Global Smart Signaling Market - Key Trends & Drivers Summarized

Why Is Smart Signaling Becoming Critical to Urban Mobility and Network Infrastructure?

Smart signaling systems are revolutionizing the way urban transportation networks and communication infrastructures operate by replacing legacy, time-based signaling with intelligent, adaptive, and real-time traffic and data control solutions. These systems utilize integrated sensors, edge computing, wireless connectivity, and AI algorithms to optimize signal timing, reduce latency in data flows, manage congestion, and improve safety across multimodal environments such as urban intersections, railways, telecom switches, and emergency response networks. In both transportation and telecommunications sectors, smart signaling represents a shift toward dynamic, context-aware decision-making for infrastructure performance enhancement.In urban traffic networks, smart signaling enables intelligent traffic lights that adjust in real-time to vehicle flows, pedestrian movement, public transportation schedules, and emergency vehicle paths. These systems reduce idle times, decrease greenhouse gas emissions from congestion, and enhance pedestrian safety. In telecommunications, smart signaling refers to advanced signaling protocols and intelligent routing mechanisms that prioritize network reliability, minimize packet loss, and support scalable digital transformation in 5G and cloud-native architectures. The convergence of smart mobility and intelligent network signaling is now forming the backbone of smarter, more responsive cities.

What Technologies Underpin the Functionality of Smart Signaling Systems?

Smart signaling systems are powered by a mix of AI, sensor fusion, data analytics, IoT platforms, and edge computing. In urban mobility, smart traffic signals rely on embedded cameras, radar, infrared sensors, and loop detectors to assess traffic volume, lane occupancy, and pedestrian movement in real time. Machine learning algorithms process this data to predict congestion build-up and dynamically adjust light phases, enabling adaptive traffic control. These systems are often integrated with Vehicle-to-Infrastructure (V2I) communication protocols, which allow real-time coordination with connected vehicles, enhancing flow efficiency and collision avoidance.In telecommunications, smart signaling involves intelligent switching protocols such as Signaling System No. 7 (SS7), Session Initiation Protocol (SIP), Diameter, and 5G Service-Based Architecture (SBA) interfaces. These protocols manage the setup, routing, and teardown of data sessions, enabling seamless handovers, congestion avoidance, and prioritization of high-value or latency-sensitive communications. Signaling analytics engines leverage deep packet inspection, anomaly detection, and quality-of-service metrics to ensure optimal load balancing across nodes. In 5G and next-gen broadband networks, signaling virtualization via network function virtualization (NFV) allows for elastic scaling and real-time failover.

The integration of edge computing enhances smart signaling responsiveness by allowing decisions to be made closer to the data source. This reduces latency in traffic control or call routing and enables systems to function even during intermittent cloud connectivity. These systems are managed via centralized platforms offering dashboards for monitoring signal health, outage detection, predictive maintenance, and integration with emergency protocols. Over-the-air updates, encrypted signaling channels, and fail-safe redundancy mechanisms ensure operational continuity and cybersecurity compliance.

Which Domains Are Driving Deployment and What Use Cases Are Gaining Prominence?

Smart signaling systems are seeing high adoption in domains such as urban transportation, railways, smart highways, public safety infrastructure, and advanced telecom networks. Cities with high traffic congestion and pollution levels are deploying intelligent traffic signaling to achieve sustainability targets, reduce travel times, and enhance livability. Smart intersections are being implemented across North America, Europe, and parts of Asia-Pacific, where urban centers are integrating AI-driven signals with traffic management centers and transit schedules. These systems prioritize buses, ambulances, and cyclists, creating intelligent multimodal corridors.Railway operators are implementing smart signaling to optimize train schedules, reduce headways, and minimize delays. Technologies such as the European Train Control System (ETCS), Communications-Based Train Control (CBTC), and Positive Train Control (PTC) are modernizing legacy block signaling systems, enabling near real-time train separation and increased rail network throughput. In smart highway projects, dynamic lane control and variable speed limit enforcement are powered by smart signaling modules that adapt based on vehicle load, weather, and incidents.

In telecommunications, operators are deploying intelligent signaling solutions to support 5G core networks, IoT device management, and mission-critical communications. These systems ensure seamless handovers across base stations, real-time congestion management in control planes, and prioritization of ultra-reliable low-latency communications (URLLC) for use cases like remote surgery or autonomous vehicles. Emergency networks and public safety agencies are using smart signaling to route calls efficiently during disasters, where traditional channels become overloaded. Integration with digital twin platforms is also emerging to simulate, test, and optimize signaling flows across large-scale infrastructure deployments.

What Forces Are Fueling Market Expansion and Innovation in Smart Signaling?

The growth in the global smart signaling market is driven by several factors, including urbanization, demand for congestion mitigation, increasing deployment of connected vehicles, advancement of 5G infrastructure, and growing emphasis on sustainable and resilient cities. As urban areas become more densely populated, the limitations of static signaling systems become more evident. Adaptive, data-driven signaling improves traffic flow, reduces energy consumption, and supports safety goals-making it a priority in smart city master plans worldwide.The rapid adoption of electric and autonomous vehicles is also influencing signaling strategies. Smart signals now need to communicate with vehicle onboard systems to optimize travel trajectories and charging patterns. Governments are introducing funding schemes and mandates that support smart signaling retrofits as part of broader transportation digitalization initiatives. Examples include the EU-s Green Deal, U.S. Infrastructure Investment and Jobs Act, and Japan-s Society 5.0 agenda-all of which earmark smart mobility as a pillar of national competitiveness.

In telecommunications, 5G rollouts are driving signaling innovation across mobile core networks, MEC (multi-access edge computing) nodes, and IoT control platforms. The exponential rise in data traffic, mobile applications, and connected devices is necessitating smarter, automated signaling protocols that can manage billions of concurrent sessions with low latency and high reliability. Telecom vendors and operators are investing in AI-based signaling analytics to predict outages, reroute traffic dynamically, and improve spectrum utilization.

Vendor competition is intensifying, with companies offering modular signaling platforms, open APIs, cloud-native control planes, and security-enhanced signaling firewalls. Strategic partnerships between governments, mobility technology firms, and telecom providers are accelerating pilot projects, testing frameworks, and cross-sector integration. With rising investments in digital infrastructure, energy-efficient mobility, and autonomous systems, smart signaling is positioned as a foundational enabler of interconnected, responsive, and future-ready ecosystems.

Scope Of Study:

The report analyzes the Smart Signaling market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Type (Hardware Type, Software Type, Service Type); Application (Urban Traffic Application, Public Transport Application, Freeway Application, Other Applications)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hardware Type segment, which is expected to reach US$4.1 Billion by 2030 with a CAGR of a 45.2%. The Software Type segment is also set to grow at 33.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $181.6 Million in 2024, and China, forecasted to grow at an impressive 39.4% CAGR to reach $823.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Smart Signaling Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Smart Signaling Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Smart Signaling Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Alstom SA, Arup, Cisco Systems, Inc., Cubic Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Smart Signaling market report include:

- ABB Ltd.

- Alstom SA

- Arup

- Cisco Systems, Inc.

- Cubic Corporation

- Econolite Group, Inc.

- Global Traffic Technologies (GTT)

- Hitachi Rail

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Iteris, Inc.

- Itron Inc.

- Kapsch TrafficCom AG

- KYOSAN Electric Mfg. Co., Ltd.

- Nippon Signal Co., Ltd.

- PTV Planung Transport Verkehr GmbH

- Schneider Electric SE

- Siemens AG

- SWARCO AG

- Thales Group

- Trafficware (now part of Cubic)

- Wabtec Corporation

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Alstom SA

- Arup

- Cisco Systems, Inc.

- Cubic Corporation

- Econolite Group, Inc.

- Global Traffic Technologies (GTT)

- Hitachi Rail

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Iteris, Inc.

- Itron Inc.

- Kapsch TrafficCom AG

- KYOSAN Electric Mfg. Co., Ltd.

- Nippon Signal Co., Ltd.

- PTV Planung Transport Verkehr GmbH

- Schneider Electric SE

- Siemens AG

- SWARCO AG

- Thales Group

- Trafficware (now part of Cubic)

- Wabtec Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

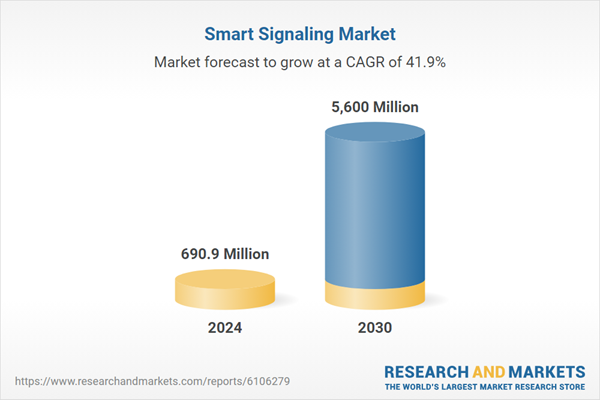

| Estimated Market Value in 2024 | 690.9 Million |

| Forecasted Market Value by 2030 | 5600 Million |

| Compound Annual Growth Rate | 41.9% |

| Regions Covered | Global |