India Chocolate Market Growth

Chocolates have been traditionally popular in India, and with the growing demand for convenience foods, thus the demand for chocolates is expected to continue to grow in India. Both Indian and international brands like Amul, Cadbury, and Nestlé have introduced smaller, snack-sized bars and pouches to capitalise on the growing trend of on-the-go snacking in the country.Chocolates are popular among children as well as adults in India, due to their great taste, availability at various price points, and increasing product innovations by manufacturers.

With the rise of sweet indulgence foods, the chocolate producers in India are increasing their efforts to innovate existing range and develop new variants. They are focusing on improving flavours and textures to enhance the eating experience of consumers, which is leading to the India chocolate market development. For instance, Mason & Co., a provider of artisanal chocolates, offers unique flavours like Himalayan Pink Salt, Orange Peel, and Coconut Milk Chocolate.

Furthermore, the demand for organic, vegan, and sugar-free chocolates is growing in the country, supported by the increasing preference for healthier food options. For example, Pascati, an Indian chocolate brand, offers a range of organic and vegan chocolates made from ethically sourced ingredients. These chocolates are especially developed for health-conscious consumers seeking guilt-free indulgence.

Industry Outlook

According to industry reports, Ivory Coast emerged as the largest cocoa producer globally, accounting for 15,81,000 tonnes of production during 2015-2016. Ivory Coast was followed by other significant contributors, namely Ghana, Indonesia, Ecuador, and Cameroon, with 7,78,000 tonnes, 3,20,000 tonnes, 2,32,000 tonnes, 2,11,000 tonnes, respectively.The global cocoa production for the period of 2015-2016 amounted to 49,65,000 tonnes, as reported by the International Cocoa Organization (ICCO). The increasing production of cocoa in different parts of the world is improving the availability of raw materials for chocolate, with key players increasingly emphasizing on improving their operational efficiencies.

Additionally, the global demand for sugar-free chocolates or chocolate infused with sweeteners such as stevia, monk fruit, and aspartame, among others, is also rising due to the increasing number of people with diabetes.

Chocolate Industry Statistics in India

Within India, Andhra Pradesh emerged as the top cocoa producer, with a total production of 17,200 tonnes in the 2015-16 period. According to the Directorate of Cashewnut and Cocoa Development (DCCD), other prominent cocoa-producing states in the country include Kerala, Karnataka, and Tamil Nadu. The growing production reflects regional agricultural strengths and contributions to the global cocoa industry.The Indian chocolate market is also seeing a shift towards healthy chocolates, with premium chocolates being popular among health-conscious consumers who prefer to limit their confectionary consumption by treating themselves to bite-sized chocolates.

Fabelle, the luxury chocolate brand by ITC, offers a range of premium chocolates with exquisite flavours like Ruby Gianduja, Single Origin Dark Chocolates, and Pralines. With consumers willing to pay a premium price for high-quality, exotic, and unique chocolate experiences, the market for premium chocolates is expected to continue to grow in India.

Growing Consumption of Convenience Foods and Aggressive Product Marketing Contribute to the India Chocolate Market Value

- Increasing disposable incomes enable more consumers to afford premium and indulgent chocolate products.

- Urbanization and changing lifestyles lead to higher consumption of convenience foods, including chocolates.

- Growth of modern retail formats and online shopping platforms improves accessibility and availability of chocolate products.

- Continuous product innovation, including new flavors, health-oriented chocolates, and premium offerings, attracts a broader consumer base, which is expected to positively impact the India chocolate demand growth.

- Aggressive marketing and advertising campaigns by key players boost brand visibility and consumer demand.

- High seasonality in demand, with peak periods during festivals and holidays, requires effective inventory management.

- Price-sensitive consumers can limit the market potential for premium and imported chocolates.

- Challenges in maintaining the cold chain and logistics can affect product quality and shelf life, negatively impacting the India chocolate market revenue.

- Ensuring compliance with stringent food safety and quality regulations can be complex and costly.

- Intense competition from local brands and traditional sweets.

Growing Demand for Premium and Artisanal Chocolates is Among the Key India Chocolate Market Trends

- Expanding distribution networks into rural areas with growing disposable incomes offers significant growth potential.

- Increasing demand for healthier products like dark chocolate and sugar-free options.

- Growing market for premium and artisanal chocolates among affluent consumers is expected to support the India chocolate market dynamics and trends.

- Expanding the festive and gifting segment with innovative packaging and special edition products.

- Leveraging the growth of e-commerce to reach a wider audience and offer personalized chocolate experiences will likely influence the India chocolate demand forecast.

India Chocolate Industry Segmentation

India Chocolate Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type:

- Dark Chocolate

- Milk Chocolate

- White Chocolate

Market Breakup by Product Type:

- Pure Chocolate

- Compound Chocolate

Market Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Market Breakup by Region:

- North India

- East and Central India

- West India

- South India

India Chocolate Market Share

According to the India chocolate market analysis, milk chocolates continue to dominate the market, appealing to a wide range of consumers. The increased popularity of milk chocolates can be attributed to their creamy and sweet flavour profile. The easy availability of milk chocolates in supermarkets, hypermarkets, and online retail stores, along with its extensive application in desserts, contributes to the sustained growth of the segment.Competitive Landscape

Market players are introducing novel product lines with premium cocoa, unique flavours, and organic components, including fruit and nuts, caramel, and dark chocolate, to expand their customer base.- Mars, Incorporated

- Mondelez International, Inc.

- Ferrero International S.A

- Nestlé S.A.

- The Hershey Company

- Gujarat Co-operative Milk Marketing Federation Ltd.

- ITC Limited

- Surya Food & Agro Ltd.

- August Storck KG

- DS Group

- Others

Key Players in the India Chocolate Market and their Strategic Initiatives

The leading chocolate manufacturers in India are Mars, Incorporated, Mondelēz International, Inc., Ferrero International S.A.., The Hershey Company, Gujarat Co-operative Milk Marketing Federation Ltd., ITC Limited and Parle Products Pvt. Ltd.Mondelez International, Inc

- Introducing new flavors and variants, such as Cadbury Dairy Milk Silk, to cater to diverse consumer tastes.

- Runs aggressive marketing campaigns and promotional activities.

- Strengthening distribution channels, including modern retail formats and e-commerce to enhance product availability.

Nestlé S.A

- Product Diversification Supports the Growth of the Chocolate Industry in India: Expanding offerings with products like KitKat, Munch, and Milkybar to appeal to various consumer segments.

- Introducing health-oriented chocolates, such as dark chocolate and reduced-sugar options, to meet the demand for healthier snacks.

- Investing in sustainable sourcing and production practices.

Ferrero International S.A

- Emphasises premium quality and packaging for gifting and special occasions.

- Offers innovative products to keep up with seasonal variations.

- Strengthening distribution networks, especially in urban and semi-urban areas.

Mars, Incorporated

- High-Impact Marketing Enables Companies to Better Position Themselves in the Indian Chocolate Industry: Utilises high-impact marketing campaigns to enhance brand visibility.

- Leveraging a diverse portfolio to cater to different consumer needs.

- Increasing local production to improve cost efficiency and better meet local demands.

Gujarat Co-operative Milk Marketing Federation Ltd

- Competitively priced products to attract price-sensitive consumers.

- Focus on local sourcing and production.

- Leveraging strong brand loyalty and trust in the Amul name to drive chocolate sales.

ITC Limited

- Innovative product development, such as the premium Fabelle brand, targeting high-end consumers.

- Premium and artisanal chocolates to differentiate from mass-products.

- Exclusive chocolate boutiques and partnerships with high-end retailers.

- Wide Distribution Network Increases India Chocolate Market Opportunities: Enhancing distribution, especially in rural and semi-urban areas.

- Affordable products

- Product range expansion

India Chocolate Market Report Snapshots

India Chocolate Market Size

India Chocolate Market Growth

India Chocolate Market Share

India Chocolate Companies

Table of Contents

Companies Mentioned

- Mars, Incorporated

- Mondel?z International, Inc.

- Ferrero International S.A.

- Nestlé S.A.

- The Hershey Company

- Gujarat Co-operative Milk Marketing Federation Ltd.

- ITC Limited

- Surya Food & Agro Ltd.

- August Storck KG

- DS Group

Table Information

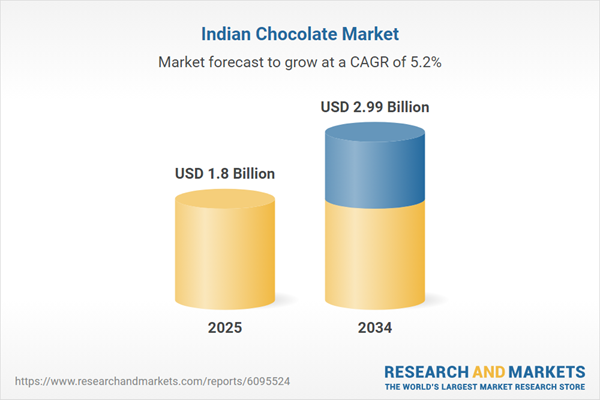

| Report Attribute | Details |

|---|---|

| No. of Pages | 138 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.8 Billion |

| Forecasted Market Value ( USD | $ 2.99 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |