Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

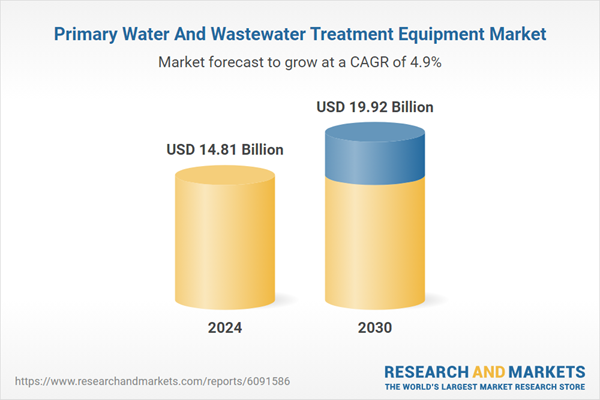

These systems - comprising screening, sedimentation, grit removal, and flotation - serve to safeguard downstream equipment and optimize the overall treatment process. Increasing water scarcity and the enforcement of stringent effluent discharge regulations across key regions like North America, Europe, and Asia-Pacific are prompting significant investments in water treatment infrastructure. Industrial sectors such as oil & gas, chemicals, power, and food & beverage are adopting advanced primary systems to meet compliance standards and minimize their environmental impact, further fueling market growth.

Key Market Drivers

Increasing Global Water Scarcity and Demand for Reuse

Escalating water scarcity, particularly in densely populated and arid regions, is propelling the demand for effective primary treatment systems. As projected by the United Nations, nearly two-thirds of the global population may face water-stressed conditions by 2025. This challenge is leading municipalities and industries to invest in water reuse and recycling technologies.Primary treatment equipment is essential in this process, removing coarse solids, grit, and organic material before secondary or advanced treatment. In water-scarce areas such as the Middle East and North Africa, where annual freshwater availability is below 1,000 cubic meters per capita, compact and high-efficiency primary systems are being widely deployed to support water reuse in agriculture and industry. The global drive to enhance water resource sustainability continues to position primary treatment as a fundamental component in water recovery and conservation strategies.

Key Market Challenges

High Capital and Operational Expenditure

A key challenge impeding market expansion is the high capital investment required for the installation of primary water and wastewater treatment equipment. Infrastructure such as clarifiers, sedimentation tanks, and grit chambers demands substantial upfront expenditure, often including ancillary costs for structural modifications and power systems. These financial barriers are particularly burdensome in developing regions with limited public funding or external financial support.Operational expenses - spanning energy usage, maintenance, labor, and treatment chemicals - further elevate the total cost of ownership. For municipal utilities and small industrial users with restricted budgets, maintaining such systems can strain resources. The slow return on investment, often mismatched with stakeholder expectations for fast payback, contributes to delayed procurement and modernization decisions. The market’s growth thus hinges on the availability of modular, scalable systems and supportive financial models that can align with diverse budget constraints and encourage phased adoption.

Key Market Trends

Rising Integration of Automation and Smart Monitoring Technologies

The adoption of automation, IoT, and AI-enabled technologies is transforming the primary water and wastewater treatment segment by enhancing operational performance and process reliability. Modern treatment facilities are implementing smart systems capable of real-time monitoring, automated flow regulation, and predictive maintenance. Embedded sensors within clarifiers, grit chambers, and sedimentation equipment track parameters such as turbidity, solids concentration, and flow velocity.These data are transmitted to cloud-based platforms or control panels for analysis and decision-making, significantly reducing the need for manual intervention and enabling faster responses to abnormalities. Automation is particularly beneficial in addressing labor shortages and rising workforce costs. Smaller and mid-sized utilities are leveraging these technologies to maintain compliance while streamlining operations. Predictive analytics also support preventative maintenance strategies, reducing unplanned downtime and extending equipment life. This trend is gaining traction in North America, Europe, and rapidly urbanizing Asian regions, where smart infrastructure is integral to water security and system modernization.

Key Market Players

- Veolia Environnement SA

- Xylem Inc.

- SUEZ SA

- Pentair plc

- Evoqua Water Technologies LLC

- Aquatech International LLC

- Ecolab Inc.

- DuPont Water Solutions

- Calgon Carbon Corporation

- Kurita Water Industries Ltd.

Report Scope:

In this report, the Global Primary Water And Wastewater Treatment Equipment Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Primary Water And Wastewater Treatment Equipment Market, By Equipment Type:

- Screens

- Grit Removal Equipment

- Sedimentation Equipment

- Dissolved Air Flotation (DAF) Systems

- Oil & Grease Removal Equipment

- Pumps & Mixers

- Others

Primary Water And Wastewater Treatment Equipment Market, By Application:

- Municipal Water Treatment

- Industrial Wastewater Treatment

Primary Water And Wastewater Treatment Equipment Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Primary Water And Wastewater Treatment Equipment Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Veolia Environnement SA

- Xylem Inc.

- SUEZ SA

- Pentair plc

- Evoqua Water Technologies LLC

- Aquatech International LLC

- Ecolab Inc.

- DuPont Water Solutions

- Calgon Carbon Corporation

- Kurita Water Industries Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.81 Billion |

| Forecasted Market Value ( USD | $ 19.92 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |