Global Electrical Substation Management Market - Key Trends & Drivers Summarized

How Is Digitalization Reshaping the Management of Electrical Substations?

Electrical substations, once managed through manual controls and legacy SCADA (Supervisory Control and Data Acquisition) systems, are now undergoing a digital transformation. This shift is driven by the rising complexity of power distribution networks, the integration of decentralized renewable energy sources, and the demand for real-time operational visibility. Substation management has evolved into a high-tech domain encompassing automation, IoT-based monitoring, cloud integration, and AI-driven analytics.Modern substation management platforms leverage intelligent electronic devices (IEDs), advanced communication protocols like IEC 61850, and distributed sensor arrays to enable real-time control, asset health tracking, and fault isolation. This enables grid operators to not only detect anomalies quickly but also to predict failures and optimize load balancing. Utilities are increasingly deploying digital substations - where conventional copper wiring is replaced with fiber-optic connections and software-defined control replaces electromechanical relays.

Substation automation reduces downtime, enhances fault recovery times, and increases the agility of grid operations, especially as demand peaks become more erratic due to distributed energy resources (DERs). Moreover, cybersecurity and data integrity have emerged as critical layers in the management stack, necessitating secure access protocols, encryption, and intrusion detection systems to prevent threats to national power infrastructure.

What Technologies Are Driving Intelligent Substation Management Solutions?

The backbone of modern electrical substation management lies in its convergence with IT and OT (Operational Technology) domains. Real-time monitoring tools feed into centralized energy management systems (EMS) or distributed control systems (DCS) that enable live visualization of voltage levels, load fluctuations, breaker statuses, and equipment health. The Internet of Things (IoT) is being used to connect sensors and actuators, offering granular control over substation assets.Artificial Intelligence and machine learning models analyze operational patterns to identify potential transformer overheating, breaker failures, or partial discharge in switchgear. Predictive maintenance, powered by digital twins, minimizes costly unplanned outages by enabling condition-based interventions rather than time-based ones. Cloud-based platforms allow remote operators to configure, monitor, and maintain substations across large geographies, with multi-tiered dashboards, event logs, and alarms.

GIS (Geographic Information System) integration supports spatial visualization of substations and their transmission corridors. It enables field technicians to localize faults more accurately and manage assets proactively. Substation management systems are also incorporating mobile applications for real-time field updates, inspection checklists, and remote authorizations, enhancing operational agility and workforce safety.

How Are Market Segments and Stakeholders Influencing Growth Trajectories?

The electrical substation management market is segmented by type (transmission vs. distribution substations), voltage level (low, medium, high), and end-user sectors such as utilities, industrial plants, and renewable energy farms. Transmission substations, typically owned by grid operators, require sophisticated automation due to their role in bulk power transfer. Distribution substations, on the other hand, are increasingly integrating DER management capabilities as rooftop solar and community battery systems proliferate.Utilities are the largest customer segment, with public and private grid operators investing heavily in digital substations as part of smart grid modernization programs. Industrial users - especially oil & gas, mining, and manufacturing - are deploying intelligent substations to improve internal power distribution reliability and ensure compliance with safety codes. In renewables, substations now incorporate reactive power compensation, voltage regulation, and remote synchronization features to stabilize intermittent solar and wind power inputs.

Vendors in the market include ABB, Siemens, Schneider Electric, GE Grid Solutions, and Eaton, who offer full-stack solutions combining hardware, software, and support services. These players are also offering cloud-based energy platforms with modular subscription models, enabling utilities to scale services without upfront CapEx. Local EPCs (Engineering, Procurement, and Construction firms) and system integrators play a pivotal role in regional deployment, often customizing solutions to local grid topologies and standards.

What Factors Are Fueling the Growth of the Substation Management Market?

The growth in the electrical substation management market is driven by several factors including grid modernization mandates, decarbonization policies, increasing renewable energy penetration, and the need for predictive asset management. As global power grids age and become more decentralized, efficient substation control becomes critical to maintain grid stability and resilience.Firstly, governments worldwide are investing in smart grid infrastructure, often allocating substantial funds under stimulus programs. These programs prioritize digital substations capable of remote operation, dynamic reconfiguration, and cybersecure communication. The European Green Deal, India's RDSS scheme, and U.S. DOE's Grid Modernization Initiative are examples of large-scale public-private collaborations.

Secondly, the surge in renewable energy sources introduces variability into the grid, necessitating substations to dynamically manage voltage and frequency fluctuations. Advanced substation management systems integrate with DERMS (Distributed Energy Resource Management Systems) and microgrid controllers to facilitate stable integration of solar, wind, and battery assets.

Thirdly, predictive maintenance is gaining traction as utilities seek to reduce operational costs and extend the life of high-value assets. Asset condition monitoring based on temperature, vibration, humidity, and electrical parameters ensures early fault detection and timely intervention. This leads to higher system availability, improved SAIDI/SAIFI metrics, and reduced total cost of ownership (TCO).

Finally, urbanization and electrification trends - such as EV charging infrastructure, smart buildings, and data centers - are increasing the load on existing substations. This is prompting utilities to adopt modular and scalable substation solutions that can be upgraded without complete shutdowns. As substations evolve into nodes of intelligent energy management, their role in future grid architectures becomes increasingly indispensable.

Report Scope

The report analyzes the Electrical Substation Management market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Hardware Component, Software Component, Services Component); Sources (Non-Renewable Sources, Renewable Sources); Vertical (Utilities Vertical, Steelworks Vertical, Oil & Gas Transportation Vertical, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hardware Component segment, which is expected to reach US$822.3 Million by 2030 with a CAGR of a 8.1%. The Software Component segment is also set to grow at 9.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $257.9 Million in 2024, and China, forecasted to grow at an impressive 13.3% CAGR to reach $336.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electrical Substation Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electrical Substation Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electrical Substation Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, AABCOOLING LLC, Aerol Formulations Pvt. Ltd., Akfix, CAIG Laboratories, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Electrical Substation Management market report include:

- ABB Ltd

- Aclara Technologies LLC

- Arteche Group

- CG Power and Industrial Solutions Ltd

- China XD Group

- Cisco Systems, Inc.

- Eaton Corporation plc

- Ellevio AB

- Eltman Engenharia

- General Electric Company

- Hitachi Energy Ltd

- Honeywell International Inc.

- Iconic Power Systems

- Integrated Electrical Services

- KEC International Ltd

- NovaTech LLC

- Power Grid Corporation of India Ltd

- Schneider Electric SE

- Schweitzer Engineering Laboratories

- Siemens AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd

- Aclara Technologies LLC

- Arteche Group

- CG Power and Industrial Solutions Ltd

- China XD Group

- Cisco Systems, Inc.

- Eaton Corporation plc

- Ellevio AB

- Eltman Engenharia

- General Electric Company

- Hitachi Energy Ltd

- Honeywell International Inc.

- Iconic Power Systems

- Integrated Electrical Services

- KEC International Ltd

- NovaTech LLC

- Power Grid Corporation of India Ltd

- Schneider Electric SE

- Schweitzer Engineering Laboratories

- Siemens AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

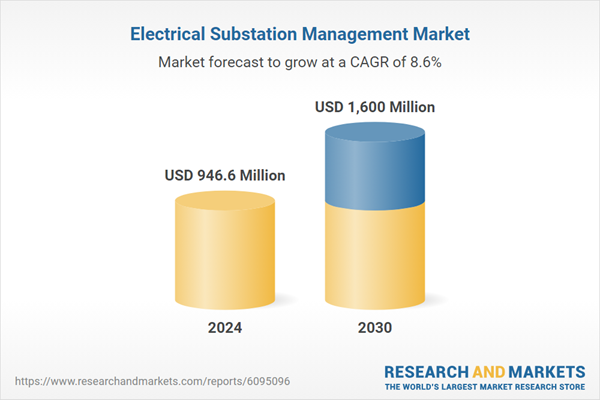

| Estimated Market Value ( USD | $ 946.6 Million |

| Forecasted Market Value ( USD | $ 1600 Million |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |