Amidst improvements in the relationship between Saudi Arabia and Iran, the establishment of a 2,000 km long undersea gas pipeline supplying fuel to Southeast Asian countries (India) is expected to drive the Middle East and Africa oil and gas line pipe market growth. This pipeline connects major oil and gas giants in the Middle East, such as Oman, UAE, Qatar, Iran, and Saudi Arabia to bolster economic growth and promote regional prosperity via mineral-rich exports.

Infrastructure development aimed at improving energy security and supporting domestic revenue generation is expected to drive further such initiatives, thereby influencing the market growth favourably.

The increasing demand for natural gas from Iran’s petrochemical, residential and industrial sectors is expected to position it as a key region for the development of oil and gas line pipes. It is estimated that by 2027, Iran is expected to add 5,340 km of oil and gas pipelines. The ongoing construction of the IGAT XI pipeline to cater to the demand in cities like Yazd, Isfahan, Fars, and Bushehr is also expected to propel the Middle East and Africa oil and gas line pipe market expansion. The Goreh-Jask oil pipeline, meant for the transportation and storage of oil for export purposes, is also a noteworthy project attracting the attention of major market players.

Market Segmentation

Middle East and Africa Oil and gas Line Pipe Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Seamless

- Welded

- LSAW

- HSAW

- ERW

Market Breakup by Country

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Competitive Landscape

The key Middle East and Africa oil and gas line pipe market players are:

- ArcelorMittal S.A.

- JFE Holdings, Inc.

- Tenaris S.A.

- Vallourec S.A.

- Sumitomo Corporation

- Nippon Steel Corp.

- Arabian Pipes Company SJSC

- Abu Dhabi Metal Pipes & Profiles Industries Complex LLC (ADPICO

- Jindal Saw Limited (Jindal SAW Gulf LLC)

- others

Table of Contents

Companies Mentioned

- ArcelorMittal S.A.

- JFE Holdings, Inc.

- Tenaris S.A.

- Vallourec S.A.

- Sumitomo Corporation

- Nippon Steel Corp.

- Arabian Pipes Company SJSC

- Abu Dhabi Metal Pipes & Profiles Industries Complex LLC (ADPICO)

- Jindal Saw Limited (Jindal SAW Gulf LLC)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | May 2025 |

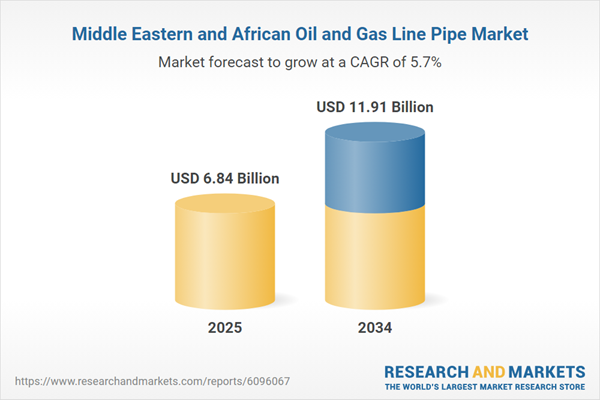

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 6.84 Billion |

| Forecasted Market Value ( USD | $ 11.91 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 9 |