Global Endoscopic Closure Devices Market - Key Trends & Drivers Summarized

Why Are Endoscopic Closure Devices Becoming the Standard for Minimally Invasive Repairs?

The adoption of endoscopic closure devices has seen a significant upsurge in recent years due to advancements in minimally invasive procedures and the rising complexity of gastrointestinal (GI) interventions. These devices are engineered to provide effective closure of perforations, leaks, fistulas, and resection sites within the GI tract without the need for open surgery. A key technological evolution has been the miniaturization and flexibility of closure instruments, allowing access to difficult anatomical locations such as the duodenum or esophagus while maintaining procedural precision. Clip-based systems, over-the-scope clips (OTSC), and suturing platforms have become widely accepted in both emergency and elective therapeutic endoscopy. These devices can be deployed via standard endoscopes, making them compatible across most interventional suites without requiring infrastructure overhaul.The technological landscape of closure devices is also expanding with the introduction of integrated endoluminal suturing systems that provide full-thickness closure capabilities. These platforms are gaining favor in procedures such as endoscopic submucosal dissection (ESD), endoscopic mucosal resection (EMR), and bariatric endoscopy, where precision closure post-resection is crucial to avoid complications like bleeding or delayed perforation. Innovations in clip design - including rotatable arms, enhanced gripping strength, and re-openable mechanisms - have also improved procedural control. Manufacturers are incorporating radiopaque markers for better visualization and post-procedural verification under fluoroscopy or X-ray, ensuring secure closure and enhanced patient safety. Such features are reshaping surgeon preference, contributing to increased procedural confidence and reduced conversion to surgical repair.

Which Medical Procedures and Use-Cases Are Driving the Demand Surge?

The utilization of endoscopic closure devices is increasingly being driven by their critical role in advanced therapeutic interventions. In gastrointestinal endoscopy, closure devices are vital post-EMR and ESD to prevent delayed bleeding and perforation. With the growing adoption of ESD for early-stage gastrointestinal tumors, especially in Asia and now gradually in Western markets, closure systems are a core component of procedural kits. The demand is also intensifying in colorectal interventions, where large polypectomies often result in mucosal defects that necessitate reliable closure to prevent post-polypectomy syndrome or delayed hemorrhage. Devices tailored to accommodate large luminal diameters and tortuous anatomy are in strong demand, especially in colorectal and bariatric centers.Beyond oncology and polypectomy applications, closure devices are gaining ground in managing GI leaks and fistulas - conditions previously managed through invasive surgeries or prolonged drainage. For instance, endoscopic management of anastomotic leaks following bariatric surgery or colorectal resections is becoming standard practice in high-volume centers. Transluminal procedures like natural orifice transluminal endoscopic surgery (NOTES) and peroral endoscopic myotomy (POEM) are also creating new demand for high-strength closure tools due to the intentional creation of full-thickness defects. Additionally, trauma care and emergency endoscopy are seeing wider use of closure clips and sutures to manage iatrogenic perforations or bleeding during diagnostic interventions. The expansion of indications from elective to emergent care has firmly embedded these devices into routine clinical workflows.

How Are Regional Ecosystems and Provider Behavior Shaping Adoption?

Regional disparities in healthcare infrastructure, training, and procedural volume significantly affect the adoption curve of endoscopic closure devices. In developed markets such as the United States, Japan, Germany, and South Korea, where GI endoscopy has matured into a subspecialty, closure devices are used extensively in both community and academic settings. Reimbursement clarity from private insurers and national healthcare systems has further enabled widespread adoption. Procedural volume is also boosted by national screening programs for colorectal cancer and gastric malignancies, increasing the incidence of complex resections that require closure. Japan, in particular, leads in procedural innovation and device usage due to its high ESD adoption rates and focus on early detection of GI cancers.Conversely, in emerging markets such as Brazil, India, and parts of Southeast Asia, adoption is still maturing due to cost constraints, device availability, and limited endoscopist training in therapeutic interventions. However, medical tourism hubs like Thailand and Mexico are rapidly adopting advanced closure systems as they cater to complex gastrointestinal cases from international patients. To bridge gaps, manufacturers are launching region-specific product variants and offering training partnerships with large hospitals and academic institutions. Simultaneously, endoscopist behavior is undergoing a shift, with increasing emphasis on mastering therapeutic and closure techniques. Fellowship programs and global skill-sharing platforms like live endoscopy workshops are playing a crucial role in democratizing access to advanced procedural tools across geographies.

What Factors Are Propelling the Growth Momentum of the Endoscopic Closure Devices Market?

The growth in the global endoscopic closure devices market is driven by several factors that span technological advancements, evolving clinical practices, and the growing complexity of minimally invasive procedures. A primary driver is the sharp increase in gastrointestinal and bariatric endoscopic interventions, many of which require reliable mucosal or transmural closure to avoid serious complications. The global rise in early cancer detection programs, combined with a shift toward endoluminal resection techniques, is expanding the volume of procedures necessitating closure solutions. Moreover, as therapeutic endoscopy becomes a preferred treatment modality for previously surgical indications, closure devices have become indispensable components of the interventional toolkit.Another growth catalyst is the continual innovation in device design, particularly with the integration of ergonomic handles, precision deployment systems, and materials engineered for high-tensile strength. Manufacturers are also developing hybrid systems that allow both clipping and suturing in a single session, improving procedural efficiency and reducing the need for multiple devices. In parallel, hospital procurement trends are favoring multi-functional platforms and bundled kits that offer value-based solutions to surgical alternatives. Regulatory approvals for new indications and favorable clinical trial outcomes - demonstrating reduced adverse event rates and faster recovery - are reinforcing physician confidence and health system adoption.

Furthermore, the expansion of procedural training and digital simulation tools is reducing the skill barrier associated with device usage, accelerating acceptance among novice and mid-career endoscopists. Medical device companies are investing in comprehensive education programs that pair device deployment with procedural best practices, helping standardize usage across institutions. As cost-effectiveness and patient outcomes become central to hospital decision-making, endoscopic closure devices offer an optimal intersection of safety, speed, and reduced morbidity. These converging trends are expected to sustain the market's upward trajectory, driving continuous innovation and broader global penetration in the coming years.

Report Scope

The report analyzes the Endoscopic Closure Devices market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Endoscopic Closure Systems, Endoscopic Clips, Overstitch Endoscopic Suturing System, Endoscopic Vacuum-Assisted Closure Systems, Cardiac Septal Defect Occluders, Sealants / Glues, Staplers, Other Product Types); Distribution Channel (Direct Distribution Channel, Indirect Distribution Channel); End-Use (Hospitals End-Use, Ambulatory Surgery Centers End-Use, Clinics End-Use, Other End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Endoscopic Closure Systems segment, which is expected to reach US$765.4 Million by 2030 with a CAGR of a 8.7%. The Endoscopic Clips segment is also set to grow at 8.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $516.6 Million in 2024, and China, forecasted to grow at an impressive 11.9% CAGR to reach $624.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Endoscopic Closure Devices Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Endoscopic Closure Devices Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Endoscopic Closure Devices Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., Acerus Pharmaceuticals Corp., Ascendis Pharma A/S, AstraZeneca plc, Bayer AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Endoscopic Closure Devices market report include:

- Abbott Laboratories

- Ackermann Instrumente GmbH

- Apollo Endosurgery, Inc.

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Cardinal Health, Inc.

- CONMED Corporation

- Cook Medical LLC

- CooperSurgical, Inc.

- ENDO-FLEX GmbH

- EndoGastric Solutions, Inc.

- Fujifilm Holdings Corporation

- Johnson & Johnson Services, Inc.

- Karl Storz SE & Co. KG

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- Micro-Tech Endoscopy USA, Inc.

- Olympus Corporation

- Ovesco Endoscopy AG

- STERIS plc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Ackermann Instrumente GmbH

- Apollo Endosurgery, Inc.

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Cardinal Health, Inc.

- CONMED Corporation

- Cook Medical LLC

- CooperSurgical, Inc.

- ENDO-FLEX GmbH

- EndoGastric Solutions, Inc.

- Fujifilm Holdings Corporation

- Johnson & Johnson Services, Inc.

- Karl Storz SE & Co. KG

- Medtronic plc

- Meril Life Sciences Pvt. Ltd.

- Micro-Tech Endoscopy USA, Inc.

- Olympus Corporation

- Ovesco Endoscopy AG

- STERIS plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 390 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

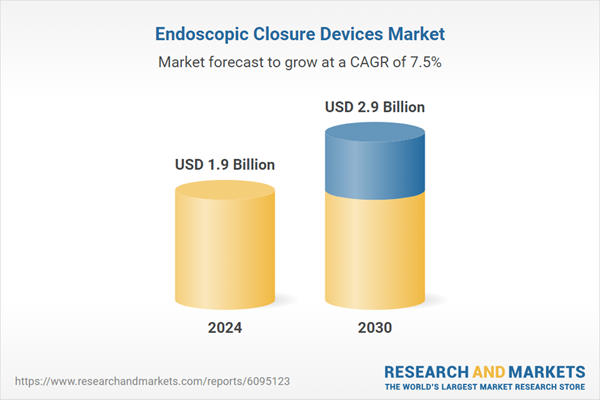

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 2.9 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |