Global RF GaN Devices in Satcom Market - Key Trends & Drivers Summarized

Why Are GaN-Based RF Devices Revolutionizing Satellite Communications?

RF GaN (Gallium Nitride) devices are transforming the satellite communications (Satcom) landscape by offering higher power efficiency, broader bandwidth, and superior thermal stability compared to traditional silicon or GaAs-based solutions. In Satcom systems - where performance, weight, and power efficiency are critical - GaN technology is quickly becoming the preferred choice for power amplifiers, upconverters, and transceivers. GaN's high electron mobility and wide bandgap enable devices to operate at higher voltages and frequencies, essential for modern broadband satellites that deliver high-speed internet, data broadcasting, and secure military communications. As the Satcom industry shifts toward high-throughput satellites (HTS) and non-geostationary constellations like LEO and MEO systems, GaN devices offer the scalability and resilience required for next-gen transponder architectures. The trend toward software-defined satellites (SDS) and phased-array antennas is also fueling demand for RF GaN devices due to their linearity and power density advantages. Defense-grade Satcom, used for tactical communication, ISR (intelligence, surveillance, reconnaissance), and command systems, is increasingly adopting GaN to ensure high-power output within compact and rugged packages. With the global push to bridge the digital divide and extend coverage to remote areas, GaN-enabled ground and space terminals are becoming central to the future of Satcom.What Technical Benefits Are Driving Preference for GaN Over Traditional Semiconductors?

RF GaN devices are favored in satellite applications due to their ability to operate efficiently at high frequencies and high output power levels. GaN's high breakdown voltage allows amplifiers to achieve greater power levels without increasing device size, which is a game-changer for payload miniaturization. Its wide bandgap enables high-temperature operation, reducing the need for bulky cooling systems on both ground and space hardware. GaN transistors also exhibit higher efficiency and linearity, reducing signal distortion and improving the overall link budget for satellite communication systems. These advantages translate to lower launch costs, higher data rates, and increased reliability - critical for both commercial and defense missions. GaN MMICs (monolithic microwave integrated circuits) are being integrated into electronically steered arrays and beamforming networks, supporting real-time tracking and multiple beam coverage. The superior thermal conductivity of GaN materials improves device longevity, making them ideal for long-duration satellite missions. In addition, hybrid integration of GaN with silicon and other materials is enhancing multi-band performance in compact form factors. These characteristics are positioning GaN as the semiconductor of choice for the new generation of satellite payloads and ground terminals.Which Satcom Segments Are Leading Adoption - and Where Is the Growth Concentrated?

The highest adoption of RF GaN devices is seen in broadband satellite services, where capacity and efficiency gains are essential to meet the exponential rise in global data consumption. Commercial Satcom providers deploying LEO constellations, such as Starlink and OneWeb, are heavily investing in GaN-based power amplifiers for both spaceborne and user terminal systems. Government and military Satcom applications are another major driver, as GaN devices deliver mission-critical performance under extreme operating conditions. The mobility Satcom segment - including maritime, airborne, and land-based terminals - is also transitioning to GaN to meet the demand for smaller, lighter, and more powerful systems. Teleports and ground stations supporting HTS and SDS architectures are using GaN for scalable, multi-band amplification. In terms of regional growth, North America leads due to strong investments in defense Satcom and LEO launches, followed by Europe, where space agencies and defense contractors are increasingly embracing GaN-based RF front ends. The Asia-Pacific region is quickly catching up, driven by expanding broadband coverage initiatives and commercial Satcom deployments. These segments are collectively accelerating the shift from legacy RF systems to GaN-powered architectures across the Satcom value chain.What's Fueling Growth in the RF GaN Devices Market Within Satcom?

The growth in the global RF GaN devices in Satcom market is driven by increasing data throughput demands, the expansion of LEO and MEO constellations, and the performance limitations of legacy semiconductors. The shift to high-capacity, multi-beam satellites requires RF devices capable of operating at high frequencies and power densities, which GaN delivers with unmatched efficiency. Military and commercial demand for portable, high-performance terminals is spurring adoption of GaN-based MMICs and amplifiers. Advances in GaN-on-SiC and GaN-on-diamond substrates are improving thermal performance and cost-effectiveness, enabling broader use in compact satellite payloads and phased-array antennas. The rising adoption of electronically steerable antennas (ESAs) and flat-panel designs is further accelerating GaN integration. Investments by space agencies and private satellite operators are also pushing manufacturers to scale GaN production and innovate faster. Government support in the form of R&D grants and defense contracts is fostering rapid commercialization of GaN in Satcom applications. Additionally, the convergence of 5G and Satcom is creating new hybrid networks that rely heavily on GaN-enabled hardware for seamless, high-speed connectivity. These forces are collectively driving robust, sustained growth in the RF GaN Satcom devices market.Report Scope

The report analyzes the RF GAN Devices in Satcom market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Module, Discrete); Device Type (Power Amplifier, Switch, Low Noise Amplifier, Phase Shifters, Attenuators, Couplers, Antenna Tuners, Other Device Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Module segment, which is expected to reach US$166.1 Million by 2030 with a CAGR of a 15.5%. The Discrete segment is also set to grow at 19.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $31.1 Million in 2024, and China, forecasted to grow at an impressive 22.3% CAGR to reach $64.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global RF GAN Devices in Satcom Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global RF GAN Devices in Satcom Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global RF GAN Devices in Satcom Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amphenol Corporation, Anritsu Corporation, AVX Corporation, Belden Inc., Bomar Interconnect Products, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this RF GAN Devices in Satcom market report include:

- Aethercomm Inc.

- Ampleon B.V.

- Analog Devices, Inc.

- Broadcom Inc.

- Coherent Corp. (formerly II-VI Inc.)

- Efficient Power Conversion Corporation

- GaN Systems Inc.

- Infineon Technologies AG

- Integra Technologies Inc.

- MACOM Technology Solutions Holdings Inc.

- Mercury Systems, Inc.

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Qorvo, Inc.

- Raytheon Technologies Corporation

- RFHIC Corporation

- ROHM Co., Ltd.

- Skyworks Solutions, Inc.

- Sumitomo Electric Device Innovations, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aethercomm Inc.

- Ampleon B.V.

- Analog Devices, Inc.

- Broadcom Inc.

- Coherent Corp. (formerly II-VI Inc.)

- Efficient Power Conversion Corporation

- GaN Systems Inc.

- Infineon Technologies AG

- Integra Technologies Inc.

- MACOM Technology Solutions Holdings Inc.

- Mercury Systems, Inc.

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Qorvo, Inc.

- Raytheon Technologies Corporation

- RFHIC Corporation

- ROHM Co., Ltd.

- Skyworks Solutions, Inc.

- Sumitomo Electric Device Innovations, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 283 |

| Published | February 2026 |

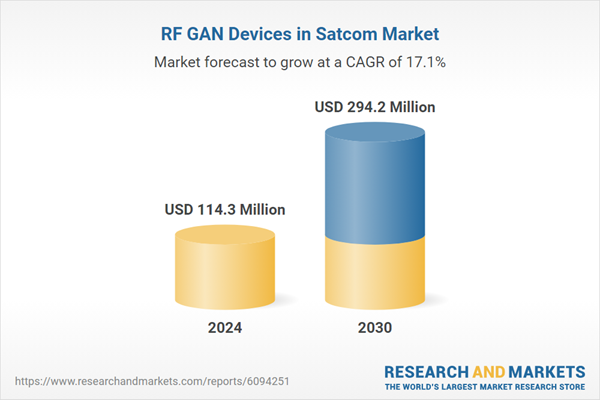

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 114.3 Million |

| Forecasted Market Value ( USD | $ 294.2 Million |

| Compound Annual Growth Rate | 17.1% |

| Regions Covered | Global |