These systems are becoming increasingly sophisticated, enabling efficient short-run digital printing while incorporating smart technologies such as RFID and NFC for real-time tracking and enhanced product security. Pressure-sensitive labeling machines are gaining preference because they eliminate the need for glue, ensuring longer machine lifespans and greater operational efficiency.

Additionally, consumer demand for eco-friendly solutions is accelerating the development of waste-free and sustainable labeling alternatives. With growing concerns over environmental impact, businesses are increasingly turning to labeling materials that are recyclable, biodegradable, or made from renewable resources. This shift aligns with broader sustainability goals and addresses the growing preference among consumers for environmentally responsible products.

The rise of e-commerce, coupled with the need for unique, well-packaged goods, has further fueled this trend, particularly in wraparound labeling technologies. These machines are becoming increasingly popular due to their ability to apply labels more efficiently and with lighter materials, which in turn leads to significant operational cost reductions. By using lighter labels, companies can reduce material consumption per unit and lower shipping and transportation costs, which are crucial in today’s fast-paced, global market.

The wraparound labeling machine segment generated USD 500 million in 2024, accounting for a substantial portion of the market share. This segment is expected to continue its growth, driven by increasing investments in labeling technologies and the expansion of manufacturing plants. The rise of e-commerce and the growing trend toward customization are also encouraging investments in these labeling systems.

Wraparound labels, which are lighter than traditional labels, help reduce material consumption per unit, resulting in more sustainable operations. These machines are versatile, capable of labeling bottles of various shapes and sizes, and are simple to maintain. Wraparound labeling machines are ideal for use on conveyor belts and are particularly suited for partial wrap labels, which further enhance their popularity in the industry.

The food & beverages sector led the market in 2024, with a 37% share, and is projected to grow at a CAGR of 4.5% from 2025 to 2034. In this industry, pressure-sensitive labeling machines are in high demand due to their speed, accuracy, and reliability. As consumer preferences shift toward sustainable packaging, there is a rising demand for recyclable and biodegradable labels. The increasing adoption of pressure-sensitive labels is a direct response to this trend, allowing brands to meet both consumer expectations and environmental regulations.

North America Pressure Sensitive Labeling Machine Market held an 82% share and generated USD 260 million in 2024. This dominance is fueled by the growth of the consumer goods sector and the continued advancements in labeling technologies. With a booming e-commerce sector, expanding trade agreements, and increasing logistical demands, manufacturers and retailers in the U.S. are increasingly focusing on improving their packaging and labeling processes. The logistics industry in the U.S. is evolving rapidly, and efficient labeling plays a crucial role in this transformation.

The leading companies in the Global Pressure Sensitive Labeling Machine Market include Accutek Packaging Equipment, Auto Labe, Bhagwati Labelling Technologies, BW Integrated Systems, CVC Technologies, Fuji Seal, GERNEP, Krones, Leva Packaging Equipment, P.E. Labellers, Quadrel Labeling Systems, SaintyCo, Sheapak, Tronics, and Weber Packaging Solutions. To strengthen their market position, companies are focusing on technological advancements, such as the integration of RFID and NFC to enhance product tracking and security. They are also developing machines with higher versatility, capable of handling a wide range of products and packaging types.

Many firms are investing in sustainable labeling solutions, such as recyclable and biodegradable materials, in response to consumer demand for eco-friendly products. Additionally, strategic partnerships with manufacturers in various sectors like food and beverages, pharmaceuticals, and consumer goods are being formed to drive product adoption. Companies are also focusing on providing flexible, modular solutions that cater to both small and large-scale production lines.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

COMPANIES MENTIONED

The companies featured in this pressure sensitive labeling machine market report include:- Accutek Packaging Equipment

- Auto Labe

- Bhagwati Labelling Technologies

- BW Integrated Systems

- CVC Technologies

- Fuji Seal

- GERNEP

- Krones

- Leva Packaging Equipment

- P.E. Labellers

- Quadrel Labeling Systems

- SaintyCo

- Sheapak

- Tronics

- Weber Packaging Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | June 2025 |

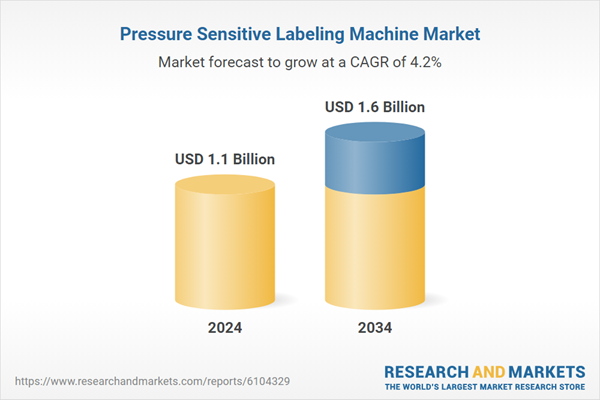

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.6 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |