Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market encompasses services and equipment such as burners, separators, sand management systems, and flaring systems, offered through both surface and downhole methods. Its applications span across onshore and offshore operations, including both conventional and unconventional reservoirs. Key growth drivers include rising drilling activity, real-time reservoir monitoring needs, and digital advancements that improve data precision. Additionally, the market supports enhanced oil recovery (EOR) and is integral to planning and optimizing field development, with expanding roles in environmental monitoring and regulatory compliance.

Key Market Drivers

Growing Global Energy Demand and Increasing Oil & Gas Production Activities

The rising global energy consumption - driven by urbanization, industrial growth, and expanding populations, especially in emerging markets like India, China, and Brazil - is intensifying oil and gas exploration and production. In response, both national and international oil companies are boosting efforts to discover new reserves and maximize output from existing wells. Production testing is essential in this process, providing insights into reservoir behavior, well integrity, and fluid composition to aid in planning and optimizing production.In aging oilfields, it supports EOR strategies, while in unconventional plays like shale and tight oil, it determines economic viability and guides hydraulic fracturing. Government incentives and a post-pandemic rebound in oil prices have further stimulated exploration spending, which exceeded USD 400 billion globally in recent years. The market is also fueled by the projected 20-25% increase in global energy demand by 2030, with fossil fuels still accounting for approximately 80% of primary energy use. As a result, production testing services continue to see sustained demand.

Key Market Challenges

High Operational and Equipment Costs Hampering Adoption Among Smaller Operators

A key obstacle in the production testing market is the substantial cost of acquiring and operating advanced testing systems, posing a significant barrier for smaller oil and gas operators. The use of high-tech equipment like multiphase flow meters, pressure sensors, and portable separators requires significant capital investment and ongoing operational expenses.For smaller exploration and production companies, especially those working in marginal fields or on tight budgets, these costs may not be justifiable, limiting their ability to perform frequent or comprehensive testing. Additionally, transporting this equipment to remote or offshore sites demands specialized logistics and skilled personnel, further raising expenses. In short-duration tests, the mobilization and demobilization costs often outweigh the benefits of the collected data, making testing less feasible for small-scale operators. This financial strain hinders these companies’ ability to fully assess well performance or reservoir health.

Key Market Trends

Integration of Digital Technologies and Automation in Production Testing

A leading trend in the production testing market is the growing integration of digital technologies and automation, transforming traditional testing methods. Operators are increasingly adopting automated solutions to enhance accuracy, reduce manual intervention, and improve safety. Technologies like IoT sensors, real-time analytics, and cloud platforms now enable continuous remote monitoring of well parameters such as flow rate, pressure, and fluid composition.Predictive analytics helps forecast performance and detect early signs of equipment failure, minimizing downtime. Digital twins are being used to simulate reservoir conditions and optimize test procedures, while automated equipment like separators and choke manifolds streamline field operations. Wireless communication further enables remote control, which is particularly beneficial for offshore or high-risk environments. This digital transformation is redefining efficiency and data reliability in production testing.

Key Market Players

- Halliburton Company

- Schlumberger Limited

- Expro Group

- Baker Hughes Company

- Fesco, Ltd.

- Grant Production Testing Services Ltd.

- Greene's Energy Services Inc.

- Roska DBO Inc.

- TETRA Technologies, Inc.

- Wespro Production Testing Ltd.

Report Scope:

In this report, the Global Production Testing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Production Testing Market, By Service Type:

- Well Testing

- Flowback Services

- Pressure Testing

Production Testing Market, By Equipment Type:

- Surface Testing Equipment

- Downhole Testing Equipment

Production Testing Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Production Testing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Halliburton Company

- Schlumberger Limited

- Expro Group

- Baker Hughes Company

- Fesco, Ltd.

- Grant Production Testing Services Ltd.

- Greene's Energy Services Inc.

- Roska DBO Inc.

- TETRA Technologies, Inc.

- Wespro Production Testing Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | June 2025 |

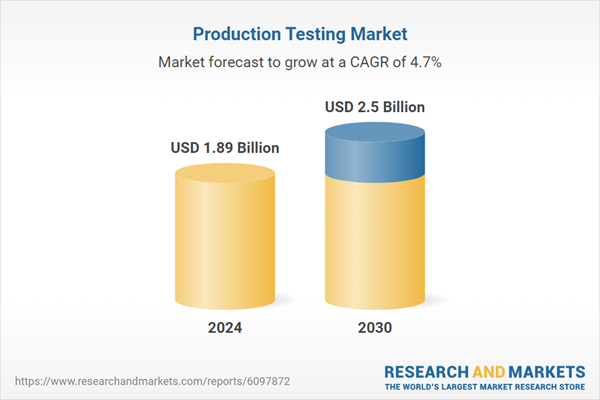

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.89 Billion |

| Forecasted Market Value ( USD | $ 2.5 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |