Global Laboratory Water Purification Systems Market - Key Trends & Drivers Summarized

Why Are High-Purity Water Systems Becoming Indispensable in Modern Laboratories?

Laboratory water purification systems sit at the heart of reliable scientific workflows because even trace contaminants in feed water can compromise analytical accuracy, reproducibility, and instrument longevity. Researchers conducting ultrasensitive techniques such as liquid chromatography, mass spectrometry, cell culture, polymerase chain reaction, and trace metal analysis must eliminate ions, organic molecules, particulates, and microorganisms that can skew results. Regulatory mandates in pharmaceutical quality control, clinical diagnostics, and food testing demand demonstrable compliance with global standards for water quality, including ASTM, ISO, and CLSI specifications. As laboratories expand into nanotechnology, metabolomics, and gene therapy, water purity requirements have tightened even further, pushing demand for systems that deliver Type I and ultrapure water on demand. Rising awareness of hidden contaminants like endocrine disruptors and microplastics underscores the need for multistage treatment that combines reverse osmosis, electrodeionization, ultraviolet oxidation, and ultrafiltration. In academic environments, principal investigators emphasize clean water to safeguard expensive reagents and sensitive assays, while industrial labs view reliable purification as essential to maintaining continuous production uptime. Environmental labs rely on purified water to establish low detection limits for pollutants, ensuring that background interference is negligible. The global shift toward digital documentation and audit trails also spotlights the value of purification systems capable of logging water quality metrics for quality assurance teams. With laboratory footprints expanding and workflows becoming more specialized, the assurance of on-site, point-of-use purified water has evolved from a convenience into a fundamental prerequisite for scientific credibility and operational efficiency.How Are Technological Advancements Elevating Performance and Sustainability in Purification Systems?

Rapid innovation is transforming laboratory water purification from a static utility into a smart, efficient, and environmentally responsible process. Integration of real-time sensors allows systems to monitor resistivity, total organic carbon, and bacterial load, automatically adjusting operating parameters to maintain consistent quality. Touchscreen interfaces and cloud-connected dashboards give users immediate visibility into cartridge life, service alerts, and historical performance data, reducing downtime and technician intervention. Advanced reverse-osmosis membranes now achieve higher rejection rates at lower pressures, cutting energy consumption while extending membrane lifespan. Electrodeionization modules enhanced with selective ion exchange resins provide continuous deionization without the need for chemical regeneration, aligning with green lab objectives. Ultraviolet light systems operating at 185 nm and 254 nm wavelengths simultaneously oxidize organic compounds and sterilize microbial contaminants, allowing single-pass polish steps that previously required separate units. Some manufacturers incorporate energy-recovery pumps and variable-frequency drives that modulate flow based on demand, further trimming power use. Recirculation loops and sanitization cycles are being optimized through machine-learning algorithms that predict biofilm formation, scheduling heat or chemical treatments exactly when needed rather than on fixed intervals. Modular designs make it possible to expand capacity by adding plug-in cartridges or additional treatment stages, accommodating evolving lab throughput without major infrastructure changes. Materials scientists are developing low-extractable plastics and environmentally friendly resins that maintain purity while reducing hazardous waste disposal. These technological innovations collectively enhance water quality assurance, prolong system lifespan, and support laboratories in meeting both operational and sustainability goals.What Market Trends and User Expectations Are Shaping Product Development Strategies?

Customer expectations for laboratory water systems are evolving alongside larger trends in digitization, sustainability, and flexible laboratory design. Researchers now look for compact, benchtop units that save space yet deliver multiple water grades for varied applications within the same footprint. As multi-disciplinary labs share facilities, demand is rising for intuitive user interfaces that minimize training time and support multilingual environments. E-commerce procurement platforms and subscription models for consumables are changing buying behavior, prompting suppliers to offer predictive cartridge replacement programs tied to usage analytics. Green procurement policies at universities and pharmaceutical firms are driving interest in systems certified for low water waste ratios and reduced chemical usage, while Environmental, Social, and Governance reporting encourages transparency in energy and plastic consumption. Field-lab and mobile testing units require rugged, portable purification solutions that can operate on limited utilities, expanding the market into environmental monitoring and humanitarian deployments. The escalating cost of laboratory real estate is pushing manufacturers to engineer wall-mounted or stackable systems that integrate seamlessly with existing casework. End users increasingly expect connectivity with laboratory information management systems, enabling automated logging of water quality data for audit readiness. Competitive differentiation is also emerging through ergonomic features such as hands-free dispensing, customizable dispense volumes, and color-coded lighting cues that indicate water grade. Post-installation service expectations are climbing, leading vendors to provide remote diagnostics, augmented-reality maintenance guides, and extended warranty packages. These shifting preferences compel manufacturers to focus on user-centric design, service excellence, and continuous product evolution.What Factors Are Driving Growth in the Global Laboratory Water Purification Systems Market?

The growth in the global laboratory water purification systems market is driven by several factors rooted in regulatory expansion, technological progress, and broader healthcare and research investments. Intensifying quality guidelines across pharmaceuticals, clinical testing, and industrial QC require documented evidence of contaminant-free water, propelling laboratories to upgrade legacy equipment. Surging R&D spending in biologics, vaccines, and precision medicine demands higher throughput and purer reagents, stimulating purchases of advanced purification units capable of delivering consistent Type I water. Rising penetration of contract research organizations and decentralized testing sites broadens the customer base, while emerging economies are building new laboratory infrastructure that includes modern water systems from project inception. Environmental and food safety surveillance programs funded by governments and NGOs further extend market reach. Technological advances that lower operating costs and reduce consumables strengthen the return on investment case, making adoption easier to justify to budget committees. The move toward lean laboratory operations and minimized inventory supports point-of-use generation over bottled water, eliminating storage and contamination risks. Sustainability targets set by institutional and corporate initiatives incentivize replacement of chemical regeneration systems with greener electrodeionization and low-waste designs. Heightened awareness of supply-chain resilience after pandemic disruptions underscores the importance of in-house water production rather than relying on external suppliers. Vendor financing plans, service contracts, and compliance-ready documentation reduce procurement hurdles, accelerating sales cycles. Collectively these drivers create a strong momentum that positions laboratory water purification systems as essential capital equipment in the global pursuit of scientific rigor and operational excellence.Report Scope

The report analyzes the Laboratory Water Purification Systems market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Type 1 - Ultrapure Water, Type 2 - Laboratory Grade Water, Type 3 - Primary Grade Water, Other Types); Application (Chromatography Application, Spectrometry Application, Microbiological Analysis Application, Clinical Biochemistry Analysis Application, Cell & Tissue Cultures Application, Other Applications); End-Use (Hospitals & Diagnostic Laboratories End-Use, Biotechnology & Pharmaceuticals Industries End-Use, Research & Academic Institutes End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Type 1 - Ultrapure Water segment, which is expected to reach US$3 Billion by 2030 with a CAGR of a 5.9%. The Type 2 - Laboratory Grade Water segment is also set to grow at 9.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.3 Billion in 2024, and China, forecasted to grow at an impressive 11.6% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Laboratory Water Purification Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Laboratory Water Purification Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Laboratory Water Purification Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agilent Technologies, Amerex Instruments, Inc., Avantor Inc., Benchmark Scientific, Bio-Rad Laboratories Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Laboratory Water Purification Systems market report include:

- Aqua Solutions, Inc.

- Avidity Science

- Biobase Group

- Biolab Scientific Ltd.

- BRITA Group

- Chengdu Ultrapure Technology Co., Ltd.

- Culligan International Company

- Danaher Corporation (including Pall Corporation, Hach)

- DuPont

- ELGA LabWater (a subsidiary of Veolia Water Technologies)

- Envirogen Group

- Evoqua Water Technologies LLC (part of Xylem)

- Labconco Corporation

- Mar Cor Purification (a Cantel Medical company, part of STERIS)

- Merck KGaA

- Purite Ltd

- RephiLe Bioscience Ltd.

- Sartorius AG

- SUEZ Water Technologies & Solutions (part of SUEZ Group)

- Thermo Fisher Scientific Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aqua Solutions, Inc.

- Avidity Science

- Biobase Group

- Biolab Scientific Ltd.

- BRITA Group

- Chengdu Ultrapure Technology Co., Ltd.

- Culligan International Company

- Danaher Corporation (including Pall Corporation, Hach)

- DuPont

- ELGA LabWater (a subsidiary of Veolia Water Technologies)

- Envirogen Group

- Evoqua Water Technologies LLC (part of Xylem)

- Labconco Corporation

- Mar Cor Purification (a Cantel Medical company, part of STERIS)

- Merck KGaA

- Purite Ltd

- RephiLe Bioscience Ltd.

- Sartorius AG

- SUEZ Water Technologies & Solutions (part of SUEZ Group)

- Thermo Fisher Scientific Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 385 |

| Published | January 2026 |

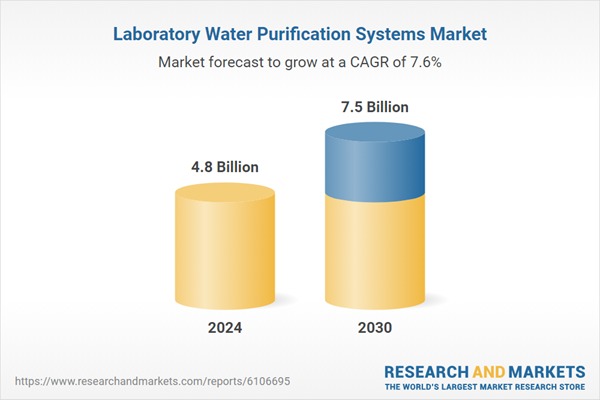

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.8 Billion |

| Forecasted Market Value ( USD | $ 7.5 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |