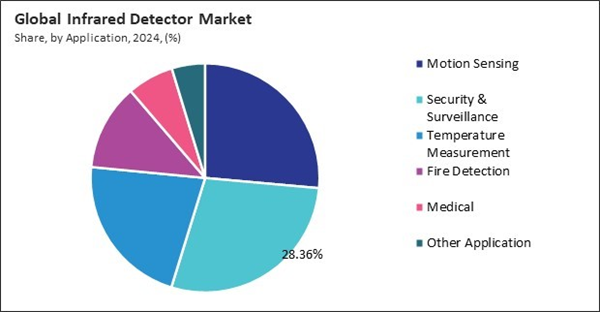

In temperature measurement, IR detectors offer non-contact sensing solutions that are invaluable in industrial, healthcare, and consumer use cases. Industrial processes benefit from these sensors through continuous equipment monitoring and predictive maintenance, reducing downtime and enhancing safety. Thus, the temperature measurement acquired 21.7% revenue share by Application in the market 2024. On the consumer side, IR thermometers became mainstream during the COVID-19 pandemic, and their usage has continued in health monitoring, especially in public places. In industrial automation, companies integrate IRDs into systems for quality control in manufacturing lines, detecting thermal inconsistencies in electronic or mechanical components. Brands like Optris, Fluke, and Melexis have a strong presence in this application segment.

Driving and Restraining Factors

Drivers

- Rising Demand for Security and Surveillance Systems

- Expansion in Industrial Automation and Manufacturing Processes

- Growth in Automotive Safety Applications

- Increased Use in Healthcare and Medical Diagnostics

Restraints

- High Cost and Manufacturing Complexity

- Stringent Export Regulations and Compliance Barriers

- Competition from Alternative Technologies

Opportunities

- Integration of Infrared Detectors in Smart Cities and Urban Infrastructure

- Expansion of Infrared Technology in Renewable Energy and Environmental Monitoring

- Rising Adoption of Infrared Detectors in Consumer Electronics and Wearables

Challenges

- High Cost and Manufacturing Complexity

- Stringent Export Regulations and Compliance Barriers

- Competition from Alternative Technologies

Market Growth Factors

The escalating need for advanced security and surveillance solutions is a significant driver of the infrared detectors market. Infrared detectors are integral to surveillance systems, offering capabilities such as night vision, motion detection, and thermal imaging. These features are crucial for monitoring activities in low-light or no-light conditions, making them indispensable for military, law enforcement, and civilian security applications. The growing concerns over safety and the need for real-time monitoring have led to the widespread adoption of infrared detectors in public spaces, critical infrastructure, and private properties. In summary, the increasing emphasis on security across various sectors, coupled with technological advancements and cost reductions, is driving the robust growth of the infrared detectors market.Additionally, the integration of infrared detectors into industrial automation and manufacturing processes is a significant factor contributing to market growth. Infrared detectors enable non-contact temperature measurements, which are essential for monitoring equipment’s health, ensuring product quality, and maintaining safety standards. In manufacturing environments, infrared detectors help in predictive maintenance by identifying overheating components before failures occur, thereby reducing downtime and maintenance costs. The integration of infrared technology into industrial systems supports the move towards Industry 4.0, where smart factories rely on real-time data and automation to optimize operations. As industries continue to embrace digital transformation and smart manufacturing practices, the demand for infrared detectors is expected to rise significantly.

Market Restraining Factors

However, one of the most significant constraints limiting the widespread adoption of infrared (IR) detectors is their high cost and complex manufacturing process. IR detectors - especially cooled types that require cryogenic systems - are composed of highly sensitive semiconductor materials such as mercury cadmium telluride (HgCdTe), indium antimonide (InSb), and indium gallium arsenide (InGaAs). These materials are not only expensive but also require precision-controlled fabrication environments. Manufacturing facilities must meet cleanroom standards and use advanced deposition and etching technologies to produce detectors that can function accurately under demanding conditions. The incorporation of vacuum packaging and cooling mechanisms, especially for long-wave infrared (LWIR) and mid-wave infrared (MWIR) ranges, makes the devices bulky and cost-intensive. In summary, unless the cost of materials, production, and long-term maintenance are significantly reduced through innovation or economies of scale, the growth of the infrared detectors market will remain somewhat restrained.Value Chain Analysis

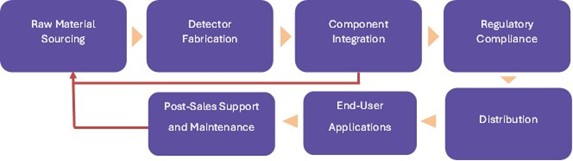

The value chain analysis of the Infrared Detectors Market comprises several key stages. It begins with raw material sourcing, where high-purity semiconductors and substrates are acquired. This feeds into detector fabrication, involving precision engineering to create sensitive IR components. The next phase is component integration, where detectors are assembled into broader systems. Regulatory compliance ensures adherence to international safety and performance standards. Afterward, the products move through distribution channels to reach various sectors. End-user applications span defense, industrial, automotive, and consumer electronics. Post-sales support and maintenance ensures continued performance, while feedback loops inform improvements, creating a cyclical enhancement of the value chain.

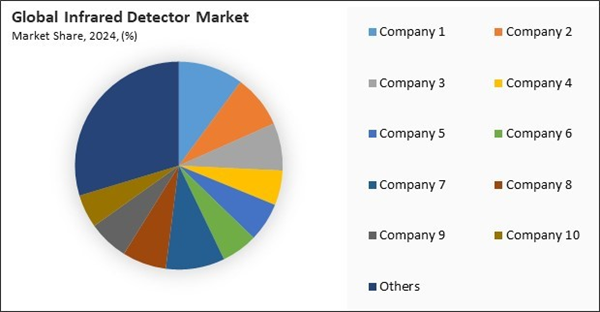

Market Share Analysis

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Type Outlook

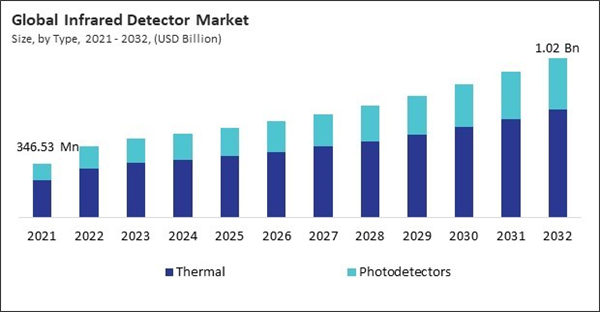

Based on Type, the market is segmented into Thermal and Photodetectors. The photodetector segment is primarily driven by increased defense spending and growing demand for advanced infrared imaging systems used in missile guidance, perimeter security, and surveillance drones. Thus, photodetector segment acquired 31.22% revenue share by type in the market 2024. The space exploration sector, with agencies like NASA and ESA relying on high-performance infrared detectors for planetary imaging and spectral analysis, is another influential driver. Additionally, automotive night vision systems in premium vehicles often use photodetectors for their accuracy and fast detection capabilities.Application Outlook

Based on Application, the market is segmented into Motion Sensing, Security & Surveillance, Temperature Measurement, Fire Detection, Medical, and Other Application. The fire detection segment utilizes IR detectors to sense heat signatures and flame patterns that are invisible to standard smoke detectors. Thus, the fire detection segment acquired 12.2% revenue share by Application in the market 2024. These are especially useful in high-risk environments such as oil rigs, chemical plants, warehouses, and data centers. By detecting the unique IR emission from flames or overheated surfaces, these sensors can provide earlier alerts than traditional methods, reducing damage and response time.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In North America, particularly the United States, the infrared detectors market is strongly driven by defense and aerospace applications, which account for a significant share of demand. The region is home to some of the world's largest defense contractors and aerospace research bodies, such as Lockheed Martin, Raytheon (RTX), and NASA, all of which rely heavily on high-performance IR detector systems for surveillance, targeting, thermal imaging, and scientific instrumentation. Government funding through programs governed by the U.S. Department of Defense and National Security Agency continues to support the growth of advanced IR technologies.Recent Strategies Deployed in the Market

- Apr-2025: Texas Instruments, Inc. unveiled a new portfolio of automotive lidar, clock, and radar chips aimed at enhancing vehicle safety and supporting autonomous features. The LMH13000, a high-speed lidar laser driver, offers ultra-fast rise times for real-time decision-making. TI’s new radar sensor and clock generators also improve ADAS reliability.

- Feb-2025: Hamamatsu Photonics K.K. unveiled the G1719X series of InGaAs photodiodes, offering high sensitivity and low dark current for near-infrared detection (1.7-2.6 μm). Designed in a compact, surface-mounted ceramic package, they suit applications like gas sensing, laser systems, and portable devices, enabling precise, reliable performance across various industrial uses.

- Feb-2024: Hamamatsu Photonics K.K. unveiled the C16741-40U InGaAs camera, offering SXGA resolution (1280×1024) and sensitivity from 400 nm to 1700 nm. With 5 μm pixels, low readout noise, and Peltier cooling, it delivers high-quality SWIR imaging for applications like plastic sorting, wafer inspection, laser alignment, and solar cell evaluation.

- Jan-2024: Teledyne FLIR LLC announced the partnership with Valeo, an automaker company to deliver the first ASIL B thermal imaging technology for night vision ADAS. Integrating Valeo’s AI-based software and Teledyne FLIR’s thermal imaging, the solution enhances night-time AEB and multispectral sensor fusion, boosting ADAS and autonomous vehicle safety, especially in low-visibility conditions.

- Jun-2023: Leonardo SpA unveiled a new 8-inch Electro-Optical/Infrared (EO/IR) stabilized gimbal designed for Group 2 and 3 Unmanned Aircraft Systems (UAS) platforms. This advanced technology enhances surveillance capabilities by providing stabilized infrared and electro-optical imaging, supporting a wide range of defense and security applications.

List of Key Companies Profiled

- Teledyne FLIR LLC (Teledyne Technologies Incorporated)

- Hamamatsu Photonics K.K.

- RTX Corporation

- TE Connectivity Ltd.

- Texas Instruments, Inc.

- Murata Manufacturing Co., Ltd.

- Honeywell International, Inc.

- BAE Systems PLC

- L3Harris Technologies, Inc.

- Leonardo SpA (Leonardo DRS, Inc.)

Market Report Segmentation

By Type

- Thermal

- Photodetectors

By Application

- Motion Sensing

- Security & Surveillance

- Temperature Measurement

- Fire Detection

- Medical

- Other Application

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Teledyne FLIR LLC (Teledyne Technologies Incorporated)

- Hamamatsu Photonics K.K.

- RTX Corporation

- TE Connectivity Ltd.

- Texas Instruments, Inc.

- Murata Manufacturing Co., Ltd.

- Honeywell International, Inc.

- BAE Systems PLC

- L3Harris Technologies, Inc.

- Leonardo SpA (Leonardo DRS, Inc.)