Global Maltodextrin and Maltodextrin Syrups Market - Key Trends & Drivers Summarized

Why Are Maltodextrin and Maltodextrin Syrups Widely Used Across Multiple Food and Beverage Applications?

Maltodextrin and maltodextrin syrups have become indispensable ingredients in the global food and beverage industry due to their multifunctional characteristics and versatility across a wide spectrum of product categories. Derived from starch, typically corn, potato, rice, or wheat, maltodextrin is a polysaccharide that serves as a texturizer, stabilizer, thickener, and bulking agent. It is prized for its neutral taste, ease of solubility, and ability to enhance mouthfeel without significantly altering the flavor profile of the final product. Maltodextrin syrups, in particular, offer a liquid alternative with similar properties but are used in formulations that benefit from moisture retention and viscosity control. These ingredients are commonly found in soft drinks, ice creams, sports drinks, soups, gravies, desserts, and processed snacks, where they not only improve product stability and shelf life but also help maintain consistency in taste and texture. The food industry favors maltodextrin for its ability to replace fat and sugar, making it ideal for reduced-calorie and low-fat formulations. In powdered foods and instant mixes, maltodextrin ensures uniform dispersion and prevents clumping. With consumers demanding more shelf-stable, ready-to-consume products, manufacturers increasingly turn to maltodextrin for its functional benefits in both solid and liquid applications. Its GRAS (Generally Recognized as Safe) status and regulatory approval across major markets further support its widespread use. This multifunctional role has positioned maltodextrin and its syrups as crucial components in the evolution of modern food processing and formulation.How Is Technological Advancement Enhancing the Production and Functional Performance of Maltodextrin?

Technological innovation in enzymatic hydrolysis, drying techniques, and raw material sourcing is significantly advancing the production and functional diversity of maltodextrin and maltodextrin syrups. Modern processing technologies now allow manufacturers to control the dextrose equivalent (DE) levels with greater precision, tailoring the sweetness, solubility, and viscosity of the final product for specific applications. Low-DE maltodextrins are used for their thickening and stabilizing properties, while higher-DE variants contribute mild sweetness and improved freeze-thaw stability. Spray-drying and drum-drying techniques are being optimized to enhance powder uniformity, improve solubility, and extend storage life. In syrups, membrane filtration and advanced concentration methods help preserve functional integrity while minimizing impurities. The shift toward non-GMO and organic sources is also shaping production methods, with starches from certified organic corn and tapioca being processed under cleaner-label protocols. Ingredient manufacturers are investing in R&D to develop modified maltodextrins that can withstand extreme processing conditions such as high heat or pH variation, thus expanding their usability in pharmaceutical, dairy, and bakery sectors. The push for sustainability has led to more energy-efficient processing and reduced water consumption in production facilities. These improvements are not only making maltodextrin more adaptable to various industrial needs but also aligning the ingredient with global trends favoring cleaner, more transparent production methods. As formulation challenges become more complex across industries, maltodextrin continues to evolve through technology, meeting the growing demand for functional, flexible, and high-performance food ingredients.What Consumer and Industry Trends Are Influencing Demand for Maltodextrin-Based Ingredients?

Shifting consumer preferences and industry dynamics are having a direct impact on the global demand for maltodextrin and maltodextrin syrups, particularly as food producers navigate the balance between health, convenience, and product integrity. Consumers are increasingly reading ingredient labels and seeking transparency in formulations, prompting brands to clarify the functional role of maltodextrin and reassure buyers of its safety. While some health-conscious segments are cautious about processed additives, others accept maltodextrin as a practical tool in achieving desired taste and texture without excess fat or sugar. The sports nutrition sector is a key area of growth, as maltodextrin is commonly used in energy drinks, protein powders, and recovery supplements due to its ability to provide quick-release carbohydrates for energy replenishment. Similarly, in infant nutrition and medical foods, maltodextrin is favored for its digestibility and compatibility with specialized formulations. The increasing demand for gluten-free and allergen-free products is also boosting the use of tapioca- and rice-derived maltodextrin as safe alternatives. On the industrial side, manufacturers value maltodextrin's ability to improve product handling, reduce caking, and act as a carrier for flavorings, colorants, and active compounds. In confectionery and dairy, it provides essential bulk and texture without altering appearance or flavor. As ready-to-eat and convenience foods continue to dominate global markets, maltodextrin's role as a reliable processing aid remains vital. These trends reflect a marketplace that, while increasingly health-aware, still prioritizes functionality and quality in food design, thereby ensuring continued demand for maltodextrin-based ingredients.What Factors Are Driving Growth in the Global Maltodextrin and Maltodextrin Syrups Market?

The growth in the global maltodextrin and maltodextrin syrups market is driven by a convergence of food innovation, rising industrial demand, health product diversification, and economic scalability. One of the strongest growth drivers is the expanding processed and convenience food industry, which relies heavily on functional ingredients to ensure product consistency, texture, and shelf stability. As food manufacturing scales across emerging markets in Asia, Africa, and Latin America, local demand for cost-effective and multipurpose additives like maltodextrin is increasing. Additionally, the surge in demand for nutraceuticals, dietary supplements, and sports nutrition products is opening up new avenues for maltodextrin use as a carbohydrate source and delivery agent. Pharmaceutical companies are also expanding its use in tablet formulation, excipients, and oral solutions due to its inert properties and ease of incorporation. The growing preference for clean-label and allergen-free products is driving the development of non-GMO and organic maltodextrin, enabling brands to appeal to increasingly discerning consumers. Cost efficiency is another significant factor, as maltodextrin offers manufacturers a way to improve product performance without significantly increasing formulation costs. Trade liberalization and improved supply chain logistics are allowing more regional players to participate in the global maltodextrin supply chain, increasing competition and innovation. Regulatory support and food safety certifications across North America, Europe, and Asia-Pacific are reinforcing consumer and manufacturer confidence. These combined factors are propelling the market forward, positioning maltodextrin and its syrup counterparts as essential components in the global food, pharmaceutical, and industrial ingredient economy.Report Scope

The report analyzes the Maltodextrin and Maltodextrin Syrups market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Syrup Type (Dry Maltodextrin, Liquid Maltodextrin); Application (Food & Beverages Application, Pharmaceuticals Application, Personal Care & Cosmetics Application, Paper & Pulp Processing Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dry Maltodextrin segment, which is expected to reach US$4.3 Billion by 2030 with a CAGR of a 5.1%. The Liquid Maltodextrin segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Maltodextrin and Maltodextrin Syrups Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Maltodextrin and Maltodextrin Syrups Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Maltodextrin and Maltodextrin Syrups Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ajanta Pharma Ltd., Bayer AG, BioNTech SE, Cipla Limited, Dr. Reddy’s Laboratories Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Maltodextrin and Maltodextrin Syrups market report include:

- ADM (Archer Daniels Midland Company)

- Agrana Group

- Avebe

- Cargill, Incorporated

- Grain Processing Corporation

- Gulshan Polyols

- Ingredion Incorporated

- Kraft Chemical

- Matsutani America

- Nowamyl

- Penford Corporation

- Roquette Frères

- SSSFI-AAA (Sabah Sdn Bhd)

- Tate?&?Lyle PLC

- Tereos Syral S.A.S.

- Xiwang Group

- Zhucheng Dongxiao Biotechnology Co. Ltd.

- Zhucheng Xingmao Bio-Tech Co. Ltd.

- Südzucker AG

- Global Sweeteners Holdings

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADM (Archer Daniels Midland Company)

- Agrana Group

- Avebe

- Cargill, Incorporated

- Grain Processing Corporation

- Gulshan Polyols

- Ingredion Incorporated

- Kraft Chemical

- Matsutani America

- Nowamyl

- Penford Corporation

- Roquette Frères

- SSSFI-AAA (Sabah Sdn Bhd)

- Tate?&?Lyle PLC

- Tereos Syral S.A.S.

- Xiwang Group

- Zhucheng Dongxiao Biotechnology Co. Ltd.

- Zhucheng Xingmao Bio-Tech Co. Ltd.

- Südzucker AG

- Global Sweeteners Holdings

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

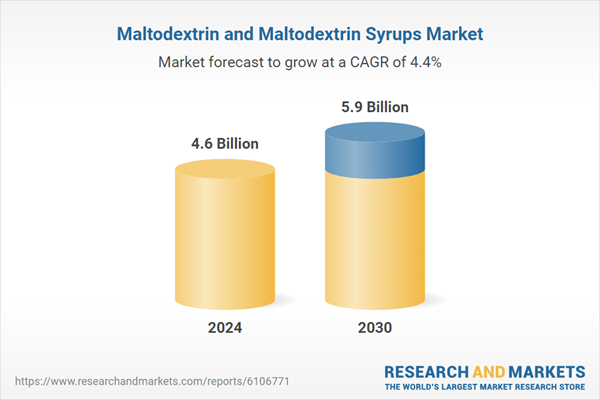

| Estimated Market Value ( USD | $ 4.6 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |