Apart from the workplace, consumers are becoming more mindful of maintaining their eye health during daily activities. People involved in outdoor recreation are seeking eyewear that provides both visual correction and defense from natural elements like dust, water, and UV radiation. Prescription goggles meet this demand by combining functionality with comfort, especially as lens technology continues to evolve. Innovations in coatings that improve clarity, scratch resistance, and lens longevity are making protective eyewear more versatile than ever. There is also a rising preference for lightweight lenses made from polycarbonate, especially those with anti-reflective properties, which enhance visual performance and reduce eye strain. As digital exposure increases, vision issues such as nearsightedness, farsightedness, and presbyopia have become more common, and the need for corrective protective goggles is steadily increasing.

Changing lifestyles, combined with longer hours in front of digital screens, are contributing to a noticeable uptick in vision-related problems across various age groups. This has spurred a rise in demand for protective eyewear with corrective capabilities. The market is further supported by the growing inclination toward physical fitness and recreational activities, where users require goggles that offer vision correction without compromising on safety. Whether used during sports, professional work, or everyday activities, prescription goggles are now considered an essential part of personal protective equipment.

By lens type, the market is segmented into single vision and bifocal progressive lenses. The single vision category accounted for the largest share, bringing in USD 5 billion in revenue in 2024. This dominance can be attributed to the effectiveness of single vision goggles in correcting widely prevalent conditions like nearsightedness and farsightedness. These goggles are often preferred due to their affordability, ease of customization, and wide applicability. They can be equipped with various coatings and materials to meet diverse user requirements, making them suitable for individuals across different age groups and occupations. Their relatively lower cost compared to bifocal or progressive lenses also contributes to their popularity.

In terms of frame materials, the prescription goggles market is categorized into plastic, silicone/rubber, and others. Plastic frames held a significant 40.8% of the global market share in 2024, with a valuation of USD 2.91 billion. The widespread use of plastic in frames is primarily due to its lightweight properties and resistance to breakage. Among plastic materials, polycarbonate remains a leading choice, known for its superior impact resistance and built-in UV protection. These features are especially critical in applications where safety is non-negotiable. Other materials, such as silicone and rubber, are used in non-optical components like seals and straps to enhance fit and comfort, although they are not suitable for lenses due to their inability to support corrective vision properties.

North America continues to be a leading region for the prescription goggles industry, with the United States playing a central role. In 2024, the U.S. held 79% of the regional market, underscoring the country's strong focus on eye health and corrective vision products. A high rate of vision correction usage and heightened safety awareness are pushing the adoption of prescription goggles across consumer and occupational segments. The popularity of eyewear in the U.S. also reflects widespread access to optical solutions and heightened consumer awareness regarding the benefits of vision protection.

Emerging trends in the industry include the adoption of advanced lens materials with improved coatings, such as those offering blue light filtration and glare reduction. Customizable frame designs and personalized fitting options are becoming more common, aligning with the broader consumer trend toward individualized products. The rise of e-commerce platforms is making it easier for consumers to access a wide range of prescription goggles tailored to specific visual and lifestyle needs.

Key players shaping the global landscape include leading optical manufacturers and niche specialists in prescription safety eyewear. These companies are leveraging technology to integrate features like anti-fogging, photochromic lenses, and polarized coatings into their products. They are also focusing on durable yet lightweight materials such as Trivex and polycarbonate to enhance user comfort and protection. From workplace applications to recreational use, prescription goggles are becoming increasingly indispensable in a visually demanding world.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Arena

- First Lens

- GOGGLEMAN

- SafeVision

- John Jacobs

- Liberty Sport

- MSA Safety

- Oakley

- RxSport

- Safety-RX

- Speedo

- Sutton Swimwear

- TYR

- Uvex

- Wiley X

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 240 |

| Published | June 2025 |

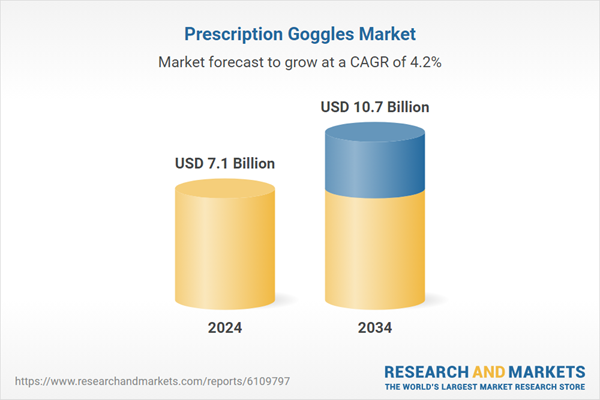

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 7.1 Billion |

| Forecasted Market Value ( USD | $ 10.7 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |