This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Additionally, the expansion of end-use industries in emerging economies, driven by urbanization and industrialization, has further fueled the demand for VAM, particularly in Asia-Pacific where rapid growth in infrastructure and manufacturing is observed. One of the critical factors shaping the VAM market is the increasing focus on sustainability and eco-friendly solutions. Vinyl Acetate Monomer is extensively used in the formulation of water-based adhesives and coatings that offer low volatile organic compounds (VOC) emissions, aligning with stringent environmental regulations globally.

Governments and regulatory bodies are imposing strict guidelines to reduce air pollution and hazardous emissions, encouraging the adoption of waterborne VAM-based products over solvent-based alternatives. This shift is particularly significant in developed regions such as North America and Europe, where environmental compliance is a priority for industries. Moreover, advancements in VAM production technologies have improved process efficiencies and reduced waste generation, making the manufacturing process greener and more cost-effective.

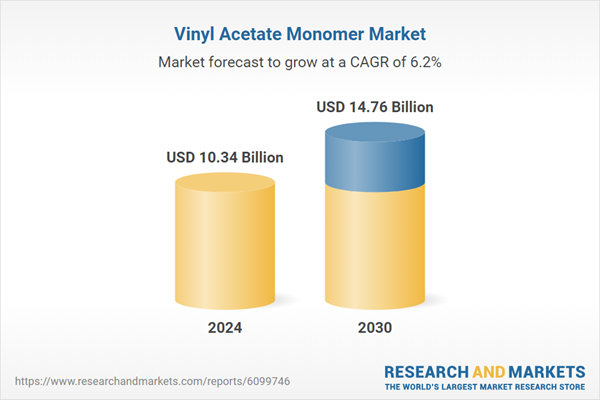

According to the research report “Global Vinyl Acetate Monomer (VAM) Market Outlook, 2030” the global Vinyl Acetate Monomer market is projected to reach market size of USD 14.76 Billion by 2030 increasing from USD 10.34 Billion in 2024, growing with 6.24% CAGR by 2025-30. Industry players are also investing in research and development to enhance product quality and develop bio-based VAM alternatives, reflecting the market’s evolving dynamics towards sustainability. The market segmentation of Vinyl Acetate Monomer is often categorized by application and geography. In terms of applications, adhesives dominate due to their vast use in packaging, woodworking, bookbinding, and textile industries.

The adhesives segment is followed closely by paints and coatings, where VAM improves adhesion, flexibility, and chemical resistance, essential for both industrial and decorative coatings. Other notable applications include textiles, paper finishing, and construction chemicals, all contributing to steady demand growth. Geographically, Asia-Pacific leads the market owing to rapid industrial growth, expanding manufacturing base, and rising consumer demand.

China and India are major contributors within this region, supported by increasing investments in automotive, construction, and packaging sectors. North America and Europe remain significant markets due to their mature industrial base and focus on innovation and sustainability. Meanwhile, emerging economies in Latin America and the Middle East & Africa are gradually increasing their consumption of VAM as infrastructure development and industrial activities gain momentum.

Market Drivers

- Rising Demand for Eco-Friendly Adhesives and Coatings: The growing emphasis on reducing volatile organic compounds (VOCs) in industrial products has significantly increased the demand for water-based adhesives and coatings derived from Vinyl Acetate Monomer. As regulations on environmental safety tighten worldwide, industries are shifting towards VAM-based formulations that provide superior bonding properties while minimizing environmental impact, driving market growth.

- Rapid Industrialization and Urbanization in Emerging Markets: Expansion of construction, packaging, textile, and automotive sectors in Asia-Pacific and other emerging economies is fueling demand for VAM. These regions are witnessing increased investments in infrastructure and manufacturing, which requires large volumes of adhesives, paints, and coatings - primary applications of Vinyl Acetate Monomer - thereby acting as a strong growth driver.

Market Challenges

- Raw Material Price Volatility: The production of VAM relies heavily on raw materials such as acetic acid and ethylene, whose prices fluctuate based on global supply-demand dynamics and geopolitical factors. This volatility creates cost uncertainties for manufacturers, impacting profitability and pricing strategies.

- Stringent Safety and Environmental Regulations: VAM is a volatile and flammable chemical, and strict regulations on its handling, storage, and emissions impose operational complexities and additional compliance costs on producers. Meeting these standards while maintaining cost efficiency remains a significant challenge for the industry.

Market Trends

- Shift Towards Bio-Based and Sustainable Production: There is a growing trend in the VAM industry to develop bio-based and greener production methods to reduce carbon footprint and dependency on fossil fuels. Innovations in biotechnology and process engineering are enabling manufacturers to explore sustainable alternatives that appeal to environmentally conscious markets.

- Technological Advancements in Polymer Formulations: The industry is witnessing continuous advancements in polymer chemistry, leading to new VAM-based adhesives and coatings with enhanced performance characteristics such as improved adhesion, flexibility, durability, and resistance to chemicals and weathering. These innovations are expanding the application scope of VAM, especially in high-value sectors like automotive and electronics.

Aqueous formulations dominate the Vinyl Acetate Monomer market due to their alignment with growing environmental concerns and regulatory requirements worldwide. Unlike solvent-based systems, aqueous formulations significantly reduce the emission of volatile organic compounds (VOCs), making them safer for both the environment and human health. This eco-friendly advantage has become a critical factor driving the preference for water-based VAM products, especially in regions with strict environmental legislation such as North America and Europe. Furthermore, aqueous formulations provide excellent film-forming properties, strong adhesion, and flexibility, which are essential attributes for adhesives, paints, coatings, and textile applications.

Their ability to maintain performance without relying on harmful solvents supports manufacturers’ goals to develop sustainable and safer products without compromising quality. Additionally, the operational benefits such as ease of handling, reduced flammability risks, and compliance with workplace safety standards further bolster the adoption of aqueous VAM-based products. As industries increasingly prioritize green chemistry and sustainable manufacturing processes, aqueous formulations stand out as the preferred choice, reinforcing their leading position in the global VAM market and paving the way for continued innovation and growth.

Polyvinyl acetate (PVA) is leading the Vinyl Acetate Monomer (VAM) market because it serves as the primary and most versatile polymer derived from VAM, extensively used in adhesives, paints, coatings, and textile applications due to its excellent bonding properties and cost-effectiveness.

Polyvinyl acetate holds a dominant position in the Vinyl Acetate Monomer market because it acts as the foundational polymer for a wide range of industrial and consumer products, particularly adhesives, which represent the largest application segment for VAM. PVA’s strong adhesive properties, flexibility, non-toxicity, and ease of processing make it ideal for use in woodworking, packaging, paper products, textiles, and construction materials. Its ability to form durable films and strong bonds with various substrates enhances product performance, which is critical for both industrial manufacturers and end consumers.

Moreover, PVA-based adhesives and coatings are compatible with water-based formulations, aligning with the increasing demand for environmentally friendly and low-VOC products across global markets. The cost-effectiveness and availability of PVA compared to alternative polymers further drive its preference, allowing manufacturers to balance performance with economic considerations. As industries seek efficient, versatile, and sustainable solutions, polyvinyl acetate continues to lead the VAM market by providing a reliable and widely accepted polymer platform that supports ongoing innovation and expansion across diverse sectors worldwide.

Packaging is leading in the Vinyl Acetate Monomer (VAM) market because the rising demand for durable, flexible, and eco-friendly packaging solutions drives extensive use of VAM-based adhesives and coatings essential for bonding, sealing, and protecting various packaging materials.

The packaging sector commands a leading share in the Vinyl Acetate Monomer market primarily due to its critical need for high-performance adhesives and coatings that ensure product integrity, safety, and aesthetic appeal. As global consumer demand for packaged goods grows - fueled by rising e-commerce, food and beverage consumption, and pharmaceutical distribution - there is an increasing requirement for packaging materials that are not only strong and reliable but also environmentally sustainable. VAM-based adhesives play a pivotal role in this by providing superior bonding strength for paper, cardboard, plastics, and flexible films, which are widely used in packaging formats.

Additionally, these adhesives offer excellent resistance to moisture, heat, and chemicals, which is essential for preserving product quality during transportation and storage. The shift towards eco-friendly packaging solutions, such as recyclable and biodegradable materials, has further accelerated the adoption of VAM formulations, as they align well with water-based, low-VOC adhesive systems preferred by environmentally conscious manufacturers. Furthermore, innovation in packaging designs, including flexible and multilayered packaging, demands adhesives with specific performance characteristics that VAM polymers can fulfill efficiently.

Vinyl Acetate Monomer with 99% and above purity is leading the market because high-purity VAM ensures superior polymerization efficiency and consistent quality, which are critical for producing high-performance adhesives, coatings, and other downstream products.

The demand for Vinyl Acetate Monomer with a purity level of 99% and above dominates the market due to its crucial role in delivering optimal performance and reliability in the production of various polymers and formulations. High-purity VAM significantly enhances polymerization reactions, resulting in polymers such as polyvinyl acetate (PVA) and polyvinyl alcohol (PVOH) with uniform molecular structures and superior physical properties. This consistency is essential for manufacturers who rely on VAM to produce adhesives, paints, coatings, textiles, and packaging materials that meet strict quality and performance standards.

Impurities in lower-grade VAM can lead to defects in the final products, such as reduced bonding strength, discoloration, or instability, which can compromise the product’s effectiveness and shelf life. Therefore, industries prefer VAM with very high purity to ensure that their end products achieve the desired durability, flexibility, and environmental resistance. Additionally, regulatory standards and customer expectations for product safety and performance further push the demand for high-purity VAM. The ability to maintain consistent batch quality also reduces waste and improves manufacturing efficiency, making 99% and above purity VAM the preferred choice across key markets worldwide.

Asia-Pacific is leading the Vinyl Acetate Monomer (VAM) market due to its rapidly expanding manufacturing base, growing packaging and construction industries, and increasing demand for adhesives and coatings fueled by urbanization and industrialization.

The Asia-Pacific region holds a dominant position in the Vinyl Acetate Monomer market because it is home to some of the fastest-growing economies globally, such as China and India, where industrialization and urban expansion are driving robust demand for VAM-based products. The region’s burgeoning packaging sector, supported by rising e-commerce, food and beverage, and pharmaceutical industries, significantly contributes to this demand, as VAM-derived adhesives and coatings are essential for creating flexible, durable, and sustainable packaging solutions. Additionally, the rapid growth in the construction and automotive industries within Asia-Pacific further boosts the need for high-performance paints, coatings, and adhesives made from VAM.

Increasing investments in infrastructure development and manufacturing capabilities have created a favorable environment for chemical producers and downstream manufacturers to expand production and innovate new applications. Furthermore, relatively lower production costs, availability of raw materials, and supportive government policies aimed at industrial growth provide Asia-Pacific with a competitive advantage over other regions. Rising environmental awareness and regulatory support for green and water-based VAM formulations are also encouraging manufacturers to adopt sustainable technologies, which enhances the region’s market leadership.

- In February 2023, Celanese Corporation announced the expansion of its sustainable product portfolio within its acetyl chain. This initiative includes developing and integrating eco-friendly materials and processes to meet the growing demand for sustainable solutions. The company aims to address environmental concerns by enhancing its product offerings with innovations that reduce environmental impact.

- In December 2022, Showa Denko K.K. disclosed a licensing agreement with Asian Paints Limited for its vinyl acetate monomer (VAM) production technology. This partnership, formed with KBR, entails Showa Denko supplying catalysts to Asian Paints for their VAM manufacturing needs.

- In 2023, Celanese Corporation completed an ultra-low capital project to repurpose its existing manufacturing and infrastructure assets. This strategic initiative resulted in the release of additional ethylene vinyl acetate (EVA) production capacity in Edmonton, Alberta. The expansion aligns with the company's commitment to bolstering growth in the downstream vinyl portfolio of its acetyl chain segment.

Considered in this report

- Historic Year: 2019

- Base year: 2024

- Estimated year: 2025

- Forecast year: 2030

Aspects covered in this report

- Vinyl acetate monomer Market with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

- Flexographic Printing Machine

- Flexographic Printing Ink

- Aqueous Formulations

- Solvent-Based Formulations

- Powder Coatings

- Emulsions

- Others (Specialty formulations, Hybrids)

- Polyvinyl Alcohol

- Polyvinyl Acetate

- Ethylene Vinyl Acetate

- Others (Specialty Vinyl Acetate Copolymers,Modified or functionalized polymers, Emerging polymers)

- 99% & Above

- < 99%

The approach of the report:

This report consists of a combined approach of primary as well as secondary research. Initially, secondary research was used to get an understanding of the market and listing out the companies that are present in the market. The secondary research consists of third-party sources such as press releases, annual report of companies, analyzing the government generated reports and databases.After gathering the data from secondary sources primary research was conducted by making telephonic interviews with the leading players about how the market is functioning and then conducted trade calls with dealers and distributors of the market. Post this we have started doing primary calls to consumers by equally segmenting consumers in regional aspects, tier aspects, age group, and gender. Once we have primary data with us we have started verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations & organizations related to this industry, government bodies and other stakeholders to align their market-centric strategies. In addition to marketing & presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Brenntag SE

- Clariant AG

- Saudi Basic Industries Corporation

- Exxon Mobil Corporation

- Evonik Industries AG

- LyondellBasell Industries N.V.

- Dow Inc.

- Eastman Chemical Company

- Wacker Chemie AG

- Mitsubishi Chemical Group Corporation

- Innospec Inc.

- Azelis Holding S.A.

- Celanese Corporation

- Novasol Chemicals

- Shanghai Douwin Chemical Co.,Ltd

- Loba Chemie Pvt Ltd

- LOTTE INEOS Chemicals CO.,LTD

- Accord Chemical Corporation

- Dairen Chemical Corporation

- Kaneka Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 171 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.34 Billion |

| Forecasted Market Value ( USD | $ 14.76 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |