Global Non-Alcoholic Liquors and Mocktails Market - Key Trends & Drivers Summarized

Why Is Consumer Behavior Shifting Toward Alcohol-Free Alternatives?

Changing lifestyles, evolving health priorities, and a rising preference for moderation are reshaping beverage consumption patterns globally. Consumers are increasingly choosing non-alcoholic liquors and mocktails as they seek to reduce or eliminate alcohol intake without sacrificing social engagement or taste experience. This shift is especially evident among younger adults and health-conscious segments who value mindful drinking, clean-label products, and functional ingredients.In urban markets, alcohol-free spirits and crafted mocktails are no longer limited to teetotalers or designated drivers. They are becoming part of a broader wellness movement that promotes mental clarity, better sleep, and reduced calorie intake. Additionally, rising awareness of the risks associated with alcohol consumption, including its effects on long-term health and productivity, is strengthening the demand for premium non-alcoholic beverage options that replicate the complexity of traditional cocktails.

How Is Product Innovation Elevating the Non-Alcoholic Drinking Experience?

Product innovation is at the heart of the market's expansion. New formulations use distillation techniques and botanical blends to mimic the flavor complexity of alcoholic beverages without ethanol. Non-alcoholic gins, whiskeys, and aperitifs are now crafted with herbal infusions, spice extracts, citrus peels, and adaptogens to deliver sensory profiles that appeal to seasoned drinkers. This growing sophistication allows mocktails to transcend sugary substitutes and become premium offerings in their own right.Packaging, branding, and positioning are also evolving to reflect the aspirational nature of these products. Sleek bottles, minimalist designs, and curated pairings with mixers enhance appeal. In addition to shelf-ready offerings, many brands are launching ready-to-drink mocktails that are convenient, stylish, and suitable for occasions from home gatherings to upscale dining. The use of natural ingredients, low sugar formulations, and functional additives like nootropics or mood enhancers is creating a bridge between indulgence and wellness.

What Role Do Hospitality and Retail Channels Play in Market Expansion?

Restaurants, hotels, and bars are expanding their non-alcoholic beverage menus to meet demand for sophisticated alternatives that align with evolving guest expectations. High-end venues now offer dedicated alcohol-free cocktail lists, often crafted with the same attention to detail as traditional drinks. Bartenders are using alcohol-free spirits to build layered mocktails with flavor depth, aroma, and presentation, elevating the category's profile in social and formal settings.Retail adoption is growing in parallel. Supermarkets, specialty stores, and e-commerce platforms are increasing shelf space for non-alcoholic liquors and ready-made mocktails. Online platforms allow consumers to explore new products, receive home deliveries, and access detailed product information, aiding trial and repeat purchase. Seasonal promotions, curated tasting boxes, and influencer-led campaigns are further supporting category visibility and consumer education.

Growth in the non-alcoholic liquors and mocktails market is driven by several factors.

Rising consumer demand for healthier lifestyle choices and moderation is creating strong interest in alcohol-free alternatives. Advances in botanical distillation and flavor engineering are enabling high-quality product formulations with rich, layered taste profiles. Expansion of alcohol-free offerings across hospitality venues is normalizing non-alcoholic consumption in social contexts. Retail availability, especially through direct-to-consumer and e-commerce platforms, is supporting wider access and brand discovery. Wellness trends, including low-sugar and functional ingredient preferences, are fueling innovation. Broader cultural acceptance of mindful drinking and inclusion of non-drinkers in social rituals continue to support long-term growth in this evolving category.Report Scope

The report analyzes the Non-Alcoholic Liquors and Mocktails market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Rum, Vodka, Whiskey, Gin, Tequila, Other Product Types); Flavor (Herbal & Botanical Flavor, Spiced Flavor, Exotic & Tropical Fruits & Vegetables Flavor, Agave Flavor, Smoky Flavor, Other Flavors).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Rum segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 5.5%. The Vodka segment is also set to grow at 5.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.9 Billion in 2024, and China, forecasted to grow at an impressive 7.1% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Non-Alcoholic Liquors and Mocktails Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Non-Alcoholic Liquors and Mocktails Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Non-Alcoholic Liquors and Mocktails Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACE Controls Inc., AZOL, Bansbach Easylift GmbH, Barnes Group Inc., BORDIGNON and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Non-Alcoholic Liquors and Mocktails market report include:

- Aplós

- Almave

- Athletic Brewing Company

- Caleno Drinks

- CleanCo

- Curious Elixirs

- Crodino (Campari Group)

- De Soi Aperitifs

- Everleaf

- Ghia

- Hella Cocktail Co.

- Kin Euphorics

- Little Saints

- Lyre’s Spirit Co.

- Monday Zero Alcohol Spirits

- Per Se

- Riteous? (Ritual Zero Proof)

- Seedlip

- Spiritless Inc.

- Three Spirit

- V9 Beverages Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aplós

- Almave

- Athletic Brewing Company

- Caleno Drinks

- CleanCo

- Curious Elixirs

- Crodino (Campari Group)

- De Soi Aperitifs

- Everleaf

- Ghia

- Hella Cocktail Co.

- Kin Euphorics

- Little Saints

- Lyre’s Spirit Co.

- Monday Zero Alcohol Spirits

- Per Se

- Riteous? (Ritual Zero Proof)

- Seedlip

- Spiritless Inc.

- Three Spirit

- V9 Beverages Pvt. Ltd.

Table Information

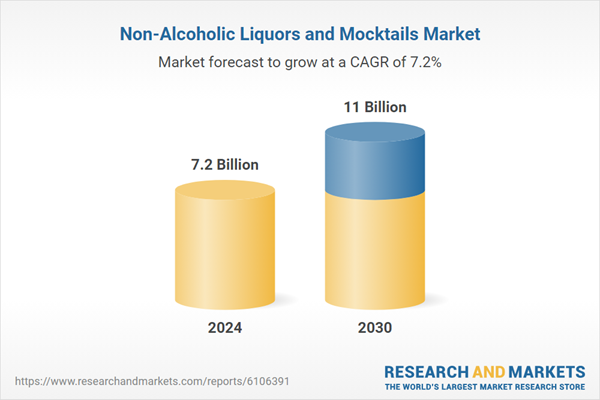

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.2 Billion |

| Forecasted Market Value ( USD | $ 11 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |