Global Cell and Gene Supply Chain Services Market - Key Trends & Drivers Summarized

What's Fueling the Revolution in Cell and Gene Therapy Logistics?

The cell and gene supply chain services market is undergoing a dynamic transformation as cell and gene therapies (CGTs) transition from niche experimental treatments to mainstream clinical applications. These therapies demand highly specialized logistics due to their sensitivity to temperature, time, and contamination. As the number of approved cell and gene therapies continues to rise globally, the need for tailored supply chain services is intensifying. This includes cold chain logistics, real-time tracking, cryopreservation, and secure, timely transportation between manufacturing sites and treatment centers. Traditional pharmaceutical logistics infrastructures are ill-suited to handle these complexities, prompting an industry-wide shift toward specialized providers.The rising number of clinical trials for CGTs - especially autologous therapies that require patient-specific manufacturing - has heightened the need for precise, integrated supply chain models. These services must not only ensure product integrity but also maintain chain-of-identity and chain-of-custody throughout the process. The logistical challenges become even more intricate with international trials, where regulatory standards, time zone management, and customs requirements can introduce critical risks. This is creating a premium on supply chain agility and compliance expertise, fueling demand for vendors offering end-to-end solutions.

How Are Technological Advances Reshaping the Supply Chain Landscape?

Cutting-edge technologies are redefining how cell and gene therapies are transported, tracked, and monitored. Real-time GPS and IoT-enabled monitoring systems are becoming industry standards, allowing continuous surveillance of temperature, location, and other critical parameters. Such advancements are vital for maintaining the integrity of living therapies, which can degrade or become nonviable if environmental conditions deviate from their required ranges. Automation, robotics, and AI are also streamlining warehouse operations and predictive maintenance within cold storage environments, reducing human error and operational inefficiencies.In addition, the use of blockchain for secure tracking is gaining traction, ensuring an immutable digital ledger of the product journey. This innovation supports compliance with regulatory demands for traceability, especially in Europe and North America. Another game-changing development is the emergence of digital twins - virtual models that simulate supply chain logistics under various scenarios to optimize outcomes and preempt disruptions. These technologies are empowering stakeholders to enhance visibility, mitigate risks, and improve on-time delivery of life-saving treatments, positioning tech-driven firms at the forefront of the market.

Why Are Strategic Collaborations and Regulatory Compliance Critical?

The intricate and high-stakes nature of CGT logistics necessitates close collaboration across multiple stakeholders, including biopharma companies, logistics providers, hospitals, and regulators. Partnerships between therapy developers and specialized logistics firms are becoming more frequent, aiming to streamline operations, align timelines, and meet strict quality standards. Pharmaceutical companies are increasingly outsourcing their logistics to third-party vendors with dedicated CGT expertise rather than building internal capabilities from scratch. These partnerships are often structured as long-term alliances to ensure stability and shared investment in innovation.Regulatory compliance remains a critical focus, especially as authorities tighten guidelines around temperature control, product traceability, and documentation. Agencies such as the FDA, EMA, and PMDA are reinforcing Good Distribution Practice (GDP) regulations, and companies that can demonstrate full adherence are gaining a competitive edge. Moreover, regulatory harmonization efforts between regions are simplifying cross-border transport, reducing delays, and expanding access to emerging markets. The synergy of strategic alliances and robust compliance infrastructure is proving essential in navigating the unique challenges of this supply chain sector.

What Are the Core Drivers Behind Market Acceleration?

The growth in the cell and gene supply chain services market is driven by several factors. The surge in cell and gene therapy development, with hundreds of products in clinical pipelines globally, is increasing the demand for customized, high-integrity logistics. Advances in biotechnology and the shift toward personalized medicine are emphasizing the need for precise, patient-centric transport solutions. The complexity of handling living therapies is also necessitating expanded capabilities in cryogenic storage, temperature-controlled packaging, and last-mile delivery. Additionally, the rise in regulatory scrutiny and the need for digital traceability systems are prompting investments in tech-enabled, compliant supply chain networks. Evolving patient expectations and the globalization of CGT clinical trials are further fueling the requirement for agile, globally harmonized logistics platforms. These converging factors are collectively propelling the market forward, making it one of the fastest-growing niches within healthcare logistics.Report Scope

The report analyzes the Cell and Gene Supply Chain Services market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (Presence On Cloud Technology, Presence ln-Premises Technology); End-Use (Biobank / Cell-Bank End-Use, Hospitals End-Use, Research Institutes End-Use, Cell Therapy Labs End-Use, Other End-Uses); Application (Ordering & Scheduling Applications, Sample Collection Applications, Logistics Applications, Post Treatment Follow-Up Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Presence On Cloud Technology segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of a 6.1%. The Presence ln-Premises Technology segment is also set to grow at 10.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $382.5 Million in 2024, and China, forecasted to grow at an impressive 11.4% CAGR to reach $451.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cell and Gene Supply Chain Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cell and Gene Supply Chain Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cell and Gene Supply Chain Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Ashland Inc., Bayer AG, Bluebonnet Nutrition, Country Life and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Cell and Gene Supply Chain Services market report include:

- Almac Group

- AmerisourceBergen Corporation

- Arvato Supply Chain Solutions

- Biocair

- BioLife Solutions

- Brooks Life Sciences

- Catalent, Inc.

- Charles River Laboratories

- Clarkston Consulting

- Cryoport

- Fujifilm Diosynth Biotechnologies

- Genedata

- Haemonetics

- Hypertrust Patient Data Care

- Lonza Group AG

- Marken (UPS Company)

- Miltenyi Biotec

- Thermo Fisher Scientific

- TrakCel

- World Courier

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Almac Group

- AmerisourceBergen Corporation

- Arvato Supply Chain Solutions

- Biocair

- BioLife Solutions

- Brooks Life Sciences

- Catalent, Inc.

- Charles River Laboratories

- Clarkston Consulting

- Cryoport

- Fujifilm Diosynth Biotechnologies

- Genedata

- Haemonetics

- Hypertrust Patient Data Care

- Lonza Group AG

- Marken (UPS Company)

- Miltenyi Biotec

- Thermo Fisher Scientific

- TrakCel

- World Courier

Table Information

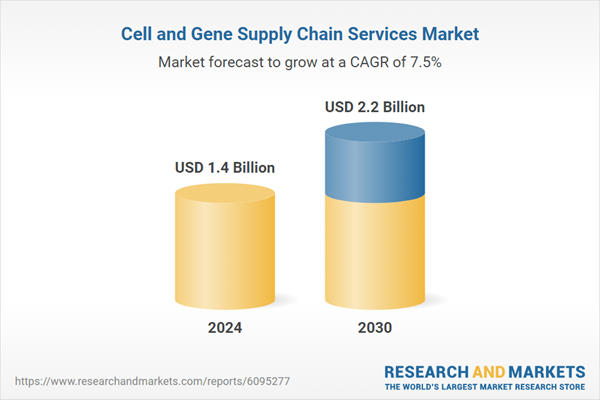

| Report Attribute | Details |

|---|---|

| No. of Pages | 373 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.4 Billion |

| Forecasted Market Value ( USD | $ 2.2 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |