Global Well Stimulation Materials Market - Key Trends & Drivers Summarized

Why Is the Demand for Well Stimulation Materials Increasing Across Oil and Gas Operations?

As global energy demand continues to rise and easily accessible hydrocarbon reserves decline, the oil and gas industry is placing growing emphasis on advanced recovery techniques, among which well stimulation plays a pivotal role. Well stimulation involves enhancing the productivity of existing oil and gas wells by improving the flow of hydrocarbons from the reservoir to the wellbore. This process relies heavily on the use of specialized materials such as proppants, acids, gelling agents, friction reducers, crosslinkers, and surfactants. These materials help in fracturing reservoir rocks, cleaning wellbores, reducing formation damage, and maintaining fracture openings. The demand for such materials is increasing not only in unconventional plays like shale formations but also in mature fields that require revitalization. Operators in regions such as North America, the Middle East, and parts of Asia-Pacific are investing in stimulation activities to maximize recovery and improve economic viability. In the United States, particularly in the Permian Basin, horizontal drilling combined with hydraulic fracturing has driven exponential growth in the use of well stimulation materials. Meanwhile, countries with aging oil infrastructure are adopting acidizing and matrix stimulation techniques to extend the productive life of existing assets. The growing focus on operational efficiency, well longevity, and cost optimization has turned stimulation materials into critical inputs in upstream planning and execution. As exploration shifts from high-cost frontier regions to enhancement of existing reserves, the use of stimulation materials will only become more central to achieving production targets and maximizing return on investment.How Are Technological Innovations Enhancing the Effectiveness of Stimulation Materials?

Rapid innovation in chemistry, materials science, and process engineering is significantly improving the performance, safety, and environmental compatibility of well stimulation materials. One of the major developments is the advancement of engineered proppants that provide superior conductivity, crush resistance, and uniformity compared to traditional sand-based materials. These engineered alternatives are tailored to perform under high-pressure, high-temperature conditions and offer enhanced hydrocarbon flow from tight formations. In acidizing operations, novel acid blends with retarded reaction rates are being deployed to provide better control during injection and reduce the risk of formation damage. Smart fluids with tunable rheological properties allow for more precise placement and better fracture propagation. Polymer-free or low-residue fracturing fluids are being developed to minimize cleanup issues and reduce environmental concerns related to chemical carryover. Additionally, nanotechnology is being integrated into stimulation materials, enabling the use of nanoparticles for improved transport, enhanced permeability, and real-time monitoring of fluid behavior. Environmentally friendly additives and biodegradable surfactants are being introduced to meet increasingly stringent environmental regulations and public scrutiny over chemical usage. Digital simulation tools are also helping operators model reservoir conditions and optimize material selection and dosage before deployment. These advancements are not only increasing the effectiveness of stimulation operations but also lowering operational risks, minimizing environmental impact, and enabling more tailored treatment designs. As the industry continues to evolve toward smarter and more sustainable practices, innovation in stimulation materials is playing a critical role in enhancing recovery rates while maintaining operational integrity.Regulatory, Environmental, and Market Forces Are Shaping Material Selection in Well Stimulation?

The selection and use of well stimulation materials are being increasingly influenced by a combination of regulatory mandates, environmental considerations, and market-driven performance expectations. Regulatory agencies across the globe are imposing tighter controls on the types of chemicals that can be used in oil and gas operations, particularly in regions where hydraulic fracturing has become politically and socially contentious. This is pushing operators to seek out materials that meet environmental safety standards, exhibit lower toxicity, and are compatible with groundwater protection requirements. In jurisdictions with carbon reduction goals and water conservation policies, there is a strong push for stimulation materials that require less freshwater, generate minimal waste, and can be recovered or recycled. Public scrutiny and pressure from environmental groups have also led to the adoption of green chemistry principles in material formulation. Market forces are simultaneously driving demand for materials that can deliver higher productivity at lower cost. This includes proppants that enable longer fracture propagation, friction reducers that work effectively at lower concentrations, and acid systems that minimize downtime and damage to well infrastructure. Supply chain factors such as availability of raw materials, logistics costs, and geopolitical trade restrictions also play a role in determining material usage. Oilfield service providers are responding to these forces by expanding their portfolios to include environmentally certified and performance-optimized products. Clients are now evaluating stimulation solutions not just on technical merit but on environmental footprint, cost-efficiency, and regulatory compliance. These shifting dynamics are redefining the competitive landscape of well stimulation materials and pushing the market toward more sustainable and high-performance solutions.What Is Fueling the Global Expansion of the Well Stimulation Materials Market?

The growth in the well stimulation materials market is being driven by a range of factors tied to resource recovery needs, technological advancement, regional energy strategies, and investment in unconventional oil and gas development. One of the most prominent growth drivers is the continued expansion of shale oil and gas extraction, particularly in North America, where hydraulic fracturing remains the primary method for accessing tight reservoirs. The widespread application of multi-stage fracturing in horizontal wells has significantly increased the volume and complexity of stimulation materials required per well. Emerging oil and gas markets in South America, Africa, and Asia are also investing in stimulation technologies to enhance production from both conventional and unconventional reserves. National energy security initiatives are prompting governments to incentivize domestic oil production, creating demand for advanced stimulation services and materials. Furthermore, the trend toward revitalizing mature fields through enhanced oil recovery (EOR) techniques is boosting the adoption of acidizing and other stimulation methods that require specialized chemicals and formulations. Oilfield service companies are forming strategic partnerships with chemical manufacturers to develop integrated stimulation packages that improve operational efficiency and reduce overall well servicing costs. The shift toward digital oilfield technologies is also enabling more precise application of materials, improving recovery rates and optimizing consumption. Supply chain improvements, coupled with increased investment in R&D, are helping manufacturers scale production and introduce new formulations that meet diverse geological and regulatory requirements. Collectively, these drivers are contributing to robust and sustained growth in the well stimulation materials market, positioning it as a key enabler of upstream productivity in an evolving global energy landscape.Scope Of Study:

The report analyzes the Well Stimulation Materials market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Technology (Hydraulic Fracturing Technology, Acidization Technology); Material (Proppants Material, Base Fluid Materials Material, Acid Material, Fracturing Fluid Additives Material)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hydraulic Fracturing Technology segment, which is expected to reach US$22.2 Billion by 2030 with a CAGR of a 4.4%. The Acidization Technology segment is also set to grow at 7.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $7.5 Billion in 2024, and China, forecasted to grow at an impressive 8.7% CAGR to reach $7.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Well Stimulation Materials Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Well Stimulation Materials Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Well Stimulation Materials Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aalbäck Proppants, AkzoNobel NV, Albemarle Corporation, Ashland Inc., Badger Mining Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Well Stimulation Materials market report include:

- Aalbäck Proppants

- AkzoNobel NV

- Albemarle Corporation

- Ashland Inc.

- Badger Mining Corporation

- Baker Hughes

- BASF SE

- Chevron Phillips Chemical Company LLC

- Clariant AG

- Dow Chemical Company

- E.I. du Pont de Nemours & Co.

- Elkem

- Flotek Industries Inc.

- FMC Corporation

- Linde Group

- NexTier Oilfield Solutions

- Proppants suppliers (U.S. Silica)

- Solvay S.A.

- U.S. Silica / Emerge Energy Services

- US Silica Holdings Inc.

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aalbäck Proppants

- AkzoNobel NV

- Albemarle Corporation

- Ashland Inc.

- Badger Mining Corporation

- Baker Hughes

- BASF SE

- Chevron Phillips Chemical Company LLC

- Clariant AG

- Dow Chemical Company

- E.I. du Pont de Nemours & Co.

- Elkem

- Flotek Industries Inc.

- FMC Corporation

- Linde Group

- NexTier Oilfield Solutions

- Proppants suppliers (U.S. Silica)

- Solvay S.A.

- U.S. Silica / Emerge Energy Services

- US Silica Holdings Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

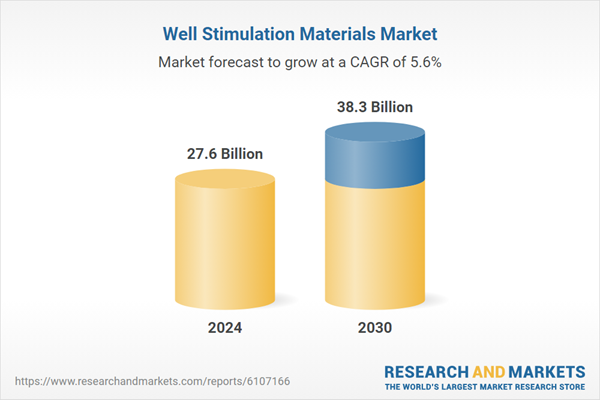

| Estimated Market Value in 2024 | 27.6 Billion |

| Forecasted Market Value by 2030 | 38.3 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |