Increasing Preference for Plant-Based Diets Fuels North America Frozen Vegetables Market

In developed regions such as Europe and North America, the increasing preference for plant-based diets is influenced by cultural and religious factors and rising awareness about the health benefits of vegetable consumption. Frozen vegetables are considered versatile ingredients in plant-based meals and snacks. Frozen vegetables, such as okra, peas, green beans, etc., are commonly used in pie, lasagna, soup, stews, and side dishes, providing households with convenient options to prepare nutritious meals at home. Frozen spinach, broccoli, and kale are convenient additions to stir-fries, soups, and pasta dishes. Frozen vegetables can be added to meals anytime, regardless of seasonal availability. These vegetables are convenient and nutritious options for consumers seeking to adopt healthier and more sustainable dietary habits, thereby catering to flexitarian, vegetarian, and vegan consumers' preferences. Thus, the increasing preference for plant-based diets drives the frozen vegetables market.North America Frozen Vegetables Market Overview

In North America, the latest consumer preference trends exhibit a shift toward healthy and nutritious food options, which has surged the demand for vegan, gluten-free, high-fiber, high-protein, or low-calorie food, as well as frozen vegetables. According to the "2023 Power of Frozen in Retail" by The Food Industry Association and the American Frozen Food Institute, frozen food sales in the US increased by 7.9%, reaching US$ 74.2 billion between July 2022 and July 2023. The report also reveals that the number of online grocery shoppers' share who purchase frozen food through e-commerce channels is rising significantly. The research also revealed that 86% of shoppers who bought groceries online purchased frozen products in 2023, indicating a rise of 82% in 2020 in the US. According to the National Restaurant Association (US), the food and beverage sales from the full-service segment (including family-dining, casual-dining, and fine-dining full-service restaurants) grew from US$ 199 billion in 2020 to US$ 289 billion in 2022, while the sales from the limited-service segment (including quick-service restaurants, fast-casual restaurants, and cafeteria) in the US increased from US$ 297 billion in 2020 to US$ 355 billion in 2022. Frozen vegetables are widely purchased by foodservice operators, as these vegetables keep the menu options consistent throughout the year, aids in meeting the demand of the foodservice industry, and minimizes overall food losses. Thus, the growth in the foodservice industry and rising demand for frozen food are a few factors that drive the frozen vegetables market in the region.North America Frozen Vegetables Market Segmentation

The North America frozen vegetables market is categorized into type, category, end user, and country.By type, the North America frozen vegetables market is segmented into corn cob, corn kernels/sweet corn, green peas, baby corn, carrot, cauliflower, green beans, spinach, broccoli, onions, brussel sprouts, mixed vegetables, and others. The others segment held the largest share of the North America frozen vegetables market share in 2023.

In terms of category, the North America frozen vegetables market is bifurcated into organic and conventional. The conventional segment held a larger share of the North America frozen vegetables market share in 2023.

Based on end user, the North America frozen vegetables market is segmented into food processing, food retail, and foodservice. The food retail segment held the largest share of the North America frozen vegetables market share in 2023.

Based on country, the North America frozen vegetables market is segmented into the US, Canada, and Mexico. The US segment held the largest share of North America frozen vegetables market in 2023.

Alasko Food Inc.; Ardo Foods NV; B&G Foods; Bonduelle SA; Dawtona Frozen; General Mills Inc; Goya Foods Inc; Grupo Virto; Hanover Foods; La Fe Foods; McCain Foods Ltd; Mondial Foods BV; Mother Dairy Fruit & Vegetable Pvt. Ltd; Seneca Foods Corp; and Simplot Global Food are some of the leading companies operating in the North America frozen vegetables market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America frozen vegetables market.

- Highlights key business priorities to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America frozen vegetables market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America frozen vegetables market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the North America Frozen Vegetables Market include:- Alasko Food Inc.

- Ardo Foods NV

- B&G Foods

- Bonduelle SA

- Dawtona Frozen

- General Mills Inc

- Goya Foods Inc

- Grupo Virto

- Hanover Foods

- La Fe Foods

- McCain Foods Ltd

- Mondial Foods BV

- Mother Dairy Fruit & Vegetable Pvt. Ltd

- Seneca Foods Corp

- Simplot Global Food

Table Information

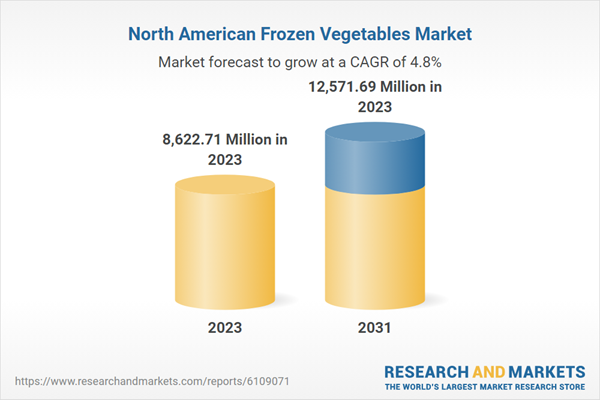

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | April 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value in 2023 | 8622.71 Million in 2023 |

| Forecasted Market Value by 2031 | 12571.69 Million by 2031 |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | North America |

| No. of Companies Mentioned | 16 |