Governments are also placing greater emphasis on regulating product quality and safety, encouraging responsible manufacturing, which fosters consumer trust and fuels long-term growth in the sector. These regulations are not only pushing companies to enhance the safety standards of their products but are also encouraging them to innovate in eco-friendly materials and manufacturing processes. With increasing consumer awareness around sustainability and safety, compliance with these regulations becomes a key differentiator for brands, ultimately driving market expansion. In addition, governments are offering incentives and grants to businesses that prioritize sustainable practices and eco-friendly packaging solutions, further incentivizing manufacturers to invest in green technology. This support leads to better collaboration between regulatory bodies and private companies, ensuring the adoption of industry standards that align with environmental goals.

In 2024, sports supplements accounted for the largest share of the market, valued at USD 24.3 billion. Growing engagement in athletic activities and gym culture has accelerated demand for products that boost energy, muscle repair, endurance, and recovery. The expanding interest in strength training, bodybuilding, and high-performance sports has amplified the need for amino acids, creatine, vitamins, and minerals that support muscular and metabolic functions. Supplements tailored to support vitamin D, iron, and calcium levels, especially in active individuals experiencing high physical exertion and nutrient loss, have become more relevant.

Capsules segment held the leading position by form in 2024, securing 38.3% share. Known for faster absorption, better bioavailability, and ease of consumption, capsules-especially soft gels and liquid-filled forms-are preferred by both manufacturers and consumers. Their versatility in formulation allows for precise nutrient combinations and longer shelf stability, enhancing their popularity in general wellness and condition-specific supplementation.

United States Men’s Health Supplement Market generated USD 27.1 billion in 2024. Chronic conditions such as heart disease and diabetes continue to impact a large portion of the male population, raising the need for daily health support through supplements. Additionally, growing concerns around aging, hormone balance, and reproductive health have increased the adoption of supplements for testosterone regulation and prostate wellness. As awareness grows, men invest more in long-term health solutions, supporting continued expansion in the U.S. market.

Leading companies shaping this space include Zydus Wellness, Bayer, Himalaya Wellness, Patchaid, Amway, Bodywise, iHerb, HK Vitals, Abbott Laboratories, GNC, Herbalife Nutrition, Patanjali Ayurved, MuscleTech, and Eskag Pharmaceuticals. To strengthen their market positions, these companies focus on developing science-backed formulations, expanding clean-label and plant-based options, and customizing products based on age and lifestyle. Many are scaling digital marketing efforts, increasing outreach through influencers and fitness communities. By optimizing e-commerce and subscription models and offering convenient packaging, brands reinforce customer loyalty while attracting new users.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Men’s Health Supplement market report include:- Abbott Laboratories

- Amway

- Bayer

- Bodywise

- Eskag Pharmaceuticals

- GNC

- Herbalife Nutrition

- Himalaya wellness

- HK vitals

- iHerb

- MuscleTech

- Patanjali ayurved

- Zydus wellness

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | May 2025 |

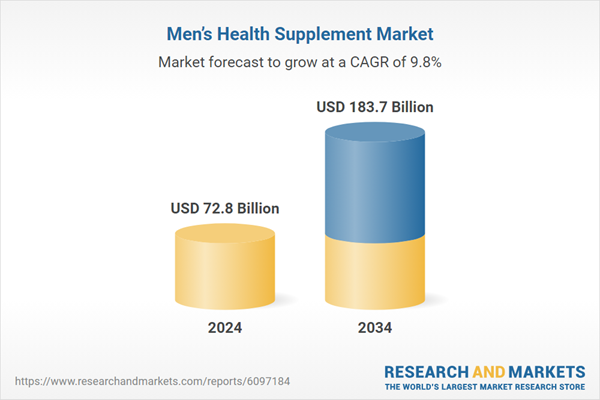

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 72.8 Billion |

| Forecasted Market Value ( USD | $ 183.7 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |