Global Wheat Gluten Market - Key Trends & Drivers Summarized

Why Is Wheat Gluten Increasingly Vital in Food and Industrial Applications Worldwide?

Wheat gluten, a natural protein derived from wheat, is becoming increasingly important in both the food industry and various industrial applications due to its unique viscoelastic properties and high protein content. In the food sector, wheat gluten plays a critical role in baked goods, plant-based meat products, noodles, and pasta, where it provides structure, chewiness, and moisture retention. Its ability to form a strong, elastic network makes it indispensable for breadmaking, where it traps gas during fermentation and helps dough rise properly. Beyond its functional benefits, wheat gluten is also valued for its nutritional profile, offering a high concentration of plant-based protein with minimal fat and carbohydrates. This has made it a favored ingredient among manufacturers looking to create high-protein and meat alternative products in response to growing consumer interest in vegetarian and vegan diets. Additionally, in regions where protein fortification is a priority due to dietary gaps, wheat gluten is used to enrich staple foods and processed items. Outside of the food industry, wheat gluten finds applications in pet foods, aquafeeds, biodegradable plastics, adhesives, and even paper processing, where its binding and film-forming properties are utilized. Its natural origin and biodegradability further support its use in environmentally conscious formulations. As industries and consumers increasingly seek sustainable and functional ingredients, wheat gluten's broad versatility, cost-effectiveness, and performance make it an essential input across multiple production ecosystems.How Are Innovations in Processing and Extraction Enhancing Wheat Gluten Quality and Efficiency?

Advancements in wheat processing technology are significantly improving the quality, consistency, and extraction efficiency of wheat gluten, enabling its wider adoption in both traditional and emerging applications. The production of wheat gluten typically involves separating the gluten protein from wheat starch through wet milling, followed by washing, drying, and purification steps. Recent improvements in enzymatic treatment and filtration technologies are enhancing protein yield while minimizing waste and energy consumption. These innovations not only improve the functional properties of the final product but also reduce production costs and environmental impact. Sophisticated drying techniques are helping maintain the solubility and elasticity of the gluten, which is particularly important in high-performance applications such as plant-based meat analogues and bakery mixes. Furthermore, advanced quality control systems and real-time monitoring tools ensure better standardization of protein content and microbiological safety, which are crucial for compliance in global food markets. In addition, customized gluten variants are now being developed to meet specific application needs, such as high-tensile strength for industrial uses or improved emulsification for specialty foods. The integration of automation and data analytics into wheat gluten processing plants is also enabling producers to optimize throughput, minimize variability, and respond quickly to shifting market demands. As food manufacturers and industrial users continue to require high-performance, consistent ingredients, these technological advancements in wheat gluten processing are enhancing its competitiveness, sustainability, and versatility in the global marketplace.What Consumer and Market Trends Are Shaping the Demand for Wheat Gluten-Based Products?

Evolving consumer preferences, dietary trends, and global supply chain strategies are significantly shaping the growing demand for wheat gluten-based products. One of the key trends driving demand is the global rise in flexitarian, vegetarian, and vegan lifestyles, which emphasize reducing animal protein consumption without sacrificing nutrition or texture. Wheat gluten, particularly in the form of seitan, has become a staple in the plant-based meat category because it mimics the fibrous texture of animal protein while offering a high protein-to-calorie ratio. Food brands are leveraging wheat gluten's versatility to develop meat substitutes, high-protein snacks, and fortified bakery goods that appeal to health-conscious consumers. At the same time, global concerns about food security and protein availability are encouraging food producers and governments to invest in scalable plant-based protein sources like wheat gluten. In markets such as Asia and Europe, where wheat-based diets are common, gluten-enhanced products are becoming more prevalent in both traditional foods and modern health products. There is also growing demand for clean-label ingredients, and wheat gluten, being a single-ingredient product with minimal processing, aligns well with this trend. While gluten-free diets remain relevant for individuals with celiac disease or gluten sensitivity, the majority of consumers are looking for balanced protein sources, and wheat gluten is finding strong support in these segments. Industrial buyers are also aligning with these consumer preferences, leading to increased investment in gluten-enhanced product lines. These shifting market dynamics are reinforcing the role of wheat gluten as a versatile, high-value protein ingredient for modern food and health systems.What Is Fueling the Global Growth of the Wheat Gluten Market Across Industries?

The growth in the wheat gluten market is being fueled by a confluence of factors spanning consumer health trends, food innovation, agricultural advancements, and global trade expansion. One of the most prominent growth drivers is the rising global demand for high-protein, plant-based ingredients that support both human health and environmental sustainability. Wheat gluten's relatively low cost, combined with its high protein concentration and functional properties, make it an attractive option for food manufacturers looking to diversify their protein portfolios. The surge in alternative protein markets, particularly for plant-based meats and dairy substitutes, is significantly boosting demand. Agricultural innovations, such as the development of high-gluten wheat varieties and improvements in cultivation practices, are ensuring a more consistent supply of raw material for gluten extraction. Meanwhile, global trade liberalization and the expansion of food processing infrastructure in emerging economies are improving the accessibility and affordability of wheat gluten across new markets. Regulatory support for plant-based nutrition and sustainable agriculture is also playing a role, especially in Europe and North America, where policymakers are promoting protein diversification to reduce reliance on animal agriculture. In addition to food uses, the growth of bio-based materials and green chemistry sectors is driving interest in wheat gluten as a biodegradable, functional material in non-food applications. The alignment of health, environmental, and economic incentives is creating a strong and diverse demand base, positioning wheat gluten as a strategic ingredient in both food and industrial product development. These multidimensional growth drivers ensure that the wheat gluten market will continue to expand in scope, scale, and relevance across the global economy.Scope Of Study:

The report analyzes the Wheat Gluten market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: End-Use (Bakery & Confectionery End-Use, Dietary Supplements End-Use, Animal Feed End-Use, Other End-Uses)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Bakery & Confectionery End-Use segment, which is expected to reach US$6.8 Billion by 2030 with a CAGR of a 13.2%. The Dietary Supplements End-Use segment is also set to grow at 8.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $2.0 Billion in 2024, and China, forecasted to grow at an impressive 15.8% CAGR to reach $3.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Wheat Gluten Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Wheat Gluten Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Wheat Gluten Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADM (Archer Daniels Midland), AgriChem, Inc., Amber Wave (Vital Wheat Protein), Anhui Ante Food Co., Ltd., Ardent Mills LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Wheat Gluten market report include:

- ADM (Archer Daniels Midland)

- AgriChem, Inc.

- Amber Wave (Vital Wheat Protein)

- Anhui Ante Food Co., Ltd.

- Ardent Mills LLC

- Bryan W. Nash & Sons Limited

- Cargill Inc.

- Crespel & Deiters GmbH

- CropEnergies AG

- Glico Nutrition Co., Ltd.

- Henan Tianguan Group Co. Ltd

- Kröner-Stärke GmbH

- Manildra Group

- Meelunie B.V.

- MGP Ingredients, Inc.

- Mühlenchemie GmbH & Co. KG

- Permolex Ltd

- Pioneer Industries Limited

- Sungold Corporation

- z&f Sungold Corporation

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADM (Archer Daniels Midland)

- AgriChem, Inc.

- Amber Wave (Vital Wheat Protein)

- Anhui Ante Food Co., Ltd.

- Ardent Mills LLC

- Bryan W. Nash & Sons Limited

- Cargill Inc.

- Crespel & Deiters GmbH

- CropEnergies AG

- Glico Nutrition Co., Ltd.

- Henan Tianguan Group Co. Ltd

- Kröner-Stärke GmbH

- Manildra Group

- Meelunie B.V.

- MGP Ingredients, Inc.

- Mühlenchemie GmbH & Co. KG

- Permolex Ltd

- Pioneer Industries Limited

- Sungold Corporation

- z&f Sungold Corporation

Table Information

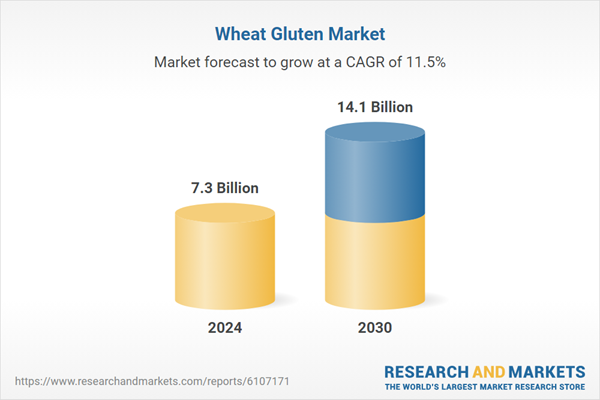

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 7.3 Billion |

| Forecasted Market Value by 2030 | 14.1 Billion |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Global |