Global Satellite Optical Ground Stations Market - Key Trends & Drivers Summarized

Why Are Optical Ground Stations Gaining Traction in Next-Generation Satellite Communications?

Optical ground stations (OGS), which utilize laser-based free-space optical communication (FSOC) to transmit and receive satellite data, are rapidly emerging as a key infrastructure component in the global space communication ecosystem. Unlike traditional radio-frequency (RF)-based ground stations, optical ground stations leverage laser beams for ultra-high bandwidth, low-latency communication links with satellites in low-earth orbit (LEO), medium-earth orbit (MEO), and geostationary orbit (GEO). The primary driver behind the shift toward optical ground stations is the exponential growth in satellite data generation, particularly from high-resolution Earth observation (EO), climate monitoring, and space-based internet constellations that require faster and more secure downlink capabilities.FSOC-enabled ground stations offer massive throughput advantages-often in the order of tens of gigabits per second-compared to their RF counterparts, which face bandwidth saturation in traditional spectrum bands such as X, Ka, and Ku. Additionally, optical communication links are immune to RF interference and spectrum licensing constraints, offering a clean and congestion-free medium for data transmission. As satellite operators aim to deliver low-latency, high-volume services-ranging from cloud data relays to secure government communications-the development of optical ground infrastructure is becoming imperative. National space agencies, defense departments, and private players are investing in OGS capabilities to enable next-generation communication backbones that support the demands of the evolving satellite ecosystem.

What Technical Innovations Are Accelerating the Adoption of Optical Ground Stations?

Technological innovations in adaptive optics, beam tracking, and atmospheric compensation are significantly improving the reliability and feasibility of satellite optical ground stations. One of the historical challenges of FSOC has been its sensitivity to atmospheric disturbances such as turbulence, clouds, and scintillation. Modern OGS platforms now integrate advanced adaptive optics systems that dynamically adjust mirror shapes and correct optical wavefront distortions in real time, thereby maintaining signal integrity even under variable weather conditions. These systems are coupled with high-speed acquisition, pointing, and tracking (APT) mechanisms that align narrow laser beams with fast-moving LEO satellites, ensuring stable and high-throughput optical links.Multi-wavelength laser communication systems are being developed to improve resilience and redundancy by enabling frequency diversity. Additionally, quantum communication protocols and encryption are beginning to be integrated into OGS designs to enable ultra-secure data links, particularly for defense, financial services, and diplomatic communications. Another significant innovation is the use of hybrid RF-optical systems, which allow seamless handover between optical and RF links depending on environmental conditions. These hybrid stations provide operational continuity while leveraging the speed of optical transmission when conditions allow. The miniaturization of optical terminals, use of thermally stabilized enclosures, and automation in ground station management are also facilitating broader deployment in global, distributed arrays of OGS infrastructure.

Which Use Cases and Regions Are Driving Demand for Satellite Optical Ground Stations?

The most prominent use case driving demand for optical ground stations is high-throughput data relay from EO and remote sensing satellites. These satellites generate terabytes of imagery and sensor data daily, which must be downlinked quickly and securely for time-sensitive applications such as disaster response, agricultural monitoring, and climate analytics. Additionally, low-latency communication is vital for real-time command-and-control operations in satellite constellations supporting navigation, autonomous systems, and scientific missions. The space science and astronomical communities are also leveraging optical downlinks for large-volume telemetry from deep space missions and for secure quantum key distribution (QKD) trials between spaceborne terminals and terrestrial stations.Geographically, Europe is leading the OGS development landscape with the European Space Agency (ESA) operating the European Data Relay System (EDRS), which uses laser communication terminals (LCTs) and optical ground links to support rapid satellite-to-ground transmission. Germany, France, and the U.K. host several operational OGS sites. In Asia-Pacific, Japan and South Korea are rapidly advancing FSOC capabilities for both civilian and military purposes, while China is integrating optical links into its Belt and Road satellite strategy. The U.S., through NASA and private operators, is building a network of optical terminals to support missions like the Laser Communications Relay Demonstration (LCRD). Emerging spacefaring nations including the UAE and India are exploring OGS to enable regional communication autonomy and secure satellite control.

What Key Forces Are Shaping the Growth Trajectory of the Optical Ground Station Market?

The growth in the satellite optical ground stations market is driven by several powerful factors, including escalating data volume from modern satellites, the limitations of RF spectrum, and heightened demand for ultra-secure communications. As EO, telecommunications, and satellite broadband providers deploy dense constellations of satellites, the capacity limitations of RF bands are becoming a bottleneck. Optical ground stations offer an elegant solution with gigabit-scale bandwidth, spectrum independence, and minimal regulatory complexity. Moreover, the rising prevalence of LEO satellite networks operating in mesh configurations necessitates high-frequency, high-speed links that optical communication is uniquely positioned to support.National security and data sovereignty concerns are also accelerating OGS adoption. Optical links are inherently difficult to intercept or jam due to their narrow beam divergence and line-of-sight requirements, making them ideal for defense and intelligence applications. Space-to-ground QKD trials are positioning OGS as enablers of future quantum internet infrastructure. Additionally, international collaborations and commercial partnerships are expanding the number of dual-use OGS facilities worldwide. Regulatory encouragement, including investment grants and standardization frameworks from international space bodies, is further smoothing the path for commercial deployment. As technology matures and cost barriers decline, optical ground stations are expected to form the backbone of a high-speed, secure global space communication network.

Scope Of Study:

The report analyzes the Satellite Optical Ground Stations market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Operation (Laser Satcom Operation, Optical Operations); Equipment (Consumer Equipment, Network Equipment); Application (Laser Operations Application, Debris Identification Application, Earth Observation Application, Space Situational Awareness Application); End-Use (Government End-Use, Military End-Use, Commercial Enterprises End-Use)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Laser Satcom Operation segment, which is expected to reach US$127.4 Billion by 2030 with a CAGR of a 15.7%. The Optical Operations segment is also set to grow at 10.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $19.9 Billion in 2024, and China, forecasted to grow at an impressive 13.4% CAGR to reach $26.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Satellite Optical Ground Stations Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Satellite Optical Ground Stations Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Satellite Optical Ground Stations Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airbus, Analytical Space Operations, Astrolight, ATLAS Space Operations, Ball Aerospace and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Satellite Optical Ground Stations market report include:

- Airbus

- Analytical Space Operations

- Astrolight

- ATLAS Space Operations

- Ball Aerospace

- BridgeComm, Inc.

- Cailabs

- CONTEC

- GA-Synopta GmbH

- Gilat Satellite Networks

- Honeywell International Inc.

- Intelsat

- Kongsberg Satellite Services (KSAT)

- L3Harris Technologies

- Leaf Space

- Maxar Technologies

- Mynaric AG

- Officina Stellare

- Safran Data Systems

- SpeQtral

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus

- Analytical Space Operations

- Astrolight

- ATLAS Space Operations

- Ball Aerospace

- BridgeComm, Inc.

- Cailabs

- CONTEC

- GA-Synopta GmbH

- Gilat Satellite Networks

- Honeywell International Inc.

- Intelsat

- Kongsberg Satellite Services (KSAT)

- L3Harris Technologies

- Leaf Space

- Maxar Technologies

- Mynaric AG

- Officina Stellare

- Safran Data Systems

- SpeQtral

Table Information

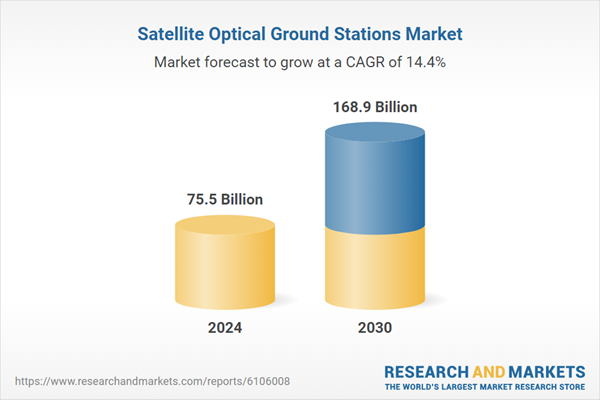

| Report Attribute | Details |

|---|---|

| No. of Pages | 262 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 75.5 Billion |

| Forecasted Market Value by 2030 | 168.9 Billion |

| Compound Annual Growth Rate | 14.4% |

| Regions Covered | Global |