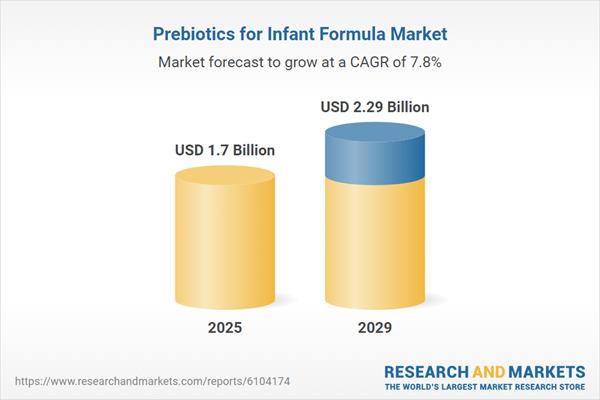

The prebiotics for infant formula market size is expected to see strong growth in the next few years. It will grow to $2.29 billion in 2029 at a compound annual growth rate (CAGR) of 7.8%. The growth in the forecast period can be attributed to growing interest in microbiome-based nutrition, increasing demand for personalized infant formula, rising healthcare expenditure by young parents, growing penetration of premium baby food brands, and increasing focus on early-life nutrition for long-term health. Major trends in the forecast period include technological advancements in ingredient formulation, innovation in synbiotic product development, investment in research and development for gut health, advancements in infant formula manufacturing, and development of region-specific prebiotic blends.

The forecast of 7.8% growth over the next five years reflects a modest reduction of 0.3% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. The imposition of tariffs may pose a significant challenge for pediatric nutrition manufacturers by increasing costs of human milk oligosaccharide analogs and gut microbiome modulators imported from the Netherlands and Singapore, potentially reducing neonatal digestive health benefits and raising specialty formula prices. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The increasing demand for organic products is anticipated to drive the expansion of the prebiotics for infant formula market in the coming years. Organic products are those cultivated or produced without synthetic chemicals, fertilizers, or genetically modified organisms (GMOs). This growing preference is largely fueled by consumers becoming more aware of the health risks linked to synthetic substances. Prebiotics in infant formula complement organic products by promoting natural gut health and supporting immune system development in infants. They replicate the positive effects of breast milk, fostering a balanced microbiome and aligning with the clean-label movement, making them suitable for health-focused and environmentally conscious families. For example, in May 2024, LETIS S.A., an Argentina-based certifying body for organic products, reported that organic food sales reached $61.67 billion in 2022, reflecting a 4.3% increase from 2021. Thus, the growing shift toward organic products is fueling the growth of the prebiotics for infant formula market.

Leading players in the prebiotics for infant formula market are concentrating on creating innovative biotics formulations to support gut health and boost immune function in infants. Biotics formulations encompass dietary supplements - such as probiotics, prebiotics, postbiotics, and synbiotics - designed to enhance gut health, strengthen the immune system, and promote overall wellness. For instance, in September 2024, Happy Family Organics, a US-based food and beverage company, introduced Happy Family Organics infant formula with biotics. This new line of USDA-certified organic infant formulas integrates both probiotics and prebiotics to support digestive and immune health in babies. These formulations are tailored to nourish infants during the critical first 1,000 days of life, a vital period for developing the gut microbiome. The inclusion of prebiotics is intended to encourage the growth of beneficial gut bacteria, further supporting immune health and general well-being.

In July 2023, Bobbie Baby Inc., a US-based infant formula manufacturer, acquired Nature’s One for an undisclosed sum. This strategic move bolsters Bobbie’s presence in the infant nutrition sector by acquiring Nature’s One’s advanced production facility in Ohio. The acquisition enhances manufacturing efficiency for organic, iron-enriched formulas to meet rising demand and improve supply chain robustness. Nature’s One is a US-based pediatric nutrition company known for its focus on prebiotics in infant formula.

Major players in the prebiotics for infant formula market are Nestle S.A., Abbott Laboratories, Danone S.A., FrieslandCampina, Ingredion Incorporated, Morinaga Milk Industry Co. Ltd., Yakult Honsha Co. Ltd., Tate & Lyle PLC, HiPP GmbH & Co. Vertrieb KG, Glanbia Nutritionals, ByHeart Inc., Synutra International Inc., BUBS Australia Ltd., Dana Dairy Group, Bobbie Baby Inc, New Francisco (Yunfu City) Biotechnology Corporation, Glycosyn Inc., Clasado Biosciences Limited, zuChem Inc., Dupont Nutrition & Health.

North America was the largest region in the prebiotics for infant formula market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in prebiotics for infant formula report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the prebiotics for infant formula market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The prebiotics for infant formula market consists of sales of infant formula additives, infant prebiotic supplements, prebiotic-enriched baby formula, aptamil gold, lactogen pro1, similac 360 total care, and enfamil neuropro. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The prebiotics for infant formula market research report is one of a series of new reports that provides prebiotics for infant formula market statistics, including the prebiotics for infant formula industry global market size, regional shares, competitors with the prebiotics for infant formula market share, detailed prebiotics for infant formula market segments, market trends, and opportunities, and any further data you may need to thrive in the prebiotics for infant formula industry. This prebiotics for infant formula market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Prebiotics in infant formula are non-digestible components, often derived from dietary fibers such as galactooligosaccharides (GOS) and fructooligosaccharides (FOS), that help promote the growth of beneficial gut bacteria. These compounds replicate the role of human milk oligosaccharides (HMOs) found in breast milk, aiding in the development of a healthy gut microbiota, boosting immune function, and potentially lowering the risk of infections and allergies in infants.

The primary types of prebiotics used in infant formula include fructooligosaccharides (FOS), galactooligosaccharides (GOS), inulin, short-chain fructooligosaccharides (scFOS), and buffered oligosaccharides. Fructooligosaccharides (FOS) are plant-based prebiotics that support gut health by encouraging the growth of beneficial bacteria, enhancing digestion, and improving nutrient absorption. The benefits of prebiotics include better digestive health, strengthened immune responses, improved mineral absorption, support for beneficial gut bacteria growth, and a reduction in gastrointestinal disorders. These prebiotics are used in a range of products, including standard infant formula, follow-on formula, specialty formulas, and other related applications. The key end users are online marketplaces, infant formula manufacturers, healthcare professionals, retailers, distributors, as well as parents and caregivers.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values and are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Prebiotics for Infant Formula Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on prebiotics for infant formula market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for prebiotics for infant formula? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The prebiotics for infant formula market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type of Prebiotics: Fructooligosaccharides (FOS); Galactooligosaccharides (GOS); Inulin; Short-chain Fructooligosaccharides (scFOS); Buffered Oligosaccharides2) By Functionality: Digestive Health Improvement; Enhanced Immune Response; Mineral Absorption Enhancement; Growth Promotion of Beneficial Gut Bacteria; Reduction of Gastrointestinal Disorders

3) By Application: Standard Infant Formula; Follow-On Formula; Specialty Formula; Other Applications

4) By End-User: Online Marketplaces; Infant Formula Manufacturers; Healthcare Professionals; Retailers and Distributors; Parents and Caregivers

Subsegments:

1) By Fructooligosaccharides: Linear Fructooligosaccharides; Branched Fructooligosaccharides; High-Purity Fructooligosaccharides; Enzyme-Synthesized Fructooligosaccharides2) By Galactooligosaccharides: High Galactooligosaccharide Content; Low Galactooligosaccharide Content; Beta-Galactooligosaccharides; Alpha-Galactooligosaccharides

3) By Inulin: Short-Chain Inulin; Long-Chain Inulin; Native Inulin; Oligofructose-Enriched Inulin

4) By Short-Chain Fructooligosaccharides: Glucose-Based Short-Chain Fructooligosaccharides; Sucrose-Based Short-Chain Fructooligosaccharides; Vegetable-Derived Short-Chain Fructooligosaccharides; Commercial-Grade Short-Chain Fructooligosaccharides

5) By Buffered Oligosaccharides: PH-Stabilized Buffered Oligosaccharides; Mineral-Enriched Buffered Oligosaccharides; Organic Acid Buffered Oligosaccharides; Multi-Buffered Oligosaccharide Blends

Companies Mentioned: Nestle S.A.; Abbott Laboratories; Danone S.A.; FrieslandCampina; Ingredion Incorporated; Morinaga Milk Industry Co. Ltd.; Yakult Honsha Co. Ltd.; Tate & Lyle PLC; HiPP GmbH & Co. Vertrieb KG; Glanbia Nutritionals; ByHeart Inc.; Synutra International Inc.; BUBS Australia Ltd.; Dana Dairy Group; Bobbie Baby Inc; New Francisco (Yunfu City) Biotechnology Corporation; Glycosyn Inc.; Clasado Biosciences Limited; zuChem Inc.; Dupont Nutrition & Health

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Prebiotics for Infant Formula market report include:- Nestle S.A.

- Abbott Laboratories

- Danone S.A.

- FrieslandCampina

- Ingredion Incorporated

- Morinaga Milk Industry Co. Ltd.

- Yakult Honsha Co. Ltd.

- Tate & Lyle PLC

- HiPP GmbH & Co. Vertrieb KG

- Glanbia Nutritionals

- ByHeart Inc.

- Synutra International Inc.

- BUBS Australia Ltd.

- Dana Dairy Group

- Bobbie Baby Inc

- New Francisco (Yunfu City) Biotechnology Corporation

- Glycosyn Inc.

- Clasado Biosciences Limited

- zuChem Inc.

- Dupont Nutrition & Health

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 2.29 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |