Speak directly to the analyst to clarify any post sales queries you may have.

Pioneering Perspectives on Mercury Cadmium Telluride Infrared Detectors Shaping Next Generation Sensing Capabilities and Opportunities for Stakeholders

The evolution of Mercury Cadmium Telluride infrared detectors has ushered in a new era of high-performance sensing across critical industries. Historically valued for their tunable bandgap and sensitivity throughout key infrared spectral ranges, these detectors have enabled breakthroughs in applications ranging from precision thermography to advanced missile tracking. As the demand for robust, low-noise, and high-resolution infrared imaging intensifies, organizations are placing renewed emphasis on detector performance enhancements that deliver both spectral adaptability and operational efficiency.In parallel with technological maturation, increased investment in research has spurred innovations in epitaxial growth techniques, advanced passivation methods, and integrated cooling solutions. These advancements have collectively reduced noise floors, enhanced pixel operability, and opened pathways for uncooled detector modules that compete with their cryogenically cooled counterparts. The convergence of material science breakthroughs with refined manufacturing processes has laid the foundation for a detector landscape poised to address emerging requirements in aerospace surveillance, biomedical diagnostics, and scientific exploration.

Within this executive summary, our analysis delves into the pivotal forces reshaping the Mercury Cadmium Telluride infrared detector market, examines policy and trade impacts, and unveils segmentation and regional dynamics that inform strategic decision making. By contextualizing these insights, stakeholders will gain a clear perspective on the trajectories driving innovation and adoption across the detector ecosystem.

Unraveling the Revolutionary Shifts Reshaping the Mercury Cadmium Telluride Detector Landscape with Emergent Applications and Technological Breakthroughs Fueling Growth

Recent years have seen a series of transformative shifts that are redefining the capabilities and applications of Mercury Cadmium Telluride detectors. Advances in molecular beam epitaxy and metal-organic chemical vapor deposition have significantly improved crystalline quality, allowing for larger detector arrays with uniform performance. Meanwhile, the integration of novel passivation layers has minimized surface recombination, driving down dark current and enabling operation closer to room temperature. As a result, uncooled detectors are increasingly viable for applications once dominated by cryogenically cooled architectures.Concurrently, the rise of edge computing and artificial intelligence has introduced new demands for on-chip processing, data compression, and real-time anomaly detection. Detector manufacturers are responding by embedding custom signal processing units and leveraging deep learning algorithms to enhance target recognition and noise reduction at the sensor level. Furthermore, the convergence of hybrid sensor designs-combining photoconductive and photovoltaic principles-has yielded devices that balance sensitivity and response time, catering to both high-speed tracking and low-flux imaging scenarios.

Through these technological and architectural breakthroughs, the detector landscape is experiencing a fundamental shift toward modular, software-defined imaging platforms. This evolution not only broadens the spectrum of end-user applications but also creates fertile ground for partnerships between detector specialists, semiconductor foundries, and algorithm developers, thereby accelerating market adoption and reinforcing long-term value creation.

Evaluating the Compounded Consequences of 2025 United States Tariffs on Mercury Cadmium Telluride Infrared Detector Value Chains and Competitive Dynamics

The imposition of new United States tariffs in 2025 has injected a layer of complexity into the global Mercury Cadmium Telluride detector supply chain. Faced with elevated import duties on key detector components and raw materials, manufacturers have pursued strategic realignment of sourcing strategies, exploring alternative epitaxial substrates and forging partnerships with overseas foundries. These shifts have not only mitigated immediate cost pressures but also catalyzed diversification across multiple assembly and packaging hubs.In response to the tariff landscape, several leading detector firms have accelerated the localization of critical manufacturing processes, investing in regional production cells to reduce cross-border dependencies. This localization trend pairs with heightened collaboration on technology transfer agreements, enabling smaller firms to access state-of-the-art epitaxial know-how without incurring prohibitive duty burdens. Moreover, end customers are recalibrating procurement cycles to incorporate longer lead times and inventory buffers, balancing risk management with budget constraints.

As trade policy continues to evolve, stakeholders must remain vigilant in monitoring regulatory developments and exploring flexible manufacturing alliances. By adopting a proactive stance-establishing contingency supply networks and leveraging bonded warehousing-companies can sustain product innovation while preserving margin stability amid tariff fluctuations.

Deciphering Intricate Market Segmentation Trends Across Product Innovation Spectral Capabilities Technology Platforms and End User Domains Driving Decision Making

An in-depth segmentation analysis reveals the intricate interplay between detector modalities, spectral sensitivities, architectural platforms, and end-user demands. When examining detector categories by product type, cooled infrared modules continue to dominate applications requiring ultra-low noise and high frame rates, especially in precision aerospace imaging and advanced defense systems. Conversely, uncooled variants are gaining traction in cost-conscious medical imaging and industrial temperature monitoring, thanks to simplified packaging and reduced operational overhead.Exploring the spectral dimension, long-wave infrared capabilities remain the gold standard for thermal contrast and environmental monitoring, whereas mid-wave infrared detectors excel in gas detection and missile plume tracking through their favorable signal-to-noise profiles. Short-wave infrared emerges as a vital niche for low-light surveillance and fiber optic analysis, leveraging InGaAs photodiode stacks that complement cadmium telluride's inherent responsiveness.

The choice of detector technology further shapes performance attributes: photoconductive detectors are prized for tunable bandgap engineering, enabling customized responsiveness across spectral bands, while photovoltaic detectors offer low-power operation and minimal dark current, making them ideal for compact imaging modules. Finally, the distribution of demand among aerospace, medical imaging, military and defense, and scientific research underscores the importance of tailoring product roadmaps to the specific operational and regulatory requirements of each vertical.

Mapping Regional Dynamics in the Mercury Cadmium Telluride Detector Market Across the Americas Europe Middle East Africa and Asia Pacific to Uncover Growth Hotspots

The geographic footprint of Mercury Cadmium Telluride detector adoption is characterized by distinct regional drivers and investment priorities. In the Americas, robust defense budgets and advanced research institutes have long served as catalysts for high-performance cooled detector systems, while a thriving industrial automation sector fuels downstream demand for uncooled thermal modules in predictive maintenance and energy efficiency applications.Europe, the Middle East and Africa present a nuanced landscape shaped by stringent regulatory frameworks, cross-border technology collaborations, and targeted funding for environmental monitoring. Regional aerospace centers in Western Europe partner closely with detector vendors to develop next-generation airborne imaging platforms, whereas medical research hubs in Northern Europe prioritize uncooled infrared modules for non-invasive diagnostics. Meanwhile, defense procurement in the Middle East sustains demand for versatile detector suites adaptable to harsh operational environments.

Across the Asia Pacific region, rapid industrial modernization and growing national space programs underpin an accelerating market for both cooled and uncooled detectors. Research institutions in East Asia are pioneering integrated photonic sensor arrays, and government-backed initiatives in South Asia are driving affordability and scale. This confluence of innovation, policy support, and expanding end-use sectors underscores the region's emergence as a pivotal growth engine in the global detector ecosystem.

Profiling Pioneering Companies Steering Mercury Cadmium Telluride Detector Advancements Through Strategic Collaborations Research Investments and Innovative Roadmaps

Key industry players are leveraging diverse strategies to solidify their leadership within the Mercury Cadmium Telluride detector arena. Market frontrunners with established epitaxial expertise are broadening their portfolios to include uncooled modules optimized for medical and industrial use cases, while concurrently scaling advanced cooled systems for defense and space missions. Strategic alliances between detector specialists and semiconductor foundries have emerged as a critical pathway to accelerate wafer-level innovation and cost-effective volume production.Notable collaborations include partnerships between legacy sensor designers and AI startups, targeting on-chip intelligence for real-time anomaly detection. Joint ventures aimed at developing hybrid photoconductive-photovoltaic arrays illustrate the industry's push toward multifunctional detector suites capable of simultaneously capturing multi-spectral data. In parallel, leading firms have increased their R&D budgets to explore next-generation epitaxial substrates and novel cooling architectures, all with a focus on reducing size, weight, power, and cost.

Acquisitions remain a pivotal tactic for accessing disruptive sensor technologies and specialized talent pools. By integrating niche innovators into broader organizational frameworks, these companies are accelerating time to market and fostering cross-disciplinary expertise that will define the next wave of infrared detection breakthroughs.

Delivering Pragmatic Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Supply Chain and Regulatory Risks in Detector Market

Industry leaders must adopt a multi-faceted approach to fully capitalize on emerging opportunities and navigate evolving challenges. First, prioritizing scalable manufacturing capabilities through strategic partnerships or capacity expansions will safeguard supply continuity and enable rapid fulfillment of defense, medical, and industrial orders. This should be complemented by diversified sourcing of epitaxial substrates and advanced packaging materials to mitigate the impact of future trade policy shifts.Second, embedding artificial intelligence and on-sensor processing capabilities will enhance system functionality, reduce data transmission burdens, and open new service models for predictive analytics and remote monitoring. Stakeholders should initiate pilot programs with software providers to co-develop algorithms tailored to specific spectral signatures and target detection scenarios. Third, focused investment in room-temperature and uncooled detector research can yield significant cost savings and broaden market accessibility, particularly in price-sensitive sectors.

Finally, engaging proactively with regulatory bodies and industry consortia will ensure alignment with evolving standards and facilitate the adoption of interoperable interfaces. By championing open protocols, companies can spur collaboration, accelerate integration, and establish themselves as preferred partners in complex aerospace, healthcare, and defense ecosystems.

Outlining Rigorous Research Methodology Combining Qualitative Expert Consultations Primary Stakeholder Interviews and Secondary Data Analysis to Ensure Analytical Integrity

The foundation of this analysis rests on a rigorous, multi-layered methodology designed to ensure depth, accuracy, and relevance. Initially, primary research was conducted through structured interviews with domain experts spanning detector R&D, manufacturing, and end-user deployment. These discussions provided firsthand insights into technological roadmaps, application challenges, and procurement decision drivers.Secondary research involved comprehensive review of technical white papers, patent filings, regulatory filings, and trade data to map the competitive landscape and identify emerging material science trends. Statistical triangulation techniques were employed to cross-validate qualitative findings with publicly available production and shipment indicators, ensuring a balanced perspective. Historical policy documents and tariff schedules were analyzed to quantify trade policy impacts and anticipate future regulatory shifts.

Throughout the research process, peer review sessions with academic collaborators and industry advisors were conducted to challenge assumptions and refine analytical frameworks. This integrative approach has produced a robust, evidence-based assessment that informs strategic action and supports confident decision making in the Mercury Cadmium Telluride detector ecosystem.

Consolidating Critical Findings on Mercury Cadmium Telluride Infrared Detectors Emphasizing Strategic Imperatives and Fostering Continued Innovation for Sustainable Competitive Advantage

The Mercury Cadmium Telluride infrared detector market is at an inflection point where material innovations, policy dynamics, and evolving end-user requirements converge to shape its future trajectory. As epitaxial growth techniques and hybrid detector architectures continue to push performance boundaries, stakeholders must remain agile in responding to tariff shifts and supply chain realignments.Segmentation analysis underscores the importance of tailoring product offerings to distinct application domains, from high-precision cooled modules in defense and aerospace to cost-effective uncooled solutions for medical imaging and industrial monitoring. Regional dynamics further highlight growth arenas in the Americas, nuanced regulatory ecosystems in Europe, the Middle East and Africa, and rapid uptake across Asia Pacific fueled by research initiatives and government backing.

Ultimately, success in this competitive landscape will be determined by an organization's ability to integrate technological foresight with strategic partnerships, regulatory engagement, and localized manufacturing agility. By synthesizing the insights presented here, decision makers are well positioned to navigate complexity, seize emerging white spaces, and secure sustainable advantage in the global detector arena.

Market Segmentation & Coverage

This research report forecasts revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Cooled Infrared Detectors

- Uncooled Infrared Detectors

- Spectral Range

- Long-Wave Infrared (LWIR)

- Mid-Wave Infrared (MWIR)

- Short-Wave Infrared (SWIR)

- Detector Technology

- Photoconductive Detectors

- Photovoltaic Detectors

- End-User

- Aerospace

- Medical Imaging

- Military & Defense

- Scientific Research

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Acal BFi Group

- Elbit Systems Ltd.

- EPIR Technologies Incorporated

- Excelitas Technologies

- Hamamatsu Photonics K.K.

- Kolmar Technologies, Inc.

- Leonardo DRS, Inc.

- Lynred S.A.

- Mitsubishi Electric Corporation

- Nippon Ceramic Co., Ltd.

- Safran Electronics & Defense

- Sierra Olympia Technologies Inc.

- Teledyne Technologies Incorporated

- Thorlabs, Inc.

- VIGO Photonics S.A.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Mercury Cadmium Telluride Infrared Detector market report include:- Acal BFi Group

- Elbit Systems Ltd.

- EPIR Technologies Incorporated

- Excelitas Technologies

- Hamamatsu Photonics K.K.

- Kolmar Technologies, Inc.

- Leonardo DRS, Inc.

- Lynred S.A.

- Mitsubishi Electric Corporation

- Nippon Ceramic Co., Ltd.

- Safran Electronics & Defense

- Sierra Olympia Technologies Inc.

- Teledyne Technologies Incorporated

- Thorlabs, Inc.

- VIGO Photonics S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

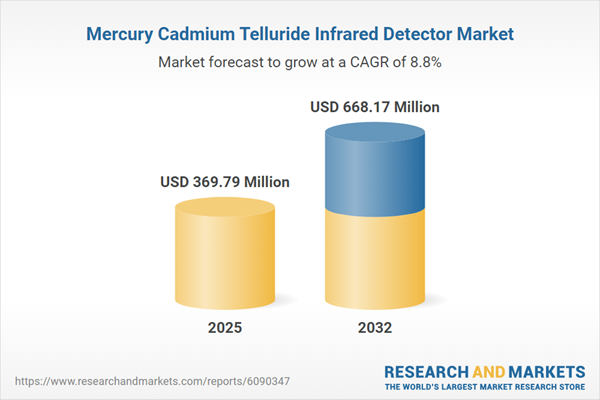

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 369.79 Million |

| Forecasted Market Value ( USD | $ 668.17 Million |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |