United States General Insurance Market Outlook

As of 2022, the United States has the largest insurance market across the globe. In 2022, 92.1% or 304 million people in the country had health insurance. Private health insurance coverage stood at 65.5% while public coverage was 36.1%, which also adds to the United States general insurance market development.Another key driver of this market is the country's rising population, which, in turn, increases the demand and requirement for life insurance, automobile insurance, and health insurance, among others. The United States population crossed the 335 million mark in 2023 and is expected to consistently grow, which will also positively influence the United States general insurance market growth.

Adding to this, the rising number of natural disasters owing to climate change is further driving the general insurance market in the United States. The number of catastrophes has increased in frequency and severity, which further motivates people to get their assets insured.

The Rising Demand for Property Insurance Solutions is One of the Crucial United States General Insurance Market Trends

- Property insurance is expected to account for a significant portion of the United States general insurance market share, growing at a CAGR of 9.2% between 2025 and 2034. This can be attributed to increasing investments in real estate and rising property values.

- Liability insurance, with a CAGR of 8.7%, follows closely, supported by the growing awareness of legal risks and the need for protection against potential liabilities.

- Health insurance is estimated to grow at a CAGR of 8.3% during the forecast period of 2025-2034. The United States general insurance demand growth is driven by the increasing cost of healthcare and the growing importance of health coverage.

- Auto insurance, with a CAGR of 7.8%, sees steady demand as vehicle ownership continues to rise.

- As per the United States general insurance market analysis, the 'Others' category, with a CAGR of 7.3%, includes various other insurance types contributing to overall market growth at a slower pace due to their niche appeal.

- Direct sales are projected to lead with the highest CAGR of 9.3% between 2025 and 2034. The United States general insurance market value is surging amid the increasing preference for direct-to-consumer models and the convenience of purchasing insurance directly from providers.

- Brokers are estimated to grow at a CAGR of 8.7% during the forecast period of 2025-2034. The rising demand for personalised advice and a wide range of insurance products offered by brokers are boosting the United States general insurance market revenue.

- Agents, with a CAGR of 8.4%, see steady demand, particularly in regions where personal interaction and trust are important factors in purchasing decisions.

- Online platforms, growing at a CAGR of 7.7%, are increasingly popular due to the convenience and accessibility they offer, particularly among younger consumers.

- As per the United States general insurance industry statistics, the 'Others' category, with a CAGR of 7.3%, includes various additional channels contributing to overall market growth at a slower pace due to their specialised nature.

United States General Insurance Market Regional Analysis

- The Far West region is expected to lead with the highest CAGR of 9.4% between 2025 and 2034. A strong economic growth and increasing demand for property and auto insurance in the region are creating lucrative United States general insurance market opportunities.

- The Rocky Mountain region follows with a CAGR of 8.8%, supported by rapid urbanisation and a growing population.

- The Southwest is projected to grow at a CAGR of 8.4% during the forecast period of 2025-2034. The expanding commercial activities and a rising middle-class population are shaping the United States general insurance market dynamics and trends.

- The Southeast, at 8.1%, reflects significant growth, driven by a large population base and increasing awareness of insurance benefits.

- New England, with a 7.6% CAGR, shows steady growth, supported by its mature market and strong economic fundamentals.

- The Mideast and Plains regions, with CAGRs of 7.0% and 6.5% respectively, exhibit slower growth due to more traditional market structures and smaller population sizes.

- The United States general insurance market regional statistics suggest that the Great Lakes region, at 6.1%, experiences the slowest growth, reflecting economic challenges and slower adoption of new insurance products.

Key Questions Answered in This Report:

- How has the United States general insurance market performed historically, and what are the growth expectations for the future?

- What are the primary factors influencing demand and growth in the United States general insurance market?

- What are the key segments within the United States general insurance market, and how are they expected to evolve over the forecast period?

- What are the major challenges and opportunities facing stakeholders in the United States general insurance market?

- Who are the key players in the United States general insurance market, and what strategies are they employing to maintain a competitive edge?

- What are the regulatory and policy factors influencing the United States general insurance market globally or regionally?

- How competitive is the United States general insurance market according to Porter's five forces analysis, including factors like the bargaining power of buyers and suppliers?

- What are the current trends shaping the United States general insurance market landscape, and how are they expected to evolve in the future?

- How are technological advancements impacting the United States general insurance market, and what role do innovation and R&D play in driving growth?

- What are the consumer preferences and buying behaviour trends influencing the United States general insurance market?

- How sustainable are current growth rates in the United States general insurance market, and what factors could potentially disrupt these trends?

- What are the regional dynamics within the United States general insurance market, and how do they contribute to overall market growth?

- What are the economic factors influencing the United States general insurance market, such as GDP growth, inflation rates, and currency fluctuations?

- How are demographic shifts, such as ageing populations or urbanization trends, affecting demand in the United States general insurance market?

- What are the key strategic partnerships, mergers, and acquisitions shaping the competitive landscape of the United States general insurance market?

- What are the regulatory and legal frameworks impacting the United States general insurance market globally or in key regions?

- How are changing consumer lifestyles and preferences influencing product or service demand within the United States general insurance market?

- What are the emerging market trends and niche opportunities within the United States general insurance market that stakeholders should be aware of?

- How resilient is the United States general insurance market to external shocks or disruptions, such as geopolitical tensions or natural disasters?

- What are the potential barriers to market entry and growth for new players in the United States general insurance market?

Key Benefits for Stakeholders:

Expert Market Research's industry report provides a comprehensive quantitative analysis of various market segments, historical and current market trends, and forecasts the dynamics of the United States general insurance market spanning from 2018 to 2034.The research report delivers up-to-date insights into the market drivers, challenges, and opportunities shaping the United States general insurance market.

Stakeholders can leverage Porter's five forces analysis to assess the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. This analysis aids in evaluating the competitiveness and attractiveness of the United States general insurance market.

The competitive landscape section enables stakeholders to gain a deep understanding of their competitive environment. It offers insights into the current market positions of key players, their strategies, and their market shares.

Additionally, the report highlights emerging trends, regulatory influences, and technological advancements that are pivotal for stakeholders navigating the United States general insurance market landscape.

Table of Contents

Companies Mentioned

- State Farm Insurance

- Allstate Insurance

- Geico

- Progressive Insurance

- Nationwide

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | May 2025 |

| Forecast Period | 2025 - 2034 |

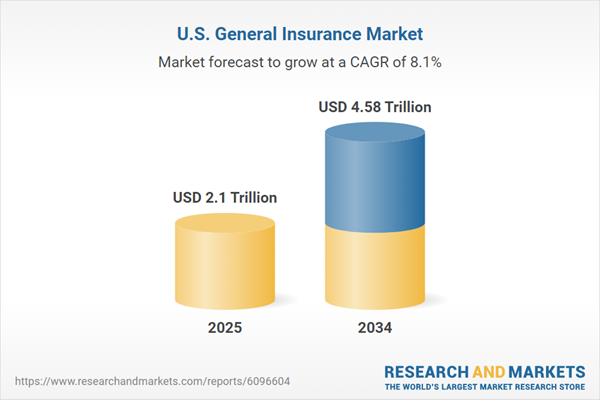

| Estimated Market Value ( USD | $ 2.1 Trillion |

| Forecasted Market Value ( USD | $ 4.58 Trillion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 5 |