Global Oilfield Integrity Management Market - Key Trends & Drivers Summarized

Why Is Integrity Management Critical Across the Oilfield Lifecycle?

Oilfield integrity management ensures the safe, reliable, and compliant operation of wells, equipment, and infrastructure throughout the life of an asset. This discipline encompasses monitoring, inspection, assessment, and mitigation activities designed to prevent failures, leaks, and environmental incidents. It applies to wellbores, pipelines, pressure vessels, flowlines, and surface facilities across both onshore and offshore environments. Integrity management has become essential for minimizing operational risk, protecting personnel, and extending asset life under increasingly demanding production conditions.As oilfields age and production becomes more complex, issues such as corrosion, fatigue, erosion, and formation pressure anomalies become more common. Integrity programs are structured to identify such risks early through regular surveillance, non-destructive testing, and predictive analytics. In high-pressure, high-temperature (HPHT) and sour gas fields, integrity management plays an even more critical role in ensuring system containment and process safety. Regulatory scrutiny and corporate ESG goals are reinforcing the importance of integrity programs as part of responsible field stewardship.

How Are Digital Technologies Reshaping Oilfield Integrity Strategies?

Digitalization is transforming integrity management from reactive to proactive systems. Advanced sensors, real-time monitoring, and remote diagnostics are enabling continuous data collection on pressure, temperature, vibration, and flow conditions. These inputs are analyzed using predictive maintenance algorithms and risk-based inspection models to anticipate failures before they occur. Digital twins of wells and equipment are increasingly used to simulate stress loads and aging scenarios, helping operators make informed decisions about repair or replacement.Drone inspections, robotic crawlers, and fiber optic sensing technologies are gaining ground in areas where manual inspection is difficult or hazardous. Artificial intelligence is also being used to process historical and real-time data to detect anomalies, recommend actions, and reduce false alarms. Integration of integrity data with central asset management platforms allows seamless tracking of inspection histories, risk scores, and compliance documentation. These technologies are helping reduce downtime, optimize resource allocation, and improve transparency in integrity planning and execution.

What Operational and Regulatory Trends Are Driving Integrity Investments?

Mature fields, especially in North America, the North Sea, and parts of the Middle East, are experiencing an increase in well workovers, re-completions, and life extension projects. These activities require rigorous integrity checks and upgrades to casing, tubing, valves, and control systems. Offshore operations are also investing heavily in subsea system integrity, including flow assurance, corrosion monitoring, and wellhead integrity assessment, where access is limited and failure consequences are high.Onshore fields in emerging regions are seeing more structured integrity programs as regulators tighten enforcement around safety and environmental protection. Asset operators are under increasing pressure to demonstrate compliance with international standards such as ISO 55000, API 580/581, and NORSOK frameworks. The integration of integrity management into field development planning and capital budgeting is becoming a common practice. In parallel, there is a growing emphasis on training and competency development in integrity-related roles, particularly in areas with expanding exploration and production activity.

What Factors Are Driving Growth in the Oilfield Integrity Management Market?

Growth in the oilfield integrity management market is driven by several factors. Aging oilfield infrastructure and extended production horizons are increasing demand for systematic integrity assessment and life extension strategies. Advancements in digital monitoring, remote inspection tools, and AI-powered risk modeling are improving detection accuracy and lowering response time. Rising offshore and deepwater drilling activity is generating demand for high-integrity subsea systems and continuous surveillance. Stricter regulatory frameworks focused on safety, leak prevention, and environmental protection are mandating formalized integrity programs. Additionally, increased adoption of integrated asset management platforms and performance-based maintenance models is supporting wider implementation of predictive integrity solutions. These drivers collectively position integrity management as a strategic priority in both brownfield redevelopment and new field development initiatives.Report Scope

The report analyzes the Oilfield Integrity Management market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Software Component, Services Component); Application (Onshore Application, Offshore Application); Management Type (Planning Management, Predictive Maintenance & Inspection Management, Data Management, Corrosion Management, Monitoring System Management).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Software Component segment, which is expected to reach US$12.2 Billion by 2030 with a CAGR of a 4.4%. The Services Component segment is also set to grow at 7.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4 Billion in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Oilfield Integrity Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Oilfield Integrity Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Oilfield Integrity Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bharat Petroleum Corporation Ltd (BPCL), BP plc, Chevron Corporation, China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corp. (Sinopec) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Oilfield Integrity Management market report include:

- Aker Solutions ASA

- Applus+

- Asset Integrity Engineering

- Axiom NDT Ltd.

- Bureau Veritas

- DNV

- Eddyfi Technologies

- Emerson Electric Co.

- EnerMech

- FORCE Technology

- Halliburton

- Intertek Group plc

- Oceaneering International, Inc.

- Petrofac Ltd.

- Proceq (Screening Eagle)

- Quest Integrity Group

- Rosen Group

- SGS S.A.

- TechnipFMC

- TÜV Rheinland Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aker Solutions ASA

- Applus+

- Asset Integrity Engineering

- Axiom NDT Ltd.

- Bureau Veritas

- DNV

- Eddyfi Technologies

- Emerson Electric Co.

- EnerMech

- FORCE Technology

- Halliburton

- Intertek Group plc

- Oceaneering International, Inc.

- Petrofac Ltd.

- Proceq (Screening Eagle)

- Quest Integrity Group

- Rosen Group

- SGS S.A.

- TechnipFMC

- TÜV Rheinland Group

Table Information

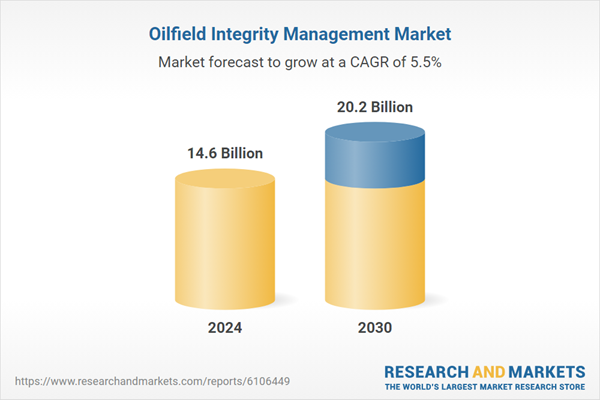

| Report Attribute | Details |

|---|---|

| No. of Pages | 375 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.6 Billion |

| Forecasted Market Value ( USD | $ 20.2 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |