Global Machining Services Market - Key Trends & Drivers Summarized

Why Are Machining Services Still Essential in the Era of Digital Manufacturing and Automation?

Despite rapid advances in automation and digital manufacturing, machining services remain foundational to the global manufacturing landscape due to their precision, versatility, and essential role in producing complex components. These services encompass a wide range of subtractive manufacturing techniques such as milling, turning, drilling, and grinding, each crucial for shaping raw materials into precise parts used across industries including aerospace, automotive, medical, energy, and defense. While 3D printing and other additive processes are gaining traction, they cannot yet replicate the high tolerances, surface finishes, and material versatility offered by traditional machining. Machining services are especially vital when working with metals, alloys, and high-performance composites that demand superior strength, resistance, and durability. Furthermore, the need for customization, prototyping, and low-volume production supports the relevance of machining shops that can quickly adapt to specific client requirements. Complex geometries and highly regulated sectors often require CNC (Computer Numerical Control) machining, which combines precision with automation to produce parts with minimal error. The integration of machining with CAD/CAM software further enhances efficiency and accuracy, enabling rapid transitions from digital models to physical components. Even as manufacturing moves toward smart factories, machining services are evolving alongside, contributing significantly to just-in-time production and lean manufacturing strategies. Their continued importance lies not only in legacy capabilities but also in their adaptability to evolving industrial needs, reinforcing their place at the core of modern production ecosystems.How Are Technological Innovations Transforming the Capabilities of Machining Services?

Technological advancements are significantly expanding the capabilities of machining services, enhancing both the quality and efficiency of output across industrial sectors. One of the most impactful developments is the rise of multi-axis CNC machining, which enables the fabrication of complex parts with fewer setups and greater precision. Machines capable of 4-, 5-, or even 9-axis movement can produce intricate geometries in a single operation, reducing production time and minimizing human intervention. Automation through robotics and pallet changers is also streamlining repetitive tasks, improving throughput, and minimizing errors. Meanwhile, the adoption of IoT (Internet of Things) in machine tools is allowing for real-time monitoring of machine conditions, tool wear, and operational parameters, leading to predictive maintenance and reduced downtime. Artificial intelligence and machine learning algorithms are now being used to optimize cutting paths, select ideal toolsets, and predict machining outcomes based on historical data. Additionally, hybrid machining systems that combine additive and subtractive capabilities are emerging, enabling the repair and modification of existing components or the production of previously impossible shapes. Material science innovations have also influenced the sector, with machines now capable of handling superalloys and composite materials that are prevalent in aerospace and energy applications. Digital twins and simulation software allow operators to test machining sequences virtually, identifying inefficiencies or risks before actual production. These innovations are not only driving cost savings and operational efficiency but are also elevating the role of machining services within the broader scope of advanced manufacturing and Industry 4.0 integration.What Market Trends and Customer Expectations Are Reshaping the Machining Services Industry?

Shifting customer expectations and market trends are reshaping the machining services industry, pushing service providers to become more agile, responsive, and digitally integrated. One of the most prominent trends is the increasing demand for high-mix, low-volume production, driven by customized product designs and shorter product life cycles. As a result, machining companies are reconfiguring their operations to offer more flexibility and faster turnaround times without compromising quality. Clients are also demanding full-service capabilities, from design support and material selection to post-processing and logistics, prompting machining firms to evolve from standalone shops into integrated manufacturing partners. Sustainability is another growing concern, with manufacturers looking to reduce material waste, optimize energy consumption, and implement cleaner machining fluids and recyclable packaging. Certifications for quality management, environmental compliance, and industry-specific standards such as ISO 13485 or AS9100 are increasingly required, especially in sectors like medical and aerospace. The globalization of supply chains has further complicated customer expectations, as clients seek vendors that can deliver consistent quality across geographies while managing geopolitical risks and currency fluctuations. Digital quoting platforms, automated inventory management, and customer portals are being implemented to improve transparency and client engagement. In response, machining service providers are embracing digital transformation not just on the shop floor but throughout their entire customer journey. These changing dynamics are raising the bar for competition and collaboration within the industry, requiring firms to blend craftsmanship with technology to meet the evolving demands of modern manufacturing clients.What Are the Primary Drivers Fueling the Expansion of the Global Machining Services Market?

The growth in the global machining services market is driven by several key factors related to industrial development, technological adoption, evolving manufacturing needs, and increased demand for high-precision components. A primary driver is the ongoing expansion of end-use industries such as aerospace, automotive, medical devices, construction, electronics, and energy, each of which requires exacting parts and reliable production methods. The increasing complexity of products, driven by miniaturization, lightweighting, and performance optimization, is pushing demand for machining processes capable of tight tolerances and advanced material handling. The rise in electric vehicles and renewable energy infrastructure is introducing new component needs that rely heavily on precision machining. Technological integration, such as the use of AI in toolpath optimization and IoT for machine monitoring, is boosting productivity and cost efficiency, making machining more attractive to OEMs and Tier 1 suppliers. The growth of small and medium-sized enterprises, especially in emerging markets, is creating fresh demand for local machining capabilities that can serve both domestic and export markets. Furthermore, the trend toward reshoring and nearshoring of manufacturing in response to geopolitical instability and supply chain vulnerabilities is increasing regional investments in machining infrastructure. Public and private funding in advanced manufacturing hubs, combined with workforce development programs, is also supporting long-term industry growth. These drivers collectively ensure that machining services remain an indispensable and evolving component of the global manufacturing ecosystem, capable of meeting the sophisticated and diverse needs of modern industries.Report Scope

The report analyzes the Machining Services market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Service Type (Automotive Services, General Machinery Services, Precision Engineering Services, Other Services).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automotive Services segment, which is expected to reach US$30.6 Billion by 2030 with a CAGR of a 2.2%. The General Machinery Services segment is also set to grow at 1.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $19.5 Billion in 2024, and China, forecasted to grow at an impressive 4.8% CAGR to reach $16 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Machining Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Machining Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Machining Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abeking & Rasmussen, Amels (Damen Yachting), Azimut Benetti Group, Baglietto, Benetti (Azimut Benetti) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Machining Services market report include:

- Ametek, Inc.

- Agathon AG

- Bharat Forge Ltd

- Carlson Tool & Manufacturing

- DMG?MORI

- Doosan Machine Tools Co.

- Godrej & Boyce

- Haas Automation, Inc.

- Kennametal Inc.

- Makino

- Matsuura Machinery

- Mazak (Yamazaki Mazak Corp.)

- Okuma Corporation

- Sandvik Coromant

- Siemens AG (Machine Tools)

- Starrag AG

- Titanium Industries, Inc.

- Xometry

- Protolabs

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ametek, Inc.

- Agathon AG

- Bharat Forge Ltd

- Carlson Tool & Manufacturing

- DMG?MORI

- Doosan Machine Tools Co.

- Godrej & Boyce

- Haas Automation, Inc.

- Kennametal Inc.

- Makino

- Matsuura Machinery

- Mazak (Yamazaki Mazak Corp.)

- Okuma Corporation

- Sandvik Coromant

- Siemens AG (Machine Tools)

- Starrag AG

- Titanium Industries, Inc.

- Xometry

- Protolabs

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

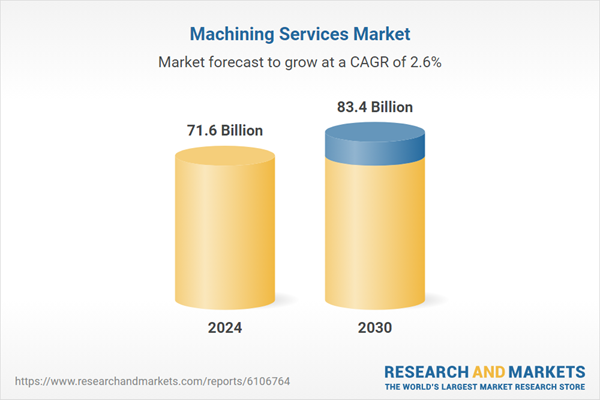

| Estimated Market Value ( USD | $ 71.6 Billion |

| Forecasted Market Value ( USD | $ 83.4 Billion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |