Global Air Cleaner Filters Market - Key Trends & Drivers Summarized

Why Are Air Cleaner Filters Becoming Critical to Indoor Air Quality Management, Health Safety, and Environmental Compliance Across Sectors?

Air cleaner filters - key components in HVAC systems, standalone purifiers, and industrial ventilation units - are gaining strategic importance as awareness of airborne pollutants, allergens, and pathogens intensifies. Designed to capture particulate matter (PM), volatile organic compounds (VOCs), microbes, and other contaminants, these filters play a vital role in maintaining healthy indoor environments across residential, commercial, healthcare, and industrial settings. The growing prioritization of air hygiene, especially in the wake of recent public health crises and rising urban pollution, has elevated demand for high-performance filtration technologies.From asthma and allergy mitigation in homes to infection control in hospitals and compliance assurance in factories, air cleaner filters are central to ensuring both occupant health and operational safety. In smart buildings and green-certified infrastructure, these filters are increasingly integrated into air quality optimization strategies aimed at enhancing energy efficiency while meeting global environmental and safety regulations.

How Are Filtration Technologies, Material Innovations, and Energy Efficiency Standards Driving Product Advancement in the Air Cleaner Filters Market?

The market is witnessing a shift toward multi-stage and high-efficiency filtration systems that combine pre-filters, HEPA, ULPA, activated carbon, and electrostatic elements. These layered systems are designed to target both coarse and ultrafine particles, balancing filtration efficacy with airflow optimization. Innovations in nanofiber membranes, antimicrobial coatings, and low-resistance synthetic media are enabling improved filtration performance without compromising ventilation efficiency.Regulatory frameworks such as ASHRAE, ISO 16890, and EN 1822 are pushing manufacturers to develop filters that meet rigorous particulate removal and pressure drop criteria. At the same time, energy efficiency is becoming a competitive differentiator, with smart filter systems now featuring pressure sensors, usage analytics, and predictive replacement alerts. These enhancements are particularly critical in commercial and industrial settings where filter performance has direct implications for equipment longevity, worker productivity, and compliance with indoor air quality (IAQ) mandates.

Which Application Environments, End-Use Segments, and Geographic Markets Are Driving the Adoption of Air Cleaner Filters?

High-growth application areas include healthcare facilities, pharmaceutical production, data centers, food processing, and cleanrooms - sectors that demand stringent airborne contaminant control. Residential demand is also expanding, fueled by consumer concerns over urban air pollution, indoor allergens, and wildfire smoke. Office buildings, schools, and hospitality venues are adopting upgraded filtration solutions to support wellness-focused design and employee/customer safety.Regionally, North America and Western Europe lead in adoption due to mature regulatory landscapes and higher public awareness around IAQ standards. The Asia-Pacific region is experiencing robust growth, driven by urbanization, industrial activity, and rising middle-class demand for home air purification. In China and India, where pollution levels are high and HVAC penetration is rising, the need for high-efficiency filters in both consumer and commercial systems is particularly pronounced. Retrofit and replacement cycles also represent a sizable opportunity across legacy infrastructure in developing and developed regions alike.

What Strategic Role Will Air Cleaner Filters Play in Supporting Public Health, Smart Infrastructure, and Climate-Responsive Building Design?

Air cleaner filters are set to become integral to the next generation of health-centric and environmentally adaptive buildings. As climate change exacerbates air quality challenges through increased wildfires, dust storms, and pollen seasons, demand for advanced filtration systems that can respond dynamically to external conditions will intensify. Their role in mitigating respiratory risks, reducing disease transmission, and ensuring regulatory compliance positions them as essential components of public health infrastructure.Looking forward, the convergence of smart building systems, IAQ analytics, and net-zero energy goals will further embed filtration into a broader sustainability and wellness framework. Filters designed for circularity, extended life, and reduced energy consumption will gain prominence as ESG criteria and green certification standards evolve. Could air cleaner filters ultimately define how indoor environments are engineered for safety, comfort, and resilience in an increasingly health-conscious and climate-sensitive world?

Report Scope

The report analyzes the Air Cleaner Filters market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Filter Type (HEPA Filters, Baghouse Filters, Cartridge Filters, Dust Collectors, Other Filter Types); Distribution Channel (Offline Distribution Channel, Online Distribution Channel); End-Use (HVAC End-Use, Industrial End-Use, Automotive End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the HEPA Filters segment, which is expected to reach US$19.3 Billion by 2030 with a CAGR of a 7.8%. The Baghouse Filters segment is also set to grow at 5.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.5 Billion in 2024, and China, forecasted to grow at an impressive 11.2% CAGR to reach $9.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Air Cleaner Filters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Air Cleaner Filters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Air Cleaner Filters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AeroFarms, Agrilution GmbH, American Hydroponics (AmHydro), Armela Farms LLC, AutoGrow Systems Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Air Cleaner Filters market report include:

- 3M Company

- A.L.Filter

- AAF Flanders

- Ahlstrom-Munksjö

- AIRTECH Japan Ltd.

- Blueair AB

- Calgon Carbon Corporation

- Camfil AB

- Daikin Industries Ltd.

- Donaldson Company, Inc.

- Filtration Group Corporation

- Freudenberg Filtration Tech.

- GVS Group

- Honeywell International Inc.

- IQAir

- K&N Engineering, Inc.

- Mann+Hummel Group

- Panasonic Corporation

- Philips N.V.

- Sharp Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- A.L.Filter

- AAF Flanders

- Ahlstrom-Munksjö

- AIRTECH Japan Ltd.

- Blueair AB

- Calgon Carbon Corporation

- Camfil AB

- Daikin Industries Ltd.

- Donaldson Company, Inc.

- Filtration Group Corporation

- Freudenberg Filtration Tech.

- GVS Group

- Honeywell International Inc.

- IQAir

- K&N Engineering, Inc.

- Mann+Hummel Group

- Panasonic Corporation

- Philips N.V.

- Sharp Corporation

Table Information

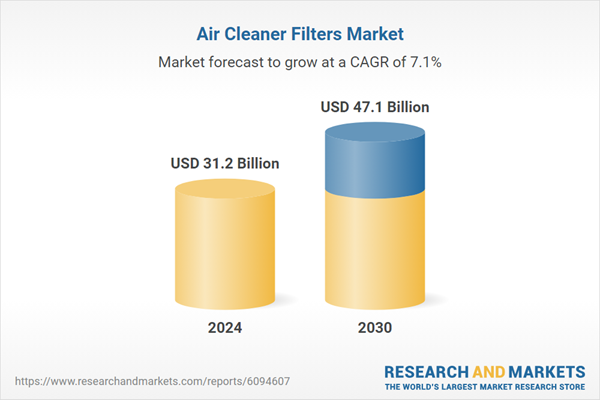

| Report Attribute | Details |

|---|---|

| No. of Pages | 373 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 31.2 Billion |

| Forecasted Market Value ( USD | $ 47.1 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |