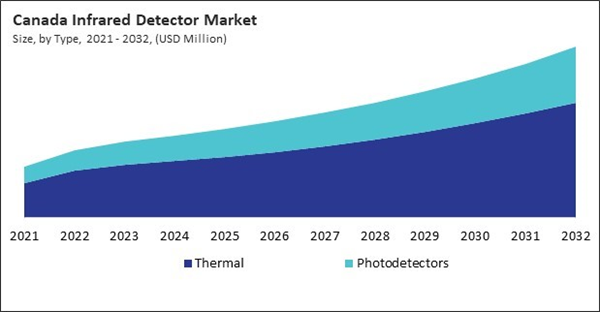

The US market dominated the North America Infrared Detector Market by country in 2024, and is expected to continue to be a dominant market till 2032; thereby, achieving a market value of $256.3 million by 2032. The Canada market is experiencing a CAGR of 9.8% during 2025-2032. Additionally, the Mexico market is expected to exhibit a CAGR of 9.4% during 2025-2032.

Firstly, the automotive industry is increasingly adopting infrared detectors to enhance vehicle safety and driver assistance systems. These detectors are integral to advanced driver-assistance systems (ADAS), providing capabilities such as night vision, pedestrian detection, and collision avoidance. By detecting heat signatures, infrared detectors enable vehicles to identify obstacles and living beings in low-visibility conditions, thereby reducing the risk of accidents. As the automotive sector moves towards higher levels of automation, the demand for reliable and efficient sensing technologies like infrared detectors is expected to rise, further propelling market growth.

Secondly, the role of infrared detectors in industrial automation and environmental monitoring is expanding. In manufacturing processes, these detectors are used for non-contact temperature measurements, ensuring equipment operates within safe parameters and improving energy efficiency. They are also employed in predictive maintenance, identifying potential equipment failures before they occur. In environmental monitoring, infrared detectors assist in detecting gas leaks and monitoring air quality, contributing to workplace safety and compliance with environmental regulations. The integration of infrared detectors into industrial Internet of Things (IoT) systems allows for real-time data collection and analysis, enhancing operational efficiency and decision-making.

Canada’s infrared detectors market is steadily expanding as the nation embraces technological innovation in sectors such as environmental monitoring, healthcare, defense, infrastructure, and industrial automation. Although not as large in scale as the United States market, Canada’s strength lies in its focused application of infrared (IR) technologies tailored to national priorities - particularly public safety, sustainability, and healthcare modernization. The country’s approach is driven by federal research agencies, partnerships with global OEMs, and regional innovation clusters that encourage the adoption and development of sensor technologies, including infrared detectors. In summary, Canada’s infrared detectors market is shaped by national priorities in environmental protection, healthcare innovation, and industrial modernization. With a strong foundation in research, a growing number of strategic applications, and supportive policy frameworks, Canada is positioning itself as a key regional player in the adoption and advancement of infrared detection technologies.

The manufacturing sector in Mexico, particularly automotive, aerospace, and electronics, is one of the primary consumers of infrared technology. Automotive production hubs in states like Nuevo León, Puebla, and Guanajuato utilize IR detectors in assembly lines for non-contact temperature measurement, component testing, and process monitoring. Major automotive manufacturers such as General Motors, Ford, and Volkswagen operate facilities in Mexico and are increasingly incorporating thermal imaging technologies to ensure product quality and operational safety. In parallel, electronics manufacturers use IR sensors in PCB testing, soldering quality inspection, and heat signature verification during production. In conclusion, Mexico’s infrared detectors market is fueled by its diverse industrial base, security challenges, and adoption of smart technologies. With growing investments in infrastructure, healthcare modernization, and industrial automation, IR detectors are becoming a critical component of Mexico’s technological advancement.

In summary, while the Rest of North America faces infrastructure and funding constraints, its demand for infrared detectors is driven by urgent needs in disaster preparedness, public safety, and environmental monitoring. With increasing international collaboration and support, the adoption of infrared technologies is expected to grow gradually and become more integrated into regional development agendas.

List of Key Companies Profiled

- Teledyne FLIR LLC (Teledyne Technologies Incorporated)

- Hamamatsu Photonics K.K.

- RTX Corporation

- TE Connectivity Ltd.

- Texas Instruments, Inc.

- Murata Manufacturing Co., Ltd.

- Honeywell International, Inc.

- BAE Systems PLC

- L3Harris Technologies, Inc.

- Leonardo SpA (Leonardo DRS, Inc.)

Market Report Segmentation

By Type

- Thermal

- Photodetectors

By Application

- Motion Sensing

- Security & Surveillance

- Temperature Measurement

- Fire Detection

- Medical

- Other Application

By Country

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

- Teledyne FLIR LLC (Teledyne Technologies Incorporated)

- Hamamatsu Photonics K.K.

- RTX Corporation

- TE Connectivity Ltd.

- Texas Instruments, Inc.

- Murata Manufacturing Co., Ltd.

- Honeywell International, Inc.

- BAE Systems PLC

- L3Harris Technologies, Inc.

- Leonardo SpA (Leonardo DRS, Inc.)