Global Military UAV Sensors Market - Key Trends & Drivers Summarized

How Are Sensors Powering the Strategic Capabilities of Military UAVs in Modern Warfare?

Military UAV sensors are at the heart of the growing effectiveness and strategic utility of unmanned aerial vehicles in contemporary conflict environments. These advanced sensors serve as the eyes and ears of UAVs, enabling them to collect high-fidelity data across multiple domains including visual, infrared, radar, and electromagnetic spectrums. From persistent surveillance and reconnaissance to target acquisition and threat detection, sensors transform UAVs into versatile, intelligence-rich platforms that extend a military's reach without risking human lives. Electro-optical and infrared (EO/IR) sensors are among the most widely used, providing real-time imagery and thermal detection capabilities even in complete darkness or adverse weather conditions. Meanwhile, synthetic aperture radar (SAR) allows UAVs to generate detailed terrain maps and track ground movement through foliage or camouflage. These capabilities have become indispensable for missions such as border surveillance, counterterrorism, and battlefield reconnaissance, where situational awareness is a decisive factor. The miniaturization of sensor technologies has also enabled their deployment on smaller, tactical drones, allowing for distributed sensing and rapid data acquisition at the platoon level. UAV sensors are further being integrated with onboard data processing and communication systems that allow real-time transmission of intelligence to command centers. This capability enables faster decision-making and more precise execution of military operations. In effect, sensors are what elevate military UAVs from simple aerial platforms to sophisticated tools of surveillance, targeting, and intelligence gathering, allowing armed forces to achieve operational dominance across diverse theaters.Why Is Multi-Sensor Fusion Transforming Tactical Decision-Making and ISR Operations?

Multi-sensor fusion is transforming how military UAVs contribute to tactical decision-making and intelligence, surveillance, and reconnaissance (ISR) operations by synthesizing inputs from diverse sensors into a cohesive operational picture. Rather than relying on a single type of data, modern UAVs are equipped with sensor suites that include EO/IR cameras, LiDAR, SAR, electronic warfare receivers, and signals intelligence (SIGINT) payloads, all working in tandem. This integration allows drones to not only detect and identify targets but also analyze their behavior, communicate threat levels, and suggest actionable responses. For example, a UAV might use its radar to detect vehicle movement through cloud cover, its EO/IR sensor to verify the object visually, and its SIGINT system to determine if it is emitting hostile signals. When processed together, this information yields a much richer and more reliable picture of the battlefield. Such capability is particularly crucial in environments where adversaries use sophisticated camouflage or operate in mixed civilian zones. With multi-sensor fusion, UAVs can help reduce uncertainty and minimize the risk of collateral damage. Additionally, fused sensor data supports predictive analytics, enabling forces to anticipate enemy movements or detect patterns over time. These integrated sensor platforms are now playing key roles in coordinated strikes, electronic warfare, and target handoff between manned and unmanned systems. The resulting synergy not only enhances operational tempo but also reduces the cognitive burden on analysts and field commanders. As militaries aim to shorten the sensor-to-shooter cycle and act on intelligence with speed and precision, the role of UAV sensor fusion will only become more central in future conflict scenarios.How Are Technological Advancements Redefining the Performance and Role of UAV Sensors?

Technological advancements are redefining the performance, miniaturization, and intelligence of military UAV sensors, allowing them to adapt to more complex missions and diverse environments. Breakthroughs in microelectromechanical systems (MEMS), AI-powered analytics, and low-power electronics are enabling sensors to collect more data with higher accuracy while consuming less power and space. Today's UAV sensors can detect minute variations in heat, light, vibration, and radiation, providing high-resolution, multi-dimensional information that supports both real-time operations and post-mission analysis. AI and machine learning are being used to automate object recognition, classify threats, and prioritize surveillance targets based on behavior and environmental context. These systems can quickly identify hostile equipment, detect unusual patterns, or alert operators to emerging risks without constant human monitoring. The evolution of hyperspectral sensors is further extending UAV capabilities, allowing them to detect materials, chemical signatures, or environmental changes that are invisible to the human eye or conventional optics. Edge computing technologies are enabling UAVs to process sensor data onboard, reducing latency and ensuring timely action even when communication links are limited. Enhanced encryption and anti-jamming features are improving the resilience and security of data transmissions, which is vital in electronically contested environments. Furthermore, adaptive sensors that recalibrate based on mission requirements or threat levels are allowing UAVs to operate with greater flexibility and autonomy. These developments are not only increasing the strategic value of UAVs but also making them viable for missions that were once the exclusive domain of manned aircraft, such as high-risk reconnaissance, electronic warfare, and battlefield interdiction.What Are the Key Factors Driving the Growth of the Global Military UAV Sensors Market?

The growth in the global military UAV sensors market is being driven by a convergence of evolving combat needs, rapid technological innovation, and strategic shifts in military doctrine. One of the primary drivers is the increasing reliance on unmanned systems for intelligence gathering, target tracking, and real-time surveillance in both conventional and asymmetric warfare settings. As conflicts become more complex and dispersed, the demand for persistent, wide-area monitoring solutions is rising, and UAVs equipped with advanced sensors provide an efficient and scalable response. Defense modernization programs across major economies are accelerating the procurement of sensor-equipped UAVs as part of broader efforts to enhance battlefield awareness and reduce soldier risk. Rising geopolitical tensions and border security challenges are also prompting nations to invest in unmanned systems capable of delivering high-fidelity intelligence without entering hostile airspace. Furthermore, the declining cost of sensor technologies and the availability of modular sensor payloads are making it easier for militaries to upgrade existing UAV fleets or customize platforms for specific missions. Interoperability between UAV sensors and broader defense networks is also becoming a priority, enabling seamless data sharing and coordinated operations across multiple domains. In addition, regulatory support for increased use of unmanned systems in defense, along with dedicated research funding, is encouraging innovation and adoption. These trends are being reinforced by the growing need for faster decision-making, improved threat detection, and automated response capabilities in high-risk environments. Altogether, these drivers are positioning military UAV sensors as a cornerstone of modern military operations, with strong demand expected to persist well into the next decade.Report Scope

The report analyzes the Military UAV Sensors market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (CMOS Technology, MEMS Technology, NEMS Technology, Other Technologies); Application (Collision Avoidance Application, Navigation Application, 3D Scanner Application, Data Acquisition Application, LIDAR Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the CMOS Technology segment, which is expected to reach US$10.6 Billion by 2030 with a CAGR of a 3.3%. The MEMS Technology segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $4.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Military UAV Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Military UAV Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Military UAV Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company (Ceradyne), ABB Ltd. (military protection division), ArmorSource LLC, Avon Protection plc (Team Wendy), BAE Systems plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Military UAV Sensors market report include:

- AeroVironment, Inc.

- ASELSAN A.S.

- BAE Systems plc

- Bharat Electronics Limited (BEL)

- Collins Aerospace (RTX)

- Elbit Systems Ltd.

- FLIR Systems (Teledyne FLIR)

- General Atomics Aeronautical Systems, Inc.

- Hensoldt AG

- IAI - Israel Aerospace Industries

- L3Harris Technologies Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems

- Raytheon Technologies Corporation

- Saab AB

- Safran Electronics & Defense

- Sierra Nevada Corporation

- Thales Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AeroVironment, Inc.

- ASELSAN A.S.

- BAE Systems plc

- Bharat Electronics Limited (BEL)

- Collins Aerospace (RTX)

- Elbit Systems Ltd.

- FLIR Systems (Teledyne FLIR)

- General Atomics Aeronautical Systems, Inc.

- Hensoldt AG

- IAI – Israel Aerospace Industries

- L3Harris Technologies Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems

- Raytheon Technologies Corporation

- Saab AB

- Safran Electronics & Defense

- Sierra Nevada Corporation

- Thales Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2026 |

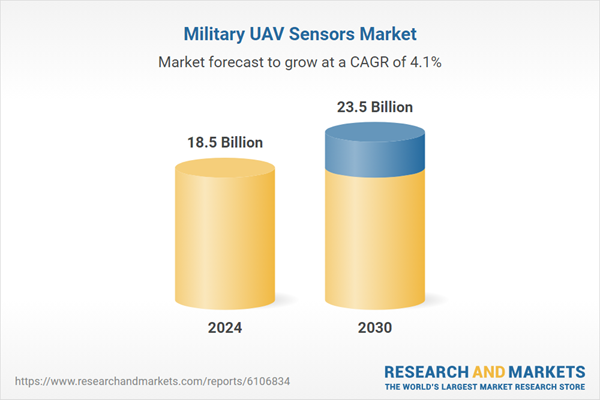

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.5 Billion |

| Forecasted Market Value ( USD | $ 23.5 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |