Global Aquatic Feed Ingredients and Products Market - Key Trends & Drivers Summarized

Why Are Aquatic Feed Ingredients and Products Crucial for the Future of Global Aquaculture?

Aquatic feed ingredients and products are fundamental to the sustainability, productivity, and profitability of the global aquaculture industry, which now accounts for more than half of the world's seafood consumption. As the demand for fish, shrimp, mollusks, and other aquatic species continues to grow, the pressure to optimize feed formulations becomes more urgent. Quality feed plays a vital role in promoting fast growth, improving feed conversion ratios (FCR), enhancing immune function, and maintaining the overall health of farmed aquatic organisms. Traditionally, fishmeal and fish oil were the dominant feed inputs, but concerns over the depletion of wild fish stocks and environmental impact have pushed the industry toward more sustainable and innovative alternatives. Plant-based proteins, insect meals, algal oils, single-cell proteins (SCPs), and fermentation-derived ingredients are now gaining significant traction. These novel inputs not only help reduce reliance on marine resources but also offer functional benefits such as improved gut health and reduced disease outbreaks. Additionally, modern feed products are increasingly being tailored to the specific nutritional requirements of different species and life stages, ensuring better resource efficiency. With aquaculture seen as a solution to global food security and nutritional diversity, the development and deployment of high-performance aquatic feeds have become central to ensuring that this growth remains ecologically viable and economically competitive.How Is Technological Innovation Driving Evolution in Aquatic Feed Formulation and Manufacturing?

Advancements in feed technology and nutritional science are playing a pivotal role in transforming the aquatic feed ingredients landscape. Precision nutrition, supported by genomics and metabolomics, is enabling the creation of species-specific diets that optimize growth, reproduction, and disease resistance. These tailored feeds are designed with carefully balanced amino acid profiles, enhanced digestibility, and targeted bioactive compounds. Furthermore, the use of feed additives such as probiotics, prebiotics, enzymes, and immunostimulants is expanding, promoting health and performance without the use of antibiotics. On the manufacturing side, innovations like microencapsulation and extrusion technology have improved the physical stability of feed pellets, ensuring consistent delivery of nutrients in various aquatic environments. Digitalization and automation in feed production are also enhancing quality control, traceability, and supply chain efficiency. AI and machine learning tools are being deployed to model feeding behavior and optimize formulations based on real-time farm data. Sustainability is another key focus: circular economy principles are being applied through the integration of agri-waste, upcycled biomass, and side-stream valorization into feed ingredients. Moreover, carbon footprint labeling and life cycle assessments (LCAs) are increasingly influencing feed formulation decisions, driven by regulatory requirements and retailer demands. These innovations are making aquatic feeds not only more efficient and effective but also more aligned with the broader goals of environmental responsibility and responsible aquaculture development.How Are Market Dynamics and Sustainability Challenges Shaping Ingredient Sourcing in Aquafeeds?

Sourcing ingredients for aquatic feeds is becoming an increasingly strategic challenge, shaped by fluctuating raw material availability, environmental pressures, and shifting economic dynamics. Fishmeal and fish oil, long considered gold standards for their protein and fatty acid content, are facing intense scrutiny due to overfishing and supply volatility. As a result, feed manufacturers are actively diversifying their ingredient bases, incorporating alternatives such as soy protein concentrate, wheat gluten, corn protein, and canola meal. However, land-based crops bring their own sustainability concerns - deforestation, water use, and competition with human food chains - which has led to increased interest in next-generation ingredients. These include black soldier fly larvae, marine microalgae, yeast-based proteins, and bacteria-derived single-cell proteins, all of which require significantly fewer resources and have lower environmental footprints. Geographic factors are also influencing ingredient strategies, with Asia-Pacific leading the way in adoption due to its dominance in global aquaculture production. Meanwhile, European producers are focused on aligning with the EU's Farm to Fork strategy and sustainability certifications such as ASC and GlobalG.A.P. The rise of transparency initiatives, ESG reporting, and consumer pressure for sustainably farmed seafood has further pushed the feed industry to demonstrate traceability and ethical sourcing. As the demand for traceable, eco-friendly, and nutritionally consistent ingredients increases, feed producers must balance cost, availability, regulatory compliance, and environmental stewardship - making ingredient selection both a business imperative and a reputational issue.What Are the Key Drivers Behind the Global Expansion of the Aquatic Feed Ingredients and Products Market?

The growth in the aquatic feed ingredients and products market is driven by a multifaceted blend of demographic, economic, technological, and regulatory factors. Rising global seafood consumption, fueled by population growth, urbanization, and increasing health consciousness, is the most direct driver, placing upward pressure on aquaculture output and, consequently, on feed demand. Technological advancements in feed formulation, ingredient processing, and farm-level precision feeding are improving feed conversion ratios and reducing production costs, making aquaculture more economically attractive and scalable. There is also a strong shift toward sustainability, with global retailers and policymakers demanding verifiable low-impact farming practices - including responsible feed sourcing. Public and private investment in sustainable aquafeed R&D is ramping up, particularly in areas such as insect farming, algae cultivation, and fermentation technologies, enabling the emergence of alternative protein supply chains. The regulatory landscape is evolving to support innovation while maintaining rigorous safety and environmental standards, further encouraging adoption of novel feed ingredients. Trade liberalization and improved logistics are also contributing, allowing global manufacturers to access new markets and source ingredients from a wider pool of suppliers. Finally, the increasing consolidation among aquaculture producers and feed companies is creating opportunities for vertical integration, strategic partnerships, and economies of scale in product development. These converging trends are establishing aquatic feed ingredients and products as not just a back-end supply item but a strategic lever for growth, innovation, and sustainability in the global aquaculture value chain.Report Scope

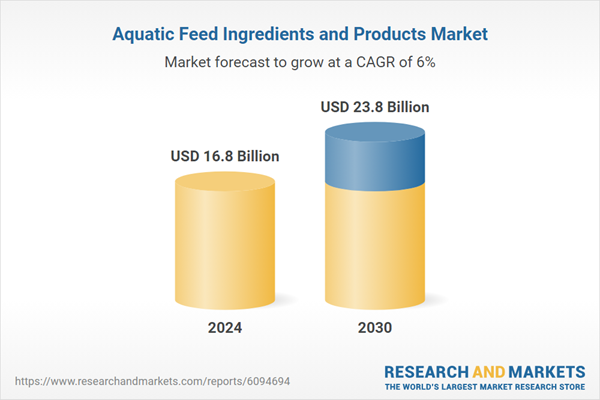

The report analyzes the Aquatic Feed Ingredients and Products market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Fishes, Crustaceans, Other Types); Product (Soybean, Fish Meal & Fish Oil, Corn / Maize, Other Products).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fishes segment, which is expected to reach US$13.5 Billion by 2030 with a CAGR of a 5.6%. The Crustaceans segment is also set to grow at 7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.4 Billion in 2024, and China, forecasted to grow at an impressive 5.8% CAGR to reach $3.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aquatic Feed Ingredients and Products Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aquatic Feed Ingredients and Products Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aquatic Feed Ingredients and Products Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ATC Group India, Australian Grain Export Pty Ltd., Bean Growers Australia Ltd, Casa Amella Bio Food SLU, Chickplease and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Aquatic Feed Ingredients and Products market report include:

- ADM (Archer Daniels Midland)

- Adisseo

- Alltech Inc.

- Aller Aqua Group

- Avanti Feeds Ltd.

- BASF SE

- BioMar Group

- Cargill Inc.

- Charoen Pokphand Foods PCL

- Chr. Olesen & Co.

- dsm-firmenich

- Evonik Industries AG

- Guangdong Haid Group Co., Ltd.

- Kemin Industries

- Nutreco N.V.

- Purina Animal Nutrition LLC

- Ridley Corporation Ltd.

- Roquette Frères

- Skretting

- Symrise AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADM (Archer Daniels Midland)

- Adisseo

- Alltech Inc.

- Aller Aqua Group

- Avanti Feeds Ltd.

- BASF SE

- BioMar Group

- Cargill Inc.

- Charoen Pokphand Foods PCL

- Chr. Olesen & Co.

- dsm-firmenich

- Evonik Industries AG

- Guangdong Haid Group Co., Ltd.

- Kemin Industries

- Nutreco N.V.

- Purina Animal Nutrition LLC

- Ridley Corporation Ltd.

- Roquette Frères

- Skretting

- Symrise AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16.8 Billion |

| Forecasted Market Value ( USD | $ 23.8 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |