Global Agar Agar Flakes Market - Key Trends & Drivers Summarized

Why Are Agar Agar Flakes Gaining Strategic Relevance Across Clean Label Formulations, Plant-Based Innovation, and Culinary Stabilization Applications?

Agar agar flakes, derived from red algae, are establishing a prominent position in the global food and beverage industry as demand escalates for plant-based, clean label, and allergen-free ingredients. These flakes serve as natural gelling, thickening, and stabilizing agents, offering a vegan alternative to gelatin in a wide range of culinary and industrial applications. Their ability to create firm gels at room temperature without animal byproducts aligns perfectly with the ethical and dietary preferences of an expanding consumer base seeking cruelty-free and sustainable food solutions.In addition to their functional versatility, agar agar flakes offer high thermal stability, excellent mouthfeel, and neutral taste, making them ideal for a variety of applications including fruit jellies, bakery glazes, dairy-free desserts, soups, and molecular gastronomy recipes. Their clear gel formation and rapid setting properties give formulators precise control over texture and appearance, further reinforcing their utility in gourmet and commercial kitchens alike. These attributes are contributing to the rising integration of agar agar in specialty, organic, and free-from product lines.

The clean label movement - centered on recognizable ingredients and transparency - is driving food manufacturers to replace synthetic stabilizers, modified starches, and animal-based thickeners with natural hydrocolloids like agar agar flakes. Additionally, with rising awareness of food allergies and digestive sensitivities, the market is shifting toward ingredients that are free from gluten, soy, and dairy. Agar's non-GMO, zero-cholesterol, and low-calorie profile makes it increasingly relevant across health-driven food segments.

How Are Processing Innovations, Nutraceutical Applications, and Regional Dietary Preferences Expanding the Use of Agar Agar Flakes?

Advancements in seaweed cultivation and flake processing technologies are enhancing the purity, yield, and functional consistency of agar agar products. Modern extraction techniques using controlled temperature and pH gradients enable better preservation of gelling properties and reduce off-flavors. These innovations support industrial-scale production of high-grade flakes suitable for standardized food and pharmaceutical use, thereby opening new avenues in nutraceutical formulations and dietary supplements.Agar agar's ability to encapsulate active compounds while remaining stable at high temperatures makes it a valuable delivery system in the nutraceutical sector. Functional gummies, fortified snack bars, and gut-health supplements are increasingly using agar-based gelling systems to stabilize vitamins, probiotics, and bioactives. Its natural fiber content and laxative properties also add value in digestive health supplements - positioning it as a multifunctional additive beyond culinary boundaries.

Regional culinary practices and dietary restrictions are fueling localized adoption of agar agar flakes, particularly in Asian and Mediterranean cuisines where seaweed-derived ingredients have long-standing acceptance. In Western markets, veganism and food innovation are pushing agar into mainstream visibility as chefs and food startups experiment with novel textures in dairy alternatives, plant-based meats, and artisanal confectionery. This cross-market versatility is extending agar agar's relevance from traditional usage to modern innovation.

Which End-Use Segments, Distribution Channels, and Geographic Markets Are Driving Growth in the Agar Agar Flakes Market?

Key end-use segments include packaged food and beverages, bakery and confectionery, ready-to-eat meals, and premium foodservice. Agar agar flakes are also penetrating pharmaceutical and cosmetic formulations where gel-based carriers, suspending agents, and film-forming materials are needed. The rise of specialty diets - gluten-free, keto-friendly, and plant-forward - is catalyzing demand in both retail and institutional segments, particularly for clean label desserts, jellies, and culinary coatings.Distribution channels are evolving to meet diverse consumer and industrial needs. Health food stores, specialty grocery chains, online platforms, and gourmet culinary suppliers play significant roles in consumer-facing sales. For industrial buyers, dedicated ingredient distributors and food tech suppliers manage bulk procurement, custom formulations, and compliance with food safety certifications such as ISO, Halal, and Kosher.

Asia-Pacific remains the largest source and consumer region for agar agar flakes, given its extensive coastline, seaweed harvesting infrastructure, and culinary integration. China, Indonesia, and Japan lead in supply, while India shows strong domestic consumption. Europe and North America are high-growth markets, driven by veganism, food innovation, and premium culinary demand. Latin America and the Middle East are emerging as new frontiers, leveraging regional plant-based food trends and rising health awareness.

What Strategic Role Will Agar Agar Flakes Play in the Future of Functional Foods, Ethical Formulations, and Textural Food Innovation?

Agar agar flakes are poised to serve as critical enablers of texture, stability, and ethical integrity in next-generation food and wellness formulations. Their ability to support clean label declarations, address diverse dietary requirements, and perform reliably across cooking and processing environments makes them uniquely positioned in an increasingly health-conscious and transparency-driven marketplace. As product developers seek functional alternatives to synthetic and animal-based additives, agar agar provides a natural bridge between tradition and innovation.Continued R&D into hybrid hydrocolloid systems, enhanced gelling profiles, and nutraceutical-grade agar will broaden its utility across functional food and pharma landscapes. Moreover, sustainability considerations - from seaweed farming practices to processing efficiencies - will shape the supply ecosystem and reinforce agar agar's positioning as a low-impact, marine-derived material.

As plant-based eating becomes a cornerstone of modern diets, could agar agar flakes evolve from niche stabilizers into mainstream texture-building agents that redefine how ethical, functional, and indulgent foods are formulated worldwide?

Report Scope

The report analyzes the Agar Agar Flakes market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Grade (Food Grade, Technical Grade, Preactivate Grade, Bacteriological Grade, Cosmetics & Pharma Grade); Claim (Kosher Claim, Organic Claim, Non-GMO Claim, Vegan Claim, Standard Claim); End-Use (Food & Beverages End-Use, Healthcare End-Use, Pharmaceuticals End-Use, Nutraceuticals End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Food Grade Agar Agar Flakes segment, which is expected to reach US$145.8 Million by 2030 with a CAGR of a 4.8%. The Technical Grade Agar Agar Flakes segment is also set to grow at 2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $74.3 Million in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $68.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Agar Agar Flakes Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Agar Agar Flakes Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Agar Agar Flakes Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aleris Corporation, Allegheny Technologies Incorporated (ATI), Aluminum Corporation of China Limited (Chalco), Arconic Corporation, Boeing and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Agar Agar Flakes market report include:

- Agar Corporation Ltd.

- Agar del Pacífico

- Agarindo Bogatama

- Agarmex

- Aquarev Industries

- B&V Agar

- Central Drug House (P) Ltd.

- Foodchem International Corporation

- Fujian Global Ocean Biotechnology

- Fujian Kingyen

- Fujian Wuyi Feiyan Agar

- Green Fresh Group

- Hispanagar

- Indoalgas

- Marine Hydrocolloids

- Meron Group

- Myeong Shin Agar

- Neogen Food Safety

- ROKO

- Setexam

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agar Corporation Ltd.

- Agar del Pacífico

- Agarindo Bogatama

- Agarmex

- Aquarev Industries

- B&V Agar

- Central Drug House (P) Ltd.

- Foodchem International Corporation

- Fujian Global Ocean Biotechnology

- Fujian Kingyen

- Fujian Wuyi Feiyan Agar

- Green Fresh Group

- Hispanagar

- Indoalgas

- Marine Hydrocolloids

- Meron Group

- Myeong Shin Agar

- Neogen Food Safety

- ROKO

- Setexam

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 392 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

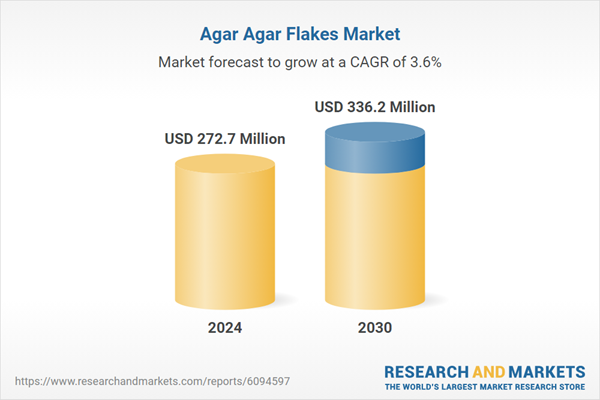

| Estimated Market Value ( USD | $ 272.7 Million |

| Forecasted Market Value ( USD | $ 336.2 Million |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |