These bars play a pivotal role across various industries, offering exceptional strength, durability, and ease of machinability. In the automotive sector, they are used to produce essential vehicle components, such as suspension parts, engine blocks, and structural elements, where their ability to withstand stress and provide longevity is critical. Similarly, in the construction and infrastructure sectors, these bars are fundamental in reinforcing concrete structures and creating durable frameworks for buildings, bridges, and roads. Their versatility also extends to heavy machinery production utilized in manufacturing components that require high tensile strength and resistance to wear and tear. The demand for these bars continues to grow as industries increasingly seek materials that offer superior performance and cost efficiency, making them an essential component in various manufacturing processes.

The low-alloy steel bars segment, valued at USD 10.6 billion in 2024, is expected to expand at a CAGR of 5.7% between 2025 and 2034. Low and medium-alloy steel bars are widely used in industries such as automotive, construction, and heavy machinery, due to their affordability and durability. These alloys are highly valued for their strength, versatility, and cost-effectiveness, making them an attractive option for manufacturers seeking materials that balance performance and price.

The automotive sector accounted for USD 12.6 billion, with a share of 24% in 2024 and is anticipated to grow at a CAGR of 6.1% through 2034. Alloy steel bars are integral to producing vehicle components, particularly in suspension units and fuel systems, where strength and durability are critical. With the global automotive production on the rise, the demand for high-quality steel bars is set to increase. The need for these materials will also continue to grow as the automotive industry moves towards more advanced fuel systems and better-performing suspension units.

China Hot-Rolled or Cold-Finished Alloy Steel Bars Market was valued at USD 6.9 billion in 2024 and is projected to grow at a 5.9% CAGR from 2025 to 2034. As one of the largest producers and exporters of steel, China plays a crucial role in the global steel market. The country’s ability to produce and export massive quantities of steel is reshaping global supply chains, although the overproduction of steel has led to challenges in domestic markets, particularly real estate, while shifting focus toward international markets.

The leading players in the Global Hot-Rolled or Cold-Finished Alloy Steel Bars Industry include Tata Steel, ArcelorMittal, United States Steel Corporation (U.S. Steel), JFE Steel Corporation, and Nippon Steel Corp. These companies are focusing on innovations to enhance steel production processes, improve product quality, and meet the evolving demands of industries such as automotive, construction, and heavy machinery. To strengthen their market positions, companies like Tata Steel and ArcelorMittal are focusing on expanding their production capabilities and diversifying their product offerings. By investing in advanced manufacturing technologies, they aim to increase production efficiency and meet the rising demand for alloy steel bars.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Hot-Rolled or Cold-Finished Alloy Steel Bars market report include:- ArcelorMittal

- Tata Steel

- Nippon Steel

- JFE Steel

- U.S. Steel

- POSCO

- Steel Dynamics

- Hyundai Steel

- Baosteel

- Thyssenkrupp

- Nucor Corporation

- Sumitomo Metal Industries

- Voestalpine

- China Steel Corporation

- Schmolz + Bickenbach

- KOBE Steel

- AK Steel

- Outokumpu

- Severstal

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 235 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

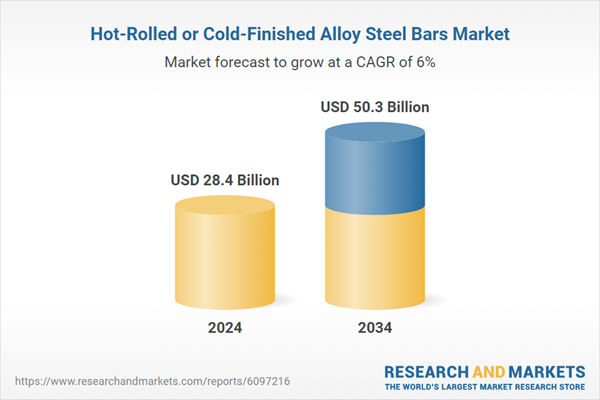

| Estimated Market Value ( USD | $ 28.4 Billion |

| Forecasted Market Value ( USD | $ 50.3 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |