Telemedicine, AI-powered diagnostics, and home-based care devices are seeing more traction, particularly in urban centers. There’s also growing demand for orthopedic, cardiovascular, and critical care equipment as the country invests in specialized treatment centers. Foreign investors see opportunity in Saudi Arabia’s combination of strong demand, a large public healthcare budget, and a commitment to diversifying the economy. This mix is expected to keep the market on a steady growth path through the forecast period.

Saudi Arabia Medical Devices Market Overview

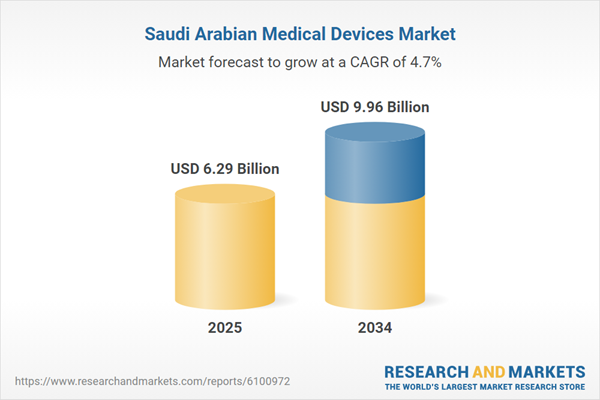

Medical devices are used for diagnosing, monitoring, and treating health conditions. In Saudi Arabia, their use is vital due to rising chronic diseases and expanding healthcare infrastructure. These devices support advanced diagnostics, surgical procedures, and patient monitoring, improving care quality and efficiency. The healthcare system heavily depends on medical technologies to meet Vision 2030 goals, promoting digital health and innovation. Consequently, demand for high-quality and innovative medical devices is growing, driving market expansion and enhancing healthcare outcomes. The market is expected to grow at a CAGR of 4.70% during the forecast period of 2025-2034 and attain a market value of USD 9.96 Billion by 2034.Saudi Arabia Medical Devices Market Growth Drivers

Regulatory Advances Accelerate AI Integration in Saudi Medical Devices

Increasing adoption of artificial intelligence in healthcare and government focus on digital health are driving market growth. For instance, in June 2024, the Saudi Food and Drug Authority (SFDA) released the MDS-G010 guidance, establishing clear regulatory requirements for AI- and machine learning-based medical devices. This regulation aligns with global standards while addressing local challenges, fostering innovation, and investor confidence. Consequently, it is expected to significantly boost market expansion and technological advancement in the forecast period.Saudi Arabia Medical Devices Market Trends

The market is evolving rapidly through digital adoption and increased international collaborations.Digital Transformation to Accelerate Market Growth

Saudi Arabia’s Vision 2030 is driving substantial investment in digital health technologies, including telemedicine and electronic health records. With over USD 1.5 billion allocated to health technology infrastructure, medical devices are being integrated across healthcare settings. This digital adoption improves device efficiency and patient outcomes, fueling demand and positioning the market for growth.Rise in International Expansion to Enhance Saudi Arabia Medical Device Market Value

In August 2021, Lepu Medical, a leading Chinese medical device manufacturer, received marketing authorization from the Saudi Food and Drug Authority (SFDA) for multiple percutaneous coronary intervention (PCI) products. The approval enabled Lepu Medical to legally market and sell these devices in Saudi Arabia, a country with a growing demand for advanced cardiovascular technologies. The entry of such international companies into the Saudi market is expected to increase competition, improve product availability, and drive innovation, thereby contributing to the expansion and modernization of the market.Saudi Arabia Medical Devices Market Segmentation

The market report offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

- Respiratory Devices

- Nebulizers

- Humidifiers

- Oxygen Concentrators

- Positive Airway Pressure Devices

- Ventilators

- Gas Analyzers

- Capnographs

- Others

- Cardiology Devices

- Diagnostic and Monitoring Devices

- Electrocardiogram (ECG)

- Remote Cardiac Monitoring Devices

- Others

- Therapeutic and Surgical Devices

- Stents

- Catheters

- Grafts

- Heart Valves

- Others

- Orthopedic Devices

- Replacement Devices

- Bone Fixation Devices

- Orthobiologics

- Braces

- Others

- Diagnostic Imaging Devices

- X-Ray Machines

- MRI Scanners

- CT Scanners

- Ultrasound Systems

- Nuclear Imaging Devices

- Others

- Endoscopy Devices

- Rigid Endoscopy Devices

- Flexible Endoscopy Devices

- Capsule Endoscopy Devices

- Disposable Endoscopy Devices

- Robot Assisted Endoscopy Devices

- Endoscopy Visualization Component

- Operative Devices

- Others

- Ophthalmology Devices

- Optical Coherence Tomography Scanners

- Fundus Cameras

- Perimeters/Visual Field Analyzers

- Autorefractors and Keratometers

- Slit Lamps

- Wavefront Aberrometers

- Optical Biometry Systems

- Corneal Topography Systems

- Specular Microscopes

- Retinoscopes

- Others

- Others

Market Breakup by Application

- Cardiology

- Neurology

- Orthopedics

- Diabetes Care

- Respiratory

- Ophthalmology

- Oncology

- Respiratory

- Others

Market Breakup by End User

- Hospitals

- Specialty Clinics

- Homecare Settings

- Ambulatory Surgical Centers

- Others

Market Breakup by Region

- Makkah

- Riyadh

- Madinah

- Qassim

- Eastern Province

- Others

Saudi Arabia Medical Devices Market Share

Hospitals to Lead the Market Share by End Users

Based on end users, the hospital segment is expected to hold the largest market share due to significant government investments in healthcare infrastructure and the expansion of tertiary care facilities. Specialty clinics and ambulatory surgical centers in the GCC are rapidly growing, driven by rising outpatient procedures and chronic disease management. Homecare settings are also gaining traction across the region, supported by increasing demand for remote patient monitoring. Other regions focus on strengthening primary care, but hospitals remain dominant overall.Saudi Arabia Medical Devices Market Analysis by Region

The market shows strong regional growth driven by major urban centers. Riyadh leads due to its advanced healthcare infrastructure and numerous specialized hospitals, attracting significant investments. Makkah and Madinah benefit from medical tourism linked to pilgrimage activities, boosting demand for medical devices. The Eastern Province thrives with its oil wealth and healthcare expansion projects, while Qassim and other regions show steady growth supported by government initiatives to improve healthcare access nationwide. These regional dynamics collectively propel market expansion.Leading Players in the Saudi Arabia Medical Devices Market

The key features of the market report comprise funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:Medtronic plc

Medtronic plc, founded in 1949 and headquartered in Dublin, Ireland, is a global leader in medical technology. The company offers a wide portfolio in Saudi Arabia, including cardiac devices, diabetes management systems, surgical tools, and neurovascular therapies. Medtronic partners with local healthcare institutions to support advanced treatments and patient care solutions. Its strong presence in the Kingdom aligns with national health initiatives, focusing on reducing chronic disease burdens through minimally invasive innovations and training programs for healthcare professionals.Johnson & Johnson MedTech

Headquartered in New Brunswick, New Jersey, and established in 1886, Johnson & Johnson MedTech operates as a leading player in surgical technology and interventional solutions. In Saudi Arabia, the company supplies a wide range of products, including orthopedic implants, cardiovascular devices, and wound care systems. It actively collaborates with healthcare institutions to improve surgical outcomes and patient safety. Johnson & Johnson MedTech supports Vision 2030 by enhancing local healthcare capabilities and investing in medical education and training initiatives across the Kingdom.Fresenius Medical Care AG & Co.

Founded in 1996 and headquartered in Bad Homburg, Germany, Fresenius Medical Care AG & Co. is the world’s largest provider of dialysis products and services. In Saudi Arabia, the company plays a vital role in managing kidney-related care through its advanced hemodialysis machines, dialyzers, and renal clinics. It works closely with the Ministry of Health to enhance chronic kidney disease treatment infrastructure. Fresenius contributes to improving patient access to quality renal care while supporting clinical training and technology transfer in the Kingdom.

Abbott

Abbott, founded in 1888 and headquartered in Illinois, USA, is a global healthcare company with a robust medical device portfolio. In Saudi Arabia, Abbott offers cardiovascular devices, diagnostic systems, diabetes care tools, and neuromodulation products. The company partners with healthcare providers to deliver advanced, patient-centric solutions that align with Saudi Arabia’s health transformation goals. Abbott also invests in local training and awareness programs, ensuring clinicians and patients benefit from the latest innovations in diagnostics and chronic disease management.Other key players in the market include GE Healthcare, Koninklijke Philips N.V., Siemens Healthcare GmbH, and 3M Company.

Key Questions Answered in the Saudi Arabia Medical Devices Market

- What was the Saudi Arabia medical devices market value in 2024?

- What is the Saudi Arabia medical devices market forecast outlook for 2025-2034?

- What are the major factors aiding the Saudi Arabia medical devices market demand?

- How has the market performed so far, and how is it anticipated to perform in the coming years?

- What are the market's major drivers, opportunities, and restraints?

- What are the major Saudi Arabia medical devices market trends?

- Which product will lead the market segment?

- Which application will lead the market segment?

- Which end user will lead the market segment?

- Who are the key players involved in the Saudi Arabia medical devices market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers, and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Medtronic plc

- Johnson & Johnson MedTech

- Fresenius Medical Care AG & Co.

- Abbott

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 6.29 Billion |

| Forecasted Market Value ( USD | $ 9.96 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 4 |