The luxury car market represents a premium segment of the automotive industry, encompassing vehicles that offer superior performance, advanced technology, top-tier materials, and a prestigious brand image. These cars are typically equipped with bespoke interiors, state-of-the-art infotainment systems, and enhanced safety features. Brands such as Mercedes-Benz, BMW, Audi, Porsche, and Lexus dominate this space, with niche players like Rolls-Royce and Bentley catering to ultra-luxury clientele. The market serves high-net-worth individuals, business executives, and consumers seeking a symbol of status, performance, and comfort. As global wealth rises and personalization becomes a top priority, the luxury car market continues to diversify with hybrid, electric, and digital-first experiences.

In 2024, the luxury car market rebounded strongly post-supply chain disruptions, driven by pent-up demand, robust EV launches, and rising luxury spending. Automakers introduced limited-edition models, electric variants, and tech-focused luxury sedans and SUVs. AI-powered in-car assistants, autonomous features, and connected car ecosystems became core offerings. China, the U.S., and the Middle East emerged as high-growth markets, with demand bolstered by economic recovery and expanding affluent populations. Luxury brands focused on digital showrooms, concierge services, and exclusive memberships to deepen customer engagement. Moreover, sustainability credentials - such as vegan interiors and net-zero factories - became crucial brand differentiators in luxury mobility.

By 2025 and beyond, the luxury car landscape will shift further toward electrification, with most premium brands aiming to become all-electric by the end of the decade. Innovation will center on immersive in-cabin experiences, autonomous driving technologies, and AI-driven customization. Emerging markets like India, Vietnam, and Saudi Arabia are expected to post double-digit growth, fueled by infrastructure development and aspirational buying. The rise of subscription-based luxury mobility, personalized financing models, and carbon-neutral product lines will redefine ownership and sustainability. Collaborations between luxury fashion houses and automotive OEMs are also expected to rise, bringing haute couture aesthetics into automotive design and interiors.

Key Insights: Luxury Car Market

- Electrification of luxury lineups is accelerating, with brands introducing high-performance EVs that maintain legacy brand DNA and prestige.

- Connected and autonomous features are reshaping the user experience, emphasizing digital dashboards, AI co-pilots, and predictive maintenance.

- Luxury carmakers are embracing sustainability with vegan leather, recycled materials, and carbon-neutral production targets.

- Digital transformation is redefining the buyer journey with virtual showrooms, AR configuration tools, and remote concierge services.

- Collaborations with luxury lifestyle and fashion brands are creating co-branded vehicles that blend automotive and design excellence.

- Rising global wealth and aspirational middle classes are boosting demand for premium vehicles, particularly in Asia-Pacific and the Middle East.

- Technological innovation in safety, connectivity, and infotainment is enhancing brand differentiation and consumer satisfaction.

- Government incentives and mandates for electric vehicles are accelerating luxury automakers’ shift toward sustainable models.

- Demand for personalization and exclusivity is encouraging bespoke vehicle customization and curated customer experiences.

- Global economic volatility and geopolitical risks can impact luxury spending patterns, particularly in key regions like Europe and China.

- Semiconductor shortages, material cost inflation, and EV infrastructure gaps may hinder production and adoption timelines.

Luxury Car Market Segmentation

By Vehicle:

- Hatchback

- Sedan

- Sports Utility

- Multi-Purpose Vehicle

By Vehicle Class:

- Entry-Level Luxury

- Mid-Level Luxury

- Ultra Luxury

By Propulsion:

- ICE

- Electric

By Fuel:

- Gasoline

- Diesel

- Electric

By Geography:

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Luxury Car Market Size Data, Trends, Growth Opportunities, and Restraining Factors:

- This comprehensive Luxury Car market report delivers updated market size estimates from 2024 to 2034, offering in-depth analysis of the latest Luxury Car market trends, short-term and long-term growth drivers, competitive landscape, and new business opportunities. The report presents growth forecasts across key Luxury Car types, applications, and major segments, alongside detailed insights into the current Luxury Car market scenario to support companies in formulating effective market strategies.

- The Luxury Car market outlook thoroughly examines the impact of ongoing supply chain disruptions and geopolitical issues worldwide. Factors such as trade tariffs, regulatory restrictions, production losses, and the emergence of alternatives or substitutes are carefully considered in the Luxury Car market size projections. Additionally, the analysis highlights the effects of inflation and correlates past economic downturns with current Luxury Car market trends, providing actionable intelligence for stakeholders to navigate the evolving Luxury Car business environment with precision.

Luxury Car Market Competition, Intelligence, Key Players, and Winning Strategies to 2034:

- The 2025 Luxury Car Market Research Report identifies winning strategies for companies to register increased sales and improve market share.

- Opinions from senior executives from leading companies in the Luxury Car market are imbibed thoroughly and the Luxury Car industry expert predictions on the economic downturn, technological advancements in the Luxury Car market, and customized strategies specific to a product and geography are mentioned.

- The Luxury Car market report is a source of comprehensive data and analysis of the industry, helping businesses to make informed decisions and stay ahead of the competition. The Luxury Car market study assists investors in analyzing On Luxury Car business prospects by region, key countries, and top companies' information to channel their investments.

- The report provides insights into consumer behavior and preferences, including their buying patterns, brand loyalty, and factors influencing their purchasing decisions. It also includes an analysis of the regulatory environment and its impact on the Luxury Car industry. Shifting consumer demand despite declining GDP and burgeoning interest rates to control surging inflation is well detailed.

What's Included in the Report?

- Global Luxury Car market size and growth projections, 2024-2034

- North America Luxury Car market size and growth forecasts, 2024-2034 (United States, Canada, Mexico)

- Europe market size and growth forecasts, 2024-2034 (Germany, France, United Kingdom, Italy, Spain)

- Asia-Pacific Luxury Car market size and growth forecasts, 2024-2034 (China, India, Japan, South Korea, Australia)

- Middle East Africa Luxury Car market size and growth estimate, 2024-2034 (Middle East, Africa)

- South and Central America Luxury Car market size and growth outlook, 2024-2034 (Brazil, Argentina, Chile)

- Luxury Car market size, share and CAGR of key products, applications, and other verticals, 2024-2034

- Short- and long-term Luxury Car market trends, drivers, challenges, and opportunities

- Luxury Car market insights, Porter’s Five Forces analysis

- Profiles of 5 leading companies in the industry - overview, key strategies, financials, product portfolio and SWOT analysis

- Latest market news and developments

Key Questions Answered in This Report:

- What is the current Luxury Car market size at global, regional, and country levels?

- What is the market penetration of different types, Applications, processes/technologies, and distribution/sales channels of the Luxury Car market?

- What will be the impact of economic slowdown/recission on Luxury Car demand/sales?

- How has the global Luxury Car market evolved in past years and what will be the future trajectory?

- What is the impact of growing inflation, Russia-Ukraine war on the Luxury Car market forecast?

- What are the Supply chain challenges for Luxury Car?

- What are the potential regional Luxury Car markets to invest in?

- What is the product evolution and high-performing products to focus in the Luxury Car market?

- What are the key driving factors and opportunities in the industry?

- Who are the key players in Luxury Car market and what is the degree of competition/Luxury Car market share?

- What is the market structure /Luxury Car Market competitive Intelligence?

Available Customizations:

The standard syndicate report is designed to serve the common interests of Luxury Car Market players across the value chain, and include selective data and analysis from entire research findings as per the scope and price of the publication.However, to precisely match the specific research requirements of individual clients, several customization options are offered to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below:

- Segmentation of choice - Clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

- Luxury Car Pricing and Margins Across the Supply Chain, Luxury Car Price Analysis / International Trade Data / Import-Export Analysis.

- Supply Chain Analysis, Supply-Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Luxury Car market analytics.

- Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations.

- Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

- Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Additional support:

- All the data presented in tables and charts of the report is provided in a separate Excel document

- Print authentication allowed on purchase of online versions

- 10% free customization to include any specific data/analysis to match the requirement

- 7 days of analyst support

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Volkswagen Group

- Toyota Motor Corporation

- Stellantis N.V.

- Mercedes-Benz Group AG

- Ford Motor Company

- BMW AG

- Honda Motor Co Ltd.

- Hyundai Motor Group

- Tesla Inc.

- Nissan Motor Co. LTD

- Audi AG

- Kia Corporation

- Renault Group

- Continental AG

- Tata Motors Limited

- Volvo Car Corporation

- Mazda Motor Corporation

- Subaru Corporation

- Jaguar Land Rover Automotive PLC

- Rolls-Royce plc

- Ferrari N.V.

- Aston Martin Lagonda Group Limited

- Acura

- Brilliance Auto Group

- Aiways.

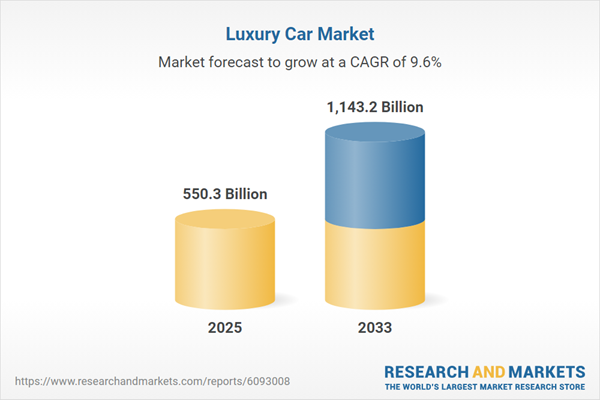

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | August 2025 |

| Forecast Period | 2025 - 2033 |

| Estimated Market Value ( USD | $ 550.3 Billion |

| Forecasted Market Value ( USD | $ 1143.2 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |