Manufacturers are prioritizing non-toxic, safe formulations that meet global safety standards and offering easy-open packaging with precision dispensing to enhance user convenience. With urban infrastructure expanding and hygiene regulations tightening, demand is expected to accelerate. Additionally, eco-conscious practices are gaining traction-green-certified and biodegradable products that minimize water and energy use are increasingly sought by businesses aiming to reduce environmental impact.

This combination of regulatory pressures and consumer demand is reshaping the market landscape by accelerating innovation, driving manufacturers to prioritize sustainable materials, and pushing legacy systems toward greener alternatives. As environmental standards tighten and climate-conscious buyers become more influential, companies are compelled to rethink sourcing, production, and product design.

Businesses are shifting from short-term compliance to long-term sustainability goals, integrating eco-friendly technologies into their supply chains and expanding portfolios to include low-emission, biodegradable, and circular-economy-aligned offerings. At the same time, heightened transparency expectations are prompting firms to invest in third-party certifications, traceability, and cleaner manufacturing processes.

The surface cleansers and disinfectants segment held a 29% share in 2024 and is expected to grow at a CAGR of 5.6% during 2025-2034. Their prevalence is rooted in stringent hygiene protocols across commercial and industrial settings, which require fast, effective, and versatile cleaning solutions. Available in convenient spray, wipe, or bottle formats, these products enable efficient routine maintenance across large surface areas. Their multi-surface utility reduces inventory needs and boosts convenience, making them the go-to option for both institutional and domestic applications.

In 2024, the healthcare and medical facilities segment held a 32.8% share and is anticipated to grow at a CAGR of 5.4% through 2034. Stringent sanitation standards in medical settings demand constant and intensive cleaning. Hospitals, clinics, labs, and diagnostic centers require 24/7 disinfection to maintain sterile conditions. These environments drive high-volume usage of hospital-grade floor disinfectants and specialized surface cleaners, which are strictly regulated for safety and efficacy. As patient care relies heavily on rigorous cleanliness, this demand remains relentless.

North America Professional Cleaning Products Market generated USD 14.8 billion in 2024. The region’s advanced infrastructure, high hygiene awareness, and strict regulatory frameworks support the pervasive adoption of quality cleaning products across healthcare, hospitality, and food service industries. Brand loyalty, established distribution networks, and ongoing product innovation by major manufacturers further reinforce market leadership.

Major players in the Global Professional Cleaning Products Market include Azelis, Blue Wonder, Bona, Nouryon, Pollet, Proctor & Gamble, Reckitt Benckiser, Solenis, Nerta, Hygeniq, Henkel, Unilever, Borer Chemie, and Ecolab. Companies in the professional cleaning products sector are employing key strategies to bolster their market positions. They are investing in research and development to launch eco-certified, biodegradable formulas that meet evolving environmental regulations. Expanding distribution networks-especially in institutional and industrial verticals-enhances market penetration. Strategic partnerships and acquisitions help increase product portfolios and geographic reach. Additionally, innovation in packaging-such as easy-dispense systems and concentrated refills-improves consumer convenience and cost-efficiency. Together, these efforts drive brand loyalty and support long-term business growth.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Azelis

- Blue Wonder

- Bona

- Borer Chemie

- Ecolab

- Henkel

- Hygeniq

- NCH

- Nerta

- Nouryon

- Pollet

- Proctor & Gamble

- Reckitt Benckiser

- Solenis

- Unilever

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | June 2025 |

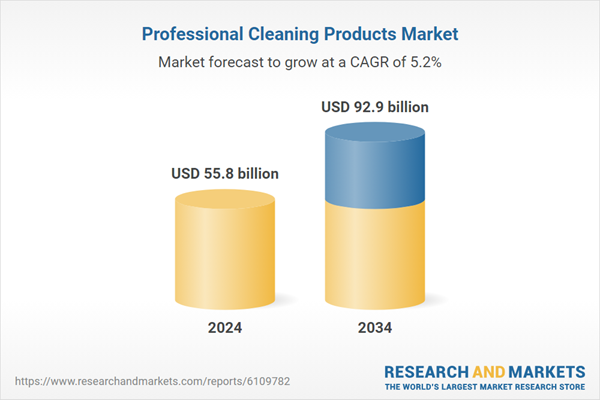

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 55.8 billion |

| Forecasted Market Value ( USD | $ 92.9 billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |