Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Stricter environmental regulations, particularly in regions such as the Gulf of Mexico and the North Sea, are accelerating the adoption of advanced subsea technologies that remove hydrocarbons and contaminants from produced water. Additionally, the focus on sustainability and reduced carbon emissions is promoting the use of energy-efficient, closed-loop water systems. Technological advancements, including compact modular designs, enhanced separation capabilities, and real-time digital monitoring, are further supporting market expansion. These solutions not only enhance recovery rates but also optimize field development and minimize the environmental footprint, making subsea water separation and treatment a key element in modern offshore operations.

Key Market Drivers

Growth of Deepwater and Ultra-Deepwater Exploration

The expansion of deepwater and ultra-deepwater exploration activities is a major growth driver for the global subsea water separation and treatment market. With many onshore and shallow-water reserves reaching maturity, oil and gas companies are targeting offshore basins that contain vast untapped resources but are located at extreme depths. Regions such as the Gulf of Mexico, Brazil’s pre-salt formations, and offshore West Africa are leading this shift.In such deepwater environments - often over 1,500 meters below sea level - transporting unprocessed fluids to surface platforms is both cost-intensive and technically complex. Subsea systems overcome these challenges by allowing oil, gas, water, and sediments to be separated and treated at the seabed. This reduces backpressure, improves oil recovery rates, extends the life of oil fields, and eliminates the need for large surface platforms. These benefits are driving increased adoption of subsea technologies to ensure operational efficiency and cost savings in challenging offshore environments.

Key Market Challenges

High Capital and Operational Costs

The global subsea water separation and treatment market faces significant challenges due to the high capital and operational costs associated with system deployment and maintenance. These advanced systems require specialized engineering, durable materials, and high-performance digital and mechanical components that can endure extreme subsea conditions.Upfront capital investment includes the development and customization of components like subsea separators, hydrocyclones, and flotation units, along with sophisticated control systems. Integration into existing offshore infrastructure and subsea installation adds further cost and complexity. Maintenance operations are also expensive, often requiring specialized vessels, remotely operated vehicles (ROVs), and deep-sea divers to ensure system reliability. The need for long-lasting components that can operate with minimal intervention contributes to elevated operational expenditure, particularly in remote or ultra-deepwater fields.

Key Market Trends

Integration of Digitalization and Remote Monitoring Technologies

The integration of digital technologies is becoming a key trend in the subsea water separation and treatment market. Operators are increasingly leveraging IoT sensors, AI-powered analytics, digital twins, and cloud-based platforms to enhance system performance, ensure operational safety, and reduce downtime. With subsea assets located in inaccessible and high-risk environments, real-time monitoring has become critical.Digital twins, which replicate physical systems in a virtual environment, allow operators to simulate conditions, forecast equipment failures, and optimize performance without interrupting operations. These digital solutions enable predictive maintenance by identifying early signs of malfunction based on parameters such as flow rates, pressure, and temperature. As a result, companies are transitioning from reactive to proactive maintenance strategies, reducing the risk of unplanned shutdowns and environmental incidents while improving asset longevity and efficiency.

Key Market Players

- TechnipFMC plc

- Schlumberger Limited (SLB)

- Aker Solutions ASA

- Halliburton Company

- Baker Hughes Company

- NOV Inc. (National Oilwell Varco)

- Oceaneering International, Inc.

- Siemens Energy AG

Report Scope:

In this report, the Global Subsea Water Separation & Treatment in Oil & Gas Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Subsea Water Separation & Treatment in Oil & Gas Market, By Water Depth:

- Shallow Water

- Deepwater

- Ultra-Deepwater

Subsea Water Separation & Treatment in Oil & Gas Market, By Technology:

- Subsea Water Separation Systems

- Subsea Water Treatment Systems

Subsea Water Separation & Treatment in Oil & Gas Market, By Water Source:

- Produced Water

- Injected Seawater

- Formation Water

Subsea Water Separation & Treatment in Oil & Gas Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- South America

- Brazil

- Colombia

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Subsea Water Separation & Treatment in Oil & Gas Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- TechnipFMC plc

- Schlumberger Limited (SLB)

- Aker Solutions ASA

- Halliburton Company

- Baker Hughes Company

- NOV Inc. (National Oilwell Varco)

- Oceaneering International, Inc.

- Siemens Energy AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | June 2025 |

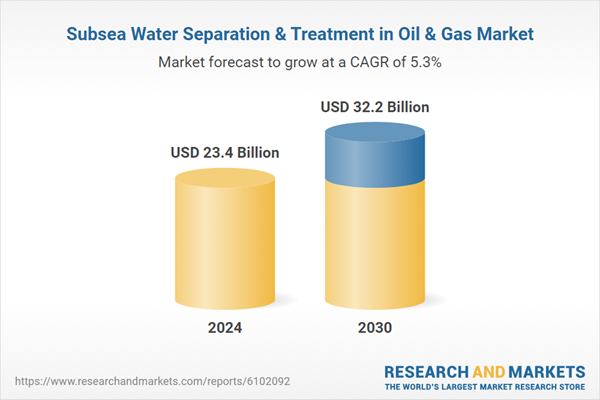

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 23.4 Billion |

| Forecasted Market Value ( USD | $ 32.2 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |