Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Modern Dynamics of the Mulching Equipment Market and Its Strategic Significance across Agricultural and Environmental Sectors

The mulching equipment sector has evolved into a critical driver for both agricultural productivity and environmental stewardship. Advances in machinery design, materials technology, and power systems have elevated mulching tools from simple ground cover solutions to sophisticated implements capable of enhancing soil health, reducing waste, and supporting precision farming initiatives. Increasing pressure to improve crop yields, alongside a growing emphasis on sustainable land management, has propelled investment in specialized machinery that can handle diverse terrains and vegetation types with minimal ecological impact.This landscape is further influenced by the convergence of digital technologies and heavy equipment, enabling real-time monitoring and adaptive operations that were once confined to large-scale agricultural projects. As stakeholders across farming cooperatives, public works agencies, and commercial landscapers seek greater return on investment, the ability to integrate operational data and predictive maintenance has become a key competitive differentiator. Moreover, the growing role of regulatory measures aimed at curbing emissions and preserving soil integrity creates both challenges and opportunities for equipment manufacturers to innovate and comply.

Taken together, these forces underscore the strategic importance of understanding current market dynamics, disruptive trends, and regional nuances. This report offers an executive overview that lays the groundwork for informed decision-making, highlighting how manufacturers, distributors, and end-users can navigate the complex interplay of technological advancement, environmental regulation, and evolving customer requirements in the mulching equipment domain.

Examining Disruptive Technological and Regulatory Shifts Reshaping the Mulching Equipment Landscape with Sustainable and Efficiency-Driven Innovations

In recent years, the mulching equipment landscape has witnessed an unprecedented acceleration of technological innovation. Manufacturers have embraced advanced materials and precision engineering to deliver lighter yet more durable disc and drum mulchers capable of operating under higher stress and extended duty cycles. Concurrently, the integration of sensors and telematics systems has enabled machine-to-machine communication, allowing operators to calibrate performance parameters on the fly and optimize fuel consumption in response to real-time soil and load conditions.Regulatory frameworks targeting emissions and noise pollution have spurred the development of cleaner powertrain architectures, including hybrid and fully electric drives for rotary and shaft mulchers. Incentives for low-carbon agricultural practices are influencing procurement decisions, with environmental restoration programs prioritizing equipment that minimizes soil compaction and preserves organic matter. At the same time, supply chain shifts-prompted by global trade tensions-are encouraging near-shoring of component manufacturing and the exploration of alternative alloys to mitigate dependency on imported steel.

This confluence of factors is reshaping the competitive landscape, challenging established players to adopt agile development cycles and cross-industry partnerships. As sustainability and efficiency become non-negotiable imperatives, the next wave of growth will hinge on the ability to integrate cutting-edge innovations with robust compliance strategies, ensuring that equipment not only meets performance benchmarks but also aligns with the evolving demands of regulators and conscientious end-users alike.

Analyzing the Cascading Effects of New United States Tariff Measures Expected in 2025 on Supply Chains Production Costs and Market Strategies

The announcement of heightened United States tariffs slated for implementation in 2025 has reverberated across global supply chains for mulching equipment. These measures, targeting key inputs such as high-strength steel and precision bearings, have introduced heightened cost uncertainty for manufacturers reliant on overseas suppliers. Consequently, procurement teams are reevaluating global sourcing strategies, weighing the benefits of partner diversification against the logistical overhead of near-term inventory buildup.Beyond the raw material surcharges, secondary effects have emerged in the form of fluctuating freight rates and insurance premiums, as shipping lines adjust to evolving trade patterns. Importers are contending with protracted lead times and more complex customs compliance requirements, which in turn are driving a trend toward modular production models and regional assembly hubs. By localizing key stages of the value chain, OEMs aim to mitigate duty impacts while maintaining responsiveness to shifting customer orders.

These dynamics are prompting a strategic refocus on cost management and supply chain resilience. Partnerships with regional steel producers and component fabricators are being forged to secure preferential terms, and some firms are exploring vertical integration for critical subassemblies. As this tariff landscape takes shape, manufacturers and distributors who proactively adapt procurement and inventory strategies will be best positioned to preserve margins and sustain market share amidst regulatory headwinds.

Deriving Actionable Insights from Detailed Segmentation Revealing Growth Drivers across Types Power Sources Operation Modes Applications and Sales Channels

The mulching equipment market demonstrates distinct growth trajectories when analyzed through the lens of product type. Disc mulchers have gained traction for their ability to handle stony grounds and roots, with innovations focusing on blade longevity and adjustable cutting angles. Drum mulchers are increasingly preferred in forestry and land management applications, as their robust construction and torque characteristics facilitate heavy biomass reduction without compromising operator safety. Rotary and shaft mulchers, meanwhile, are finding expanded use where versatility and ease of maintenance are paramount, especially in niche applications such as utility maintenance and erosion control.Power source selection further refines the competitive environment. Diesel engines continue to dominate large-scale agricultural and forestry settings due to their torque output and fuel logistics advantage, yet electric power units are carving out a presence in noise-sensitive environments and light landscaping tasks. Gasoline-powered models maintain relevance in remote or cost-constrained operations, while hydraulic drive systems are prized for their seamless integration with existing heavy machinery fleets.

Operation mode segmentation reveals a bifurcation between fully automatic and manual controls. Automated systems, integrating GPS guidance and adaptive speed regulation, are appealing to precision agriculture practitioners seeking uniform mulch distribution and minimized operator fatigue. Manual units, on the other hand, remain indispensable for customized interventions in small-scale and boundary-sensitive tasks.

Application diversity drives adjacent opportunities as agriculture, environmental restoration and erosion control, forestry and land management, landscaping and lawn maintenance, and utility and infrastructure maintenance each demand tailored equipment features. From reinforced cutting chambers for deforestation projects to low-emission electric mulchers for urban landscapers, product customization is emerging as a key differentiator.

Sales channels likewise shape market penetration strategies. Offline retail networks offer hands-on demonstrations and service support for complex machinery, whereas online retail platforms facilitate rapid comparison shopping and direct ordering for standard-configuration units. Balancing these channels enables manufacturers and distributors to reach a broader end-user base while adapting to evolving purchasing behaviors.

Uncovering Regional Dynamics Highlighting Distinct Market Opportunities and Challenges across the Americas Europe Middle East Africa and the Asia-Pacific

In the Americas, the demand for heavy-duty mulching equipment has surged in agricultural heartlands and wildfire-prone regions. Farmers and landowners are investing in machines capable of managing residue more efficiently, while public agencies prioritize mulchers that support vegetation management programs to mitigate fire risks. This emphasis on multifunctional units with robust dealer support networks is shaping product design and service models.Across Europe, Middle East & Africa, strict environmental regulations and land reclamation initiatives have elevated the profile of low-emission and noise-optimized machines. Government incentives for sustainable land management are prompting procurement of electric and hybrid models, particularly in sensitive habitats. In parallel, rapid infrastructure development in select Middle Eastern markets is generating opportunities for large-scale mulchers within utility corridor maintenance.

The Asia-Pacific region is witnessing diversification of demand, driven by mechanization efforts in agriculture and expanding forestry operations in Southeast Asia. Electric power adoption is gaining pace in densely populated urban areas of China and Japan, whereas diesel-powered and hydraulic mulchers remain staples in India’s extensive farmland. Local manufacturing partnerships and joint ventures are facilitating market access for international players seeking to tailor offerings to regional requirements.

These varied regional dynamics underscore the need for nuanced go-to-market strategies that account for regulatory landscapes, terrain characteristics, and end-user preferences. Manufacturers and distributors who adeptly align product positioning and after-sales support with regional priorities will unlock significant growth potential.

Evaluating Competitive Positioning and Strategic Initiatives of Leading Mulching Equipment Manufacturers Driving Innovation and Market Expansion

Global equipment leaders are advancing differentiated strategies to capture mulching market share. One major agricultural machinery manufacturer has prioritized digital integration by embedding telematics suites in new drum and disc mulchers, enabling remote diagnostics and usage analytics that enhance uptime and operator safety. Another established industrial tools provider is leveraging its distribution network to offer bundled service agreements, ensuring rapid parts availability and skilled maintenance support in both urban and remote locations.A specialist in forestry equipment has introduced modular machine platforms that can be reconfigured for rotary, shaft, or drum mulching tasks, catering to contractors with diverse project requirements. Concurrently, a landscaping-focused firm has unveiled a compact electric rotary mulcher with zero-emission certification, aiming to win urban public works contracts. Strategic alliances between component manufacturers and complete-equipment OEMs are also on the rise, enabling co‐development of high-efficiency hydraulic drive systems and proprietary wear-resistant alloys.

Through targeted acquisitions, several players are augmenting their portfolios with niche brands that offer specialized cutters and smart control interfaces. These moves not only broaden their product range but also provide cross-selling opportunities within existing dealer networks. In response to tariff pressures, some companies are establishing local fabrication facilities to reduce import dependencies and secure faster turnaround times for aftermarket components.

Collectively, these competitive maneuvers illustrate a landscape where innovation, service excellence, and supply chain agility define market leadership. Firms that successfully align their R&D pipelines with evolving customer needs and regulatory mandates will be best positioned to maintain upward momentum.

Formulating Actionable Recommendations to Enhance Operational Efficiency Foster Collaboration and Capitalize on Emerging Trends in the Mulching Equipment Market

Industry leaders seeking to strengthen their foothold in the mulching equipment sector should invest in next-generation powertrains that deliver both emission compliance and performance efficiency. Prioritizing R&D in electric and hybrid systems will cater to noise-sensitive and low-carbon segments, while optimizing diesel engines for reduced fuel consumption can protect margins in traditional markets. Simultaneously, partnerships with sensor and software providers will accelerate the rollout of machine-learning-enabled predictive maintenance solutions, reducing unplanned downtime and enhancing total cost of ownership propositions.To navigate trade uncertainties, executives should diversify supply bases by onboarding regional steel and component suppliers, thereby mitigating exposure to fluctuating tariffs and logistics bottlenecks. Establishing regional assembly hubs with modular production lines will allow rapid customization and aftermarket responsiveness, driving customer satisfaction and loyalty. Additionally, leveraging digital channels to augment offline sales with virtual demonstrations and interactive configuration tools can expand reach without significant incremental overhead.

Sustainability must underpin product and process innovation. Adopting recycled materials where feasible and designing for ease of disassembly will resonate with environmentally conscious buyers and regulators alike. Companies can further strengthen their market position by offering comprehensive service packages, including operator training programs and performance benchmarking services, which can foster deeper customer engagement and recurring revenue streams.

By pursuing these strategic imperatives-powertrain innovation, supply chain resilience, digital enhancement, and sustainability integration-industry leaders will be well equipped to capitalize on emerging opportunities and outpace competitors in the evolving mulching equipment market.

Detailing a Rigorous Research Methodology Combining Primary Surveys Secondary Research Expert Interviews and Data Verification for Comprehensive Analysis

This analysis integrates insights from primary data gathered through structured interviews with senior executives, product managers, and field technicians across the mulching equipment value chain. Quantitative surveys were conducted with end-users including agricultural cooperatives, forestry contractors, and landscaping firms to capture usage patterns, purchase drivers, and satisfaction benchmarks. These primary inputs were complemented by secondary research encompassing industry white papers, government publications on land management, and technical journals on machine design.Expert discussions with agronomists and environmental engineers provided deeper understanding of soil health considerations and regulatory compliance factors. Trade associations and equipment dealers contributed market intelligence on pricing dynamics and distribution trends. All data points underwent rigorous triangulation, cross-referencing multiple sources to ensure consistency and reliability.

A multi-stage validation process was employed in which preliminary findings were reviewed by an advisory panel of industry veterans and independent consultants. Feedback loops were incorporated to refine assumptions around powertrain adoption curves and tariff impact scenarios. Analytical frameworks including SWOT and PESTEL were applied to structure insights and facilitate scenario planning.

This comprehensive methodology ensures that the conclusions and recommendations presented herein are grounded in empirical evidence and vetted by subject matter authorities, offering a robust foundation for strategic decision-making in the mulching equipment ecosystem.

Synthesizing Key Findings and Strategic Imperatives Highlighted in the Executive Summary to Guide Future Decisions in the Mulching Equipment Domain

Throughout this executive overview, pivotal trends have emerged at the intersection of technological advancement, regulatory evolution, and operational optimization. The shift toward electrified power sources and digital connectivity is redefining performance benchmarks, while sustainability imperatives are influencing procurement decisions and product design. Tariff-driven supply chain adjustments underscore the need for diversified sourcing and agile manufacturing footprints. Region-specific dynamics reveal varied adoption rates and customer expectations across the Americas, Europe, Middle East & Africa, and Asia-Pacific.Segmentation insights highlight that customization based on type, power architecture, operation mode, application, and sales channel can unlock new avenues of differentiation and revenue growth. Competitive analysis underscores an escalating focus on integrated service models and strategic alliances to deliver comprehensive value to end-users. The recommended strategic pillars-powertrain innovation, supply resilience, digital enhancement, and sustainability integration-provide a clear roadmap for stakeholders aiming to secure competitive advantage.

In sum, the mulching equipment market stands at a strategic inflection point. Embracing these insights will empower manufacturers, distributors, and service providers to navigate uncertainties, capitalize on emerging trends, and lay the groundwork for long-term success.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Type

- Disc Mulcher

- Drum Mulcher

- Rotary Mulcher

- Shaft Mulcher

- Power Source

- Diesel

- Electric

- Gasoline

- Hydraulic

- Operation Mode

- Fully Automatic Operation

- Manual Operation

- Application

- Agriculture

- Environmental Restoration & Erosion Control

- Forestry & Land Management

- Landscaping & Lawn Maintenance

- Utility & Infrastructure Maintenance

- Sales Channel

- Offline Retail

- Online Retail

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- SEPPI M. S.p.A.

- Bobcat Company by Doosan Corporation

- Bauma Light

- Caterpillar Inc.

- Deere & Company

- DENIS CIMAF, Inc

- FASTVO Attachments

- Fecon Inc.

- Ganzhou Bausde Machinery Co., Ltd.

- Greenworks North America LLC

- Gyrotrac

- Husqvarna AB

- RABAUD Company

- Saeco Strips Pvt. Ltd.

- Tigercat International Inc.

- TIRTH AGRO TECHNOLOGY PRIVATE LIMITED

- TK Agro Industries

- WORX by Positec Tool Corporation

- FAE Group S.p.A.

- Morbark, LLC

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Mulching Equipment market report include:- SEPPI M. S.p.A.

- Bobcat Company by Doosan Corporation

- Bauma Light

- Caterpillar Inc.

- Deere & Company

- DENIS CIMAF, Inc

- FASTVO Attachments

- Fecon Inc.

- Ganzhou Bausde Machinery Co., Ltd.

- Greenworks North America LLC

- Gyrotrac

- Husqvarna AB

- RABAUD Company

- Saeco Strips Pvt. Ltd.

- Tigercat International Inc.

- TIRTH AGRO TECHNOLOGY PRIVATE LIMITED

- TK Agro Industries

- WORX by Positec Tool Corporation

- FAE Group S.p.A.

- Morbark, LLC

Table Information

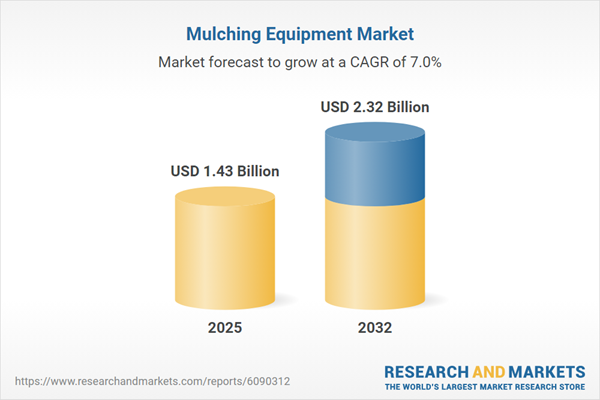

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.43 Billion |

| Forecasted Market Value ( USD | $ 2.32 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |