Global 'Solder Bumping Flip Chips' Market - Key Trends & Drivers Summarized

Can Solder Bumping Technology Keep Pace With Next-Gen Semiconductor Demands?

Solder bumping flip chips - semiconductor devices where the chip is mounted face-down using tiny solder balls - are revolutionizing the way integrated circuits are packaged and interconnected. Unlike traditional wire bonding, flip chip technology enables shorter interconnect paths, higher I/O densities, and superior electrical performance, making it the go-to solution for high-performance computing, advanced mobile devices, AI accelerators, and automotive electronics. Solder bumps act as both mechanical support and electrical interconnection between the die and substrate, allowing better thermal dissipation and space optimization. As chips become smaller and denser, the importance of fine-pitch, lead-free solder bumps grows exponentially. Key players such as ASE Group, Amkor, TSMC, and Intel are pushing the envelope with ultra-fine-pitch bumping (≤50µm) for 2.5D/3D integration and advanced packaging nodes. As Moore's Law slows, the shift toward heterogeneous integration and system-in-package (SiP) architectures is accelerating demand for flip chip solutions enabled by precision solder bumping.How Are Materials, Miniaturization, And Reliability Influencing Bumping Innovation?

Solder bumping is undergoing a rapid evolution driven by requirements for miniaturization, environmental safety, and signal integrity. Lead-free alloys like SnAgCu (SAC) and low-alpha bump materials are becoming industry standards due to RoHS compliance and electromigration resistance. Wafer-level bumping processes - such as electroplating, ball placement, and stencil printing - are being refined to accommodate advanced packaging designs with ultra-high bump counts and tight tolerances. Underfill materials and capillary flow dynamics are also optimized to maintain mechanical integrity under thermal cycling. High-reliability markets such as aerospace, automotive, and defense require bumping methods that endure extreme temperatures and mechanical stress. In AI and HPC chips, bump uniformity directly impacts heat dissipation and power delivery networks, making material selection and process control critical. With the rise of high-bandwidth memory (HBM) and chiplet architectures, the role of fine-pitch bumping is becoming even more central to achieving low-latency, high-bandwidth interconnects in space-constrained environments.Is Advanced Packaging Driving The Surge In Flip Chip Adoption?

The semiconductor packaging landscape is shifting decisively toward advanced solutions, and flip chip technology is a foundational enabler of this transition. Applications such as smartphones, data centers, autonomous vehicles, and medical imaging demand compact, high-speed chips that perform reliably under intense workloads. Flip chips allow vertical stacking, reduced package height, and direct thermal paths - all crucial for enabling cutting-edge performance in small form factors. Foundries and OSATs are scaling up investment in bumping capacity to support growing demand for heterogeneous integration, fan-out wafer-level packaging (FOWLP), and 2.5D interposers. Flip chips are also essential in silicon interposer-based architectures where multiple dies are mounted on a shared substrate. In consumer electronics, flip chip LEDs are gaining traction due to superior thermal and optical properties. The result is a widespread shift from traditional bonding techniques to flip chip models wherever performance, footprint, and power efficiency are critical.The Growth In The Solder Bumping Flip Chips Market Is Driven By Several Factors - What's Accelerating Adoption Across Industries?

The growth in the solder bumping flip chips market is driven by several factors tied to semiconductor miniaturization, performance demands, and end-use diversification. The increasing complexity of chips used in 5G, artificial intelligence, automotive ADAS, and IoT is driving the need for low-inductance, high-I/O packaging solutions. Flip chip technology enables this by offering high-density interconnects and improved heat dissipation. The migration to lead-free solder and environmentally compliant materials is also opening new application opportunities, especially in medical and consumer electronics. Foundries and OSATs are expanding their wafer bumping services as part of advanced packaging solutions, while fabless companies are choosing flip chip for time-to-market and performance advantages. Additionally, the rise of chiplet-based and multi-die architectures is cementing the role of solder bumping as a scalable, cost-effective enabler of next-gen IC design. With advanced computing moving to the edge and higher-performance cores becoming ubiquitous, solder bumping flip chips are gaining prominence as a cornerstone of future semiconductor innovation.Report Scope

The report analyzes the Solder Bumping Flip Chips market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (3D IC, 2.5D IC, 2D IC, Solder Bumping Flip Chip); Application (Electronics, Industrial, Automotive & Transport, Healthcare, IT & Telecommunication, Aerospace, Defense, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Some of the 34 companies featured in this Solder Bumping Flip Chips market report include -

- Advanced Micro Devices, Inc. (AMD)

- Amkor Technology, Inc.

- ASE Technology Holding Co., Ltd.

- BE Semiconductor Industries N.V. (Besi)

- Chipbond Technology Corporation

- Fujitsu Limited

- GlobalFoundries Inc.

- IBM Corporation

- Indium Corporation

- Intel Corporation

- JCET Group Co., Ltd.

- NEPES Corporation

- Powertech Technology Inc.

- Samsung Electronics Co., Ltd.

- SHINKO Electric Industries Co., Ltd.

- STATS ChipPAC Ltd.

- STMicroelectronics N.V.

- Taiwan Semiconductor Manufacturing Company

- Texas Instruments Incorporated

- United Microelectronics Corporation (UMC)

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 3D IC segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of a 2.6%. The 2.5D IC segment is also set to grow at 2.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $785.5 Million in 2024, and China, forecasted to grow at an impressive 3.2% CAGR to reach $584 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Solder Bumping Flip Chips Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Solder Bumping Flip Chips Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Solder Bumping Flip Chips Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Ampinvt, Danick Power Limited, EAS Technology, Enphase Energy and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 34 Featured):

- Advanced Micro Devices, Inc. (AMD)

- Amkor Technology, Inc.

- ASE Technology Holding Co., Ltd.

- BE Semiconductor Industries N.V. (Besi)

- Chipbond Technology Corporation

- Fujitsu Limited

- GlobalFoundries Inc.

- IBM Corporation

- Indium Corporation

- Intel Corporation

- JCET Group Co., Ltd.

- NEPES Corporation

- Powertech Technology Inc.

- Samsung Electronics Co., Ltd.

- SHINKO Electric Industries Co., Ltd.

- STATS ChipPAC Ltd.

- STMicroelectronics N.V.

- Taiwan Semiconductor Manufacturing Company

- Texas Instruments Incorporated

- United Microelectronics Corporation (UMC)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Micro Devices, Inc. (AMD)

- Amkor Technology, Inc.

- ASE Technology Holding Co., Ltd.

- BE Semiconductor Industries N.V. (Besi)

- Chipbond Technology Corporation

- Fujitsu Limited

- GlobalFoundries Inc.

- IBM Corporation

- Indium Corporation

- Intel Corporation

- JCET Group Co., Ltd.

- NEPES Corporation

- Powertech Technology Inc.

- Samsung Electronics Co., Ltd.

- SHINKO Electric Industries Co., Ltd.

- STATS ChipPAC Ltd.

- STMicroelectronics N.V.

- Taiwan Semiconductor Manufacturing Company

- Texas Instruments Incorporated

- United Microelectronics Corporation (UMC)

Table Information

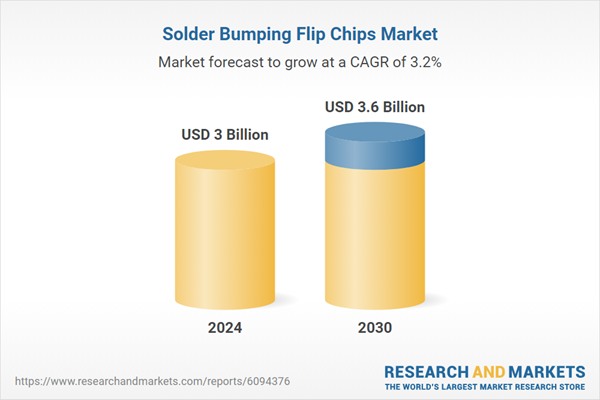

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 3.6 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Global |