Cold-finished iron and steel bars, known for their superior surface finish and exacting dimensions, play a crucial role in meeting these needs. One of the primary processes for producing these bars is cold drawing, which is favored for its ability to create highly accurate and smooth components. This process also improves the mechanical properties of the bars, making them suitable for high-stress applications where strength and fatigue resistance are essential. The evolution of these processes, combined with continuous advancements in production techniques, is allowing manufacturers to produce increasingly sophisticated materials tailored for specific industrial needs.

The carbon steel bars segment accounted for USD 5.6 billion in 2024 and is expected to grow at a CAGR of 5.5% from 2025 to 2034. Carbon steel is widely used in sectors like construction, automotive, and machinery due to its ease of machining and welding. It’s also integral to manufacturing custom components for structural and mechanical frameworks. Specialized types, like tool steel and Special Bar Quality (SBQ) bars, offer enhanced toughness and fatigue resistance, making them vital for automotive forging, mining, and die-making industries. These properties help ensure high performance in demanding environments.

Cold-drawn bars segment, valued at USD 6.2 billion in 2024, is expected to grow at a CAGR of 6.5% during 2025-2034. The cold-drawing process is especially popular for its accuracy, superior surface finish, and mechanical properties. This method is widely used in the automotive and aerospace sectors, as well as in industrial machining. One of the key advantages of cold drawing is its lower operational costs compared to hot forming methods, using 30-50% less energy. This makes it an attractive option for companies looking to optimize production efficiency.

China Cold-Finished Iron and Steel Bars and Bar-Size Shapes Market was valued at USD 3.4 billion in 2024, with a projected CAGR of 6.1%. As a global manufacturing hub, China has a high domestic demand for these products, driven primarily by its robust industrial machinery and construction industries. The demand for cold-finished steel bars in China continues to rise, reinforcing the country’s position as a critical player in the global market.

Companies like Nucor, ArcelorMittal, Timken Steel, JSW Steel, and TaeguTec are adopting several key strategies to maintain and grow their market share. These strategies include continuous investments in advanced manufacturing technologies to improve efficiency, product quality, and innovation. Additionally, these companies are focusing on expanding their product offerings to meet the increasing demand for specialized and high-performance cold-finished bars. By optimizing production processes and investing in R&D, these players are positioning themselves to capture a larger share of the growing market while maintaining a competitive advantage.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this Cold-Finished Iron and Steel Bars and Bar-Size Shapes market report include:- Nucor Corporation

- Gerdau S.A.

- ArcelorMittal

- Steel Dynamics, Inc.

- Tata Steel

- POSCO

- Baowu Steel Group

- Eaton Steel Bar Company

- Ovako AB

- Sanyo Special Steel

- Commercial Metals Company

- Aichi Steel Corporation

- Kobe Steel, Ltd.

- Daido Steel

- Saarstahl AG

- Fushun Special Steel

Table Information

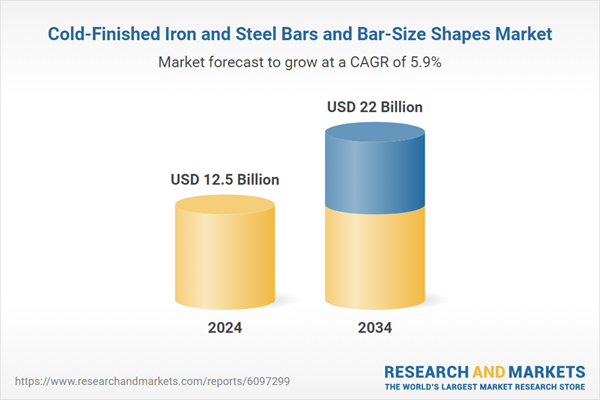

| Report Attribute | Details |

|---|---|

| No. of Pages | 235 |

| Published | May 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 12.5 Billion |

| Forecasted Market Value ( USD | $ 22 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |