Dairy blends are evolving quickly, thanks to major advancements in technology. Breakthroughs in homogenization, microencapsulation, and precision blending are allowing manufacturers to create blends that target specific health goals or dietary requirements. Whether it’s lowering fat content, enriching with vitamins, or customizing blends for children, athletes, or the elderly, the industry now has the tools to deliver precision nutrition. The focus on wellness is stronger than ever, and these tailored solutions are helping consumers meet personal health targets without giving up flavor or texture. Global supply chain diversification is another driving factor. Companies are now more agile in their sourcing and production, helping them adapt quickly to fluctuations in raw material prices, trade dynamics, and climate-related challenges.

The market is segmented by type into refined creams, butter, cheese, yogurt, and other specialty blends. Among these, butter blends are making a strong impact and are expected to reach USD 903.7 million by 2034, growing at a CAGR of 6.5%. These blends are highly valued in the food processing sector for their consistent texture, flavor, and ability to stabilize product formulations, particularly in baked and packaged foods.

In terms of form, dairy blends are categorized as powders, liquids, and spreadable products. Spreadable blends dominate with a 47.2% market share and are projected to hit USD 1.2 billion by 2034, growing at a CAGR of 6.9%. Their ease of use, compatibility with fast-paced lifestyles, and versatility in everything from direct spreads to sauces and meal kits make them a consumer favorite.

North America’s dairy blends market is forecasted to grow at a CAGR of 6.1% between 2025 and 2034, supported by the region’s shift toward health-conscious, plant-forward diets. Blends incorporating soy, oat, or almond elements are gaining traction among those seeking clean-label, functional alternatives to traditional dairy. The rising demand for flavor-enhancing, nutrient-rich, and shelf-stable foods further boosts market growth.

Leading companies such as Cargill, Agropur, Friesland Campina, Kerry Group, Fonterra, Döhler, and AFP are pushing the envelope with R&D investments aimed at delivering cleaner labels and higher nutritional value. Through strategic collaborations and sustainability-focused initiatives, these players are expanding their global footprint while meeting consumer expectations for responsible sourcing and reduced environmental impact.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this dairy blends market report include:- Kerry Group plc

- FrieslandCampina

- Cargill, Incorporated

- Fonterra Co-operative Group Limited

- Döhler GmbH

- Agropur

- AFP advanced food products llc

- Cape Food Ingredients

- Intermix Australia Pty Ltd.

- Spectrum Organics Products, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 300 |

| Published | April 2025 |

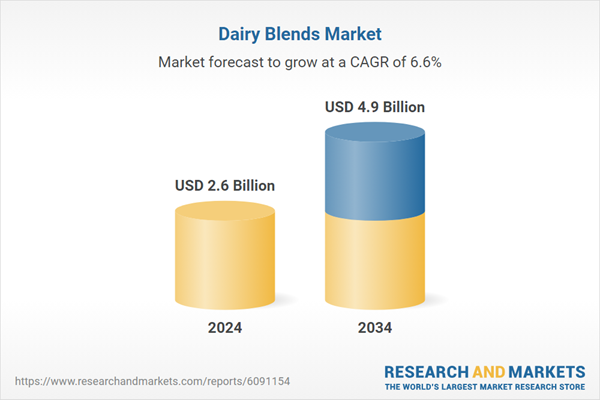

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.6 Billion |

| Forecasted Market Value ( USD | $ 4.9 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |