Flexible air cushions meet this demand by offering a versatile solution that can protect a wide range of product shapes and sizes while minimizing shipping weight. This efficiency contributes to cost reductions and aligns with evolving environmental regulations that target excessive packaging waste and carbon emissions. As brands across the globe adapt to new logistical and regulatory demands, the importance of flexible, scalable, and recyclable packaging formats continues to grow, making air cushion packaging increasingly indispensable.

Tariff-driven supply chain disruptions sparked by prior trade policies have pushed manufacturers in the U.S. air cushion packaging industry to rethink sourcing strategies. With a reliance on imported raw materials, production costs are now under pressure, as higher tariffs raise input prices. Domestic sourcing alternatives are becoming more attractive, although they must remain cost competitive.

Despite these challenges, demand for flexible protective packaging is rising thanks to its adaptability and ability to reduce volumetric shipping costs. Unlike rigid formats, air cushions accommodate various product shapes and sizes while maintaining product integrity in transit. To cater to SME and direct-to-consumer brands, suppliers are now providing low-volume custom packaging with shorter lead times, supported by automation, digital printing, and modular machinery. These innovations are reshaping packaging lines to prioritize speed-to-market and consumer personalization.

The bubble wrap segment accounted for USD 1.7 billion in 2024. Known for its cushioning properties and ability to shield fragile items from impact, bubble wrap is widely used in e-commerce, electronics, and glass-related industries. Its flexibility and ease of use make it ideal for wrapping products of varying shapes, ensuring safety during transport and storage. Recent advancements in biodegradable and recyclable bubble wrap are helping brands meet sustainability benchmarks without sacrificing performance. This shift is enhancing the relevance of bubble wrap in the market, particularly as environmental considerations become a key purchasing factor.

By 2034, the LDPE segment is expected to reach USD 3.9 billion. Low-density polyethylene is widely chosen for air cushion packaging due to its strength, flexibility, and low weight. LDPE’s ability to absorb shocks and maintain protective performance across a wide temperature range makes it suitable for air pillows and bubble wrap production. Its compatibility with automated packing lines and sealing equipment adds efficiency to fulfillment centers, while its recyclability supports sustainability goals. Though it lacks the higher durability of HDPE, LDPE remains the preferred option for applications prioritizing lightweight protection and cost-efficiency. Foam wraps made from LDPE also excel in protecting irregularly shaped items, further enhancing their utility across logistics networks.

U.S. Air Cushion Packaging Market is expected to reach USD 2.3 billion by 2034. The segment is mature yet evolving rapidly, with new demand drivers emerging from e-commerce, electronics, food, and pharmaceutical distribution. Innovation in lightweight, sustainable packaging has become critical as consumer expectations shift and regulatory scrutiny increases. Many companies are now transitioning to recyclable and compostable packaging, including paper cushions and plant-based air pillows. In response, major industry players like PAC Worldwide, Pregis, and Sealed Air are introducing eco-conscious solutions that align with omnichannel logistics models. These developments reflect a broader industry pivot toward operational agility, sustainability, and tailored solutions for dynamic retail ecosystems.

Prominent companies contributing to the competitive strength of the Global Air Cushion Packaging Market include FROMM Packaging Systems Inc., Advanced Protective Packaging Ltd., Sealed Air Corporation, Smurfit Kappa Group, and Pregis LLC. These players continue to shape the market landscape through innovation, strategic alliances, and sustainable design leadership. Companies operating in the air cushion packaging space are leveraging several strategies to cement their market presence.

A major focus lies on R&D efforts to develop recyclable, bio-based, and lightweight alternatives that align with sustainability goals and reduce shipping costs. Leading firms are adopting automation and digital customization technologies to meet demand for short-run, high-mix packaging formats favored by SME and D2C brands. In addition, global players are expanding their manufacturing footprints and localizing supply chains to avoid tariff-related cost fluctuations.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Advanced Protective Packaging Ltd.

- Amcor plc

- AptarGroup, Inc.

- DS Smith Plc

- FROMM Packaging Systems Inc.

- Huhtamaki Oyj

- Mondi Flexible Packaging

- Mondi Group

- Pregis LLC

- ProAmpac LLC

- Rengo Co., Ltd.

- Schur Flexibles Group

- Sealed Air Corporation

- Smurfit Kappa Group

- Sonoco Products Company

- Storopack Hans Reichenecker GmbH

- Toray Plastics (America), Inc.

- Winpak Ltd.

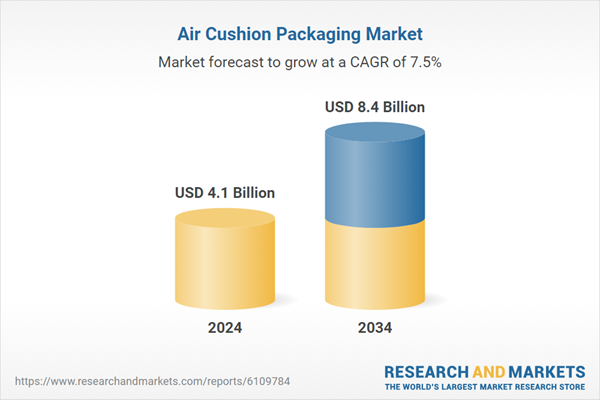

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 4.1 Billion |

| Forecasted Market Value ( USD | $ 8.4 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |