Global Video Banking Services Market - Key Trends & Drivers Summarized

Why Are Banks Turning to Video to Redefine Customer Engagement in the Digital Era?

As banking increasingly shifts from physical branches to digital platforms, video banking services are emerging as a transformative tool for enhancing customer experience while maintaining a human touch. By allowing customers to interact with banking representatives through live video calls, these services bridge the gap between self-service digital banking and traditional face-to-face interactions. The shift is being driven by consumers' growing expectations for convenience, personalization, and instant support. Financial institutions are leveraging video to offer services such as loan consultations, financial planning, account openings, and customer onboarding - all from the comfort of a customer's home. This has proven especially effective in reaching tech-savvy millennials, busy professionals, and remote populations underserved by physical branches. The COVID-19 pandemic played a pivotal role in accelerating adoption, with banks worldwide forced to rethink service delivery models amid lockdowns and safety concerns. What began as a necessity has since evolved into a competitive advantage, with banks now embedding secure video conferencing features into their mobile apps and websites. This not only reduces customer wait times and operational costs but also strengthens engagement and builds trust. As banks race to differentiate in a crowded fintech landscape, video banking has become a key pillar in delivering personalized, accessible, and emotionally resonant service experiences.How Is Technology Enabling the Growth and Sophistication of Video Banking Platforms?

Cutting-edge technologies are powering the next generation of video banking services, making them smarter, more secure, and seamlessly integrated across digital channels. High-definition video, AI-based facial recognition, eKYC (electronic Know Your Customer) systems, and biometric authentication have enabled banks to perform critical services such as identity verification and fraud prevention in real time. Many platforms now include document sharing, digital signature capabilities, and screen-sharing functionalities, allowing for complete end-to-end transactions - whether it's applying for a mortgage or updating account details. Video analytics and AI-driven sentiment analysis are being used to evaluate customer mood and engagement, helping agents tailor their responses more effectively. Some banks are integrating chatbot assistants to accompany video sessions, allowing for instant FAQs and support functions while human agents focus on high-value interactions. Additionally, cloud-based infrastructure and WebRTC (Web Real-Time Communication) technology ensure high-quality, encrypted video connections with minimal latency. Financial institutions are also deploying omnichannel video banking, enabling customers to start a video session on one device and seamlessly transition to another. These advancements are making video banking more than just a communication tool - it is evolving into a strategic service delivery platform equipped with the intelligence, security, and agility demanded by modern banking.What Market Segments and Use Cases Are Expanding the Scope of Video Banking?

The video banking services market is broadening its reach across multiple segments and use cases, transforming both retail and corporate banking landscapes. In retail banking, video is widely used for account onboarding, credit card applications, personal loan consultations, and digital customer service. Customers in rural or underserved areas benefit particularly from access to specialized services without needing to travel to a branch. In the corporate and SME segments, video banking facilitates remote advisory services, financial reviews, and onboarding of business accounts, which traditionally required in-person meetings. Wealth management is another rapidly growing segment - video consultations allow clients to receive real-time investment advice, portfolio updates, and risk assessments from relationship managers across the globe. Additionally, video teller machines (VTMs) and self-service kiosks with live video support are being deployed in semi-urban areas to provide extended-hour service while reducing branch overhead. Financial institutions are also exploring hybrid models where in-branch staff assist customers through video terminals to optimize resource allocation. From a channel perspective, mobile banking apps are the most common platform for video engagement, followed by desktop portals and in-branch kiosks. These varied use cases demonstrate video banking's versatility and its ability to enhance service delivery, efficiency, and customer satisfaction across a diverse range of financial products and demographics.What Factors Are Fueling the Growth of the Global Video Banking Services Market?

The growth in the video banking services market is driven by several factors related to changing consumer expectations, technological capabilities, service delivery innovation, and competitive pressure. One of the primary drivers is the shift in customer behavior toward on-demand, remote services that still offer human interaction - particularly valued in financial transactions involving trust and complexity. Technological advancements such as AI-powered analytics, secure cloud infrastructure, and real-time document processing are making video banking more scalable, reliable, and user-friendly. From an end-use perspective, the desire for personalized advisory services - especially in areas like loans, investments, and retirement planning - is pushing banks to adopt high-touch video channels that go beyond impersonal chatbots or call centers. Financial institutions are also looking to optimize operational efficiency by centralizing expertise through video hubs, reducing the need for specialist staff at every branch location. Moreover, the expansion of digital inclusion initiatives and rising internet penetration in emerging markets are opening new customer segments for video banking services. Regulatory support for eKYC and digital signatures across jurisdictions further facilitates seamless onboarding and compliance. Together, these technology-enabled service models, end-user adoption trends, and evolving financial infrastructure are driving rapid growth in the global video banking services market.Report Scope

The report analyzes the Video Banking Services market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Solutions, Services); Deployment (On-Premise Deployment, Cloud Deployment); Application (Banks, Credit Union, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solutions Component segment, which is expected to reach US$120 Billion by 2030 with a CAGR of a 13.6%. The Services Component segment is also set to grow at 9.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $23 Billion in 2024, and China, forecasted to grow at an impressive 16.7% CAGR to reach $35.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Video Banking Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Video Banking Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Video Banking Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Angelcare, Anker Innovations (Eufy), Arlo Technologies, Babysense, Bonoch and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Video Banking Services market report include:

- Advids

- Alltru Credit Union

- American Express

- AU Small Finance Bank

- Barclays

- Cisco Systems

- Glia Technologies

- Guaranty Trust Bank

- Merrill Lynch

- Microsoft

- Morgan Stanley

- NatWest Group

- Pexip

- STAR Financial Bank

- StonehamBank

- Tata Communications

- TrueConf

- U.S. Bank

- Vidyard

- Zoom Video Communications

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advids

- Alltru Credit Union

- American Express

- AU Small Finance Bank

- Barclays

- Cisco Systems

- Glia Technologies

- Guaranty Trust Bank

- Merrill Lynch

- Microsoft

- Morgan Stanley

- NatWest Group

- Pexip

- STAR Financial Bank

- StonehamBank

- Tata Communications

- TrueConf

- U.S. Bank

- Vidyard

- Zoom Video Communications

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 270 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

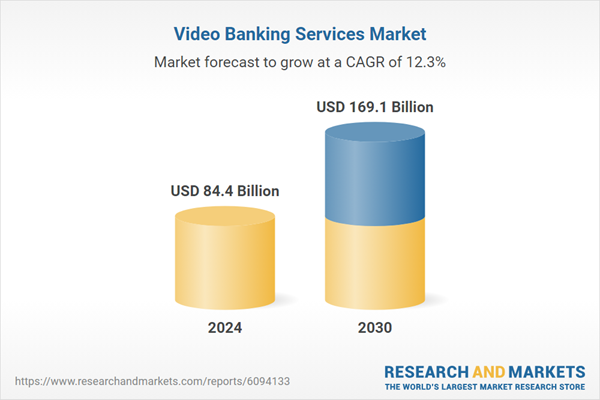

| Estimated Market Value ( USD | $ 84.4 Billion |

| Forecasted Market Value ( USD | $ 169.1 Billion |

| Compound Annual Growth Rate | 12.3% |

| Regions Covered | Global |