capture emerging opportunities and reinforce leadership in a rapidly evolving market.

Implementing Robust Mixed Research Combining Qualitative and Quantitative Analysis with Industry Expert Validation for Weight Gain Supplement Study

Our research methodology combines qualitative and quantitative techniques to ensure a holistic understanding of the weight gain supplement market. Primary interviews with C-suite executives, formulators, and distribution partners provide firsthand perspectives on strategic priorities and operational challenges. These insights are complemented by quantitative data analysis derived from proprietary industry databases and market intelligence platforms.To enhance validity, we incorporate an expert validation framework, engaging seasoned nutrition scientists and regulatory specialists to review findings and interpret data trends. This two-tiered validation process mitigates bias and elevates the credibility of our conclusions. Secondary research encompasses a thorough review of trade publications, peer-reviewed journals, and government regulatory dossiers to contextualize proprietary data.

Finally, triangulation across data sources allows us to reconcile divergent inputs and construct a cohesive narrative. Regional experts contribute localized context, while global trend analyses pinpoint macroeconomic and policy influences. This robust mixed-methods approach ensures that our insights are both comprehensive and actionable, equipping stakeholders with the clarity needed to make strategic decisions.

Synthesizing Key Market Dynamics Consumer Trends and Regulatory Considerations to Chart a Clear Path Forward in the Weight Gain Supplement Industry

The weight gain supplement industry stands at an inflection point, shaped by regulatory shifts, consumer empowerment, and technological breakthroughs. Segmentation insights reveal a tapestry of product types and delivery forms, each appealing to distinct end-user motivations. Meanwhile, regional dynamics underscore the importance of adaptability in response to diverse market and compliance landscapes.Tariff changes have prompted supply chain realignments, highlighting the need for robust sourcing strategies and risk-mitigation frameworks. At the same time, leading companies demonstrate that integration of R&D excellence, digital engagement, and sustainable practices can drive competitive differentiation. Actionable recommendations emphasize a holistic approach: substantiating claims with clinical evidence, forging strategic partnerships, and maintaining regulatory vigilance.

Looking ahead, success will hinge on the ability to anticipate consumer demands, harness innovations, and sustain operational agility. By synthesizing these dynamics into a cohesive strategy, industry stakeholders can capitalize on emerging opportunities and deliver superior value to both end users and shareholders. The path forward is clear: collaboration, scientific rigor, and a relentless focus on consumer outcomes will define market leaders.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Creatine

- Mass Gainers

- Meal Replacement

- Protein Supplements

- Form

- Bars

- Capsules/Tablets

- Liquids

- Powders

- Source

- Animal-based

- Mixed

- Plant-based

- Application

- Bodybuilding

- Medical

- Sports Nutrition

- End-User

- Athletes & Bodybuilders

- General Public

- Patients

- Distribution Channel

- Offline Retail

- Online Retail

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Abbott Limited

- ALLMAX Nutrition, Inc.

- Archer-Daniels-Midland Company

- Glanbia plc

- BioTechUSA Kft.

- Bright Lifecare Private Limited

- Cellucor Inc.

- Dymatize Enterprises, LLC

- Gaspari Nutra, LLC.

- GNC Holdings, LLC

- Iovate Health Sciences Inc.

- Labrada Nutrition, Inc.

- Nature's Best & Farm Fresh Enterprises Private Limited

- Nestlé S.A.

- NutraBio Labs, Inc.

- Nutrex Research, Inc.

- Optimum Nutrition, Inc.

- ProSupps USA, LLC

- Sapphire Health Care Private Limited

- Titan Nutrition Inc.

- Ultimate Nutrition Inc.

- UNIVERSAL NUTRISCIENCE PRIVATE LIMITED

- Velnex Medicare India Private Limited

- Weider Health and Fitness Inc.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Weight Gain Supplements Market report include:- Abbott Limited

- ALLMAX Nutrition, Inc.

- Archer-Daniels-Midland Company

- Glanbia plc

- BioTechUSA Kft.

- Bright Lifecare Private Limited

- Cellucor Inc.

- Dymatize Enterprises, LLC

- Gaspari Nutra, LLC.

- GNC Holdings, LLC

- Iovate Health Sciences Inc.

- Labrada Nutrition, Inc.

- Nature's Best & Farm Fresh Enterprises Private Limited

- Nestlé S.A.

- NutraBio Labs, Inc.

- Nutrex Research, Inc.

- Optimum Nutrition, Inc.

- ProSupps USA, LLC

- Sapphire Health Care Private Limited

- Titan Nutrition Inc.

- Ultimate Nutrition Inc.

- UNIVERSAL NUTRISCIENCE PRIVATE LIMITED

- Velnex Medicare India Private Limited

- Weider Health and Fitness Inc.

Table Information

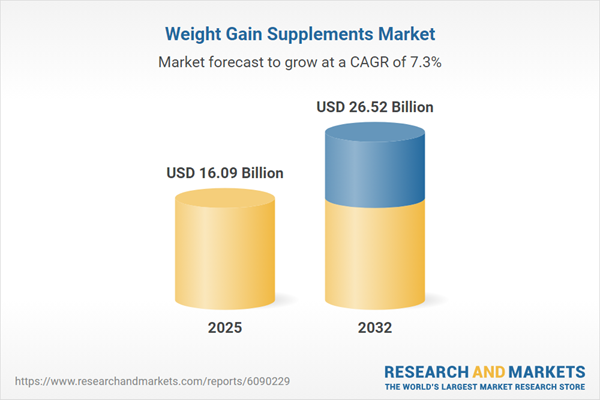

| Report Attribute | Details |

|---|---|

| No. of Pages | 191 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 16.09 Billion |

| Forecasted Market Value ( USD | $ 26.52 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |