Another factor fueling market expansion is the increasing misuse of non-steroidal anti-inflammatory drugs, which often damage the stomach lining and lead to ulcer formation. Alongside this, advancements in diagnostics and the rising adoption of innovative treatment regimens - including dual and triple combination therapies - are improving patient recovery rates and minimizing ulcer recurrence. These factors, combined with rising awareness and enhanced healthcare accessibility in both developed and emerging countries, are expected to sustain steady demand for peptic ulcer treatment solutions in the coming years.

The proton pump inhibitors (PPIs) segment generated USD 2.3 billion in 2024 and is forecasted to hit USD 3.7 billion by 2034, registering a CAGR of 5.1%. PPIs have become the cornerstone of ulcer therapy due to their effectiveness in reducing gastric acid levels, accelerating healing, and relieving pain. Their dependable efficacy and minimal side effects have made them widely preferred in treatment regimens. Their contribution to multi-drug therapy approaches for H. pylori eradication further cements their dominant market position. High healing success rates have been consistently reported in clinical settings, particularly when PPIs are administered over a treatment window of four to eight weeks.

The duodenal ulcers segment held a 50.8% share in 2024 and is set to experience significant growth throughout the forecast period. These ulcers typically form in the upper part of the small intestine and are primarily triggered by bacterial infection and long-term use of NSAIDs. They are prevalent across a broad population and frequently present with distinct symptoms that allow for quicker diagnosis and more immediate intervention, supporting higher treatment rates.

North America Peptic Ulcers Treatment Market generated USD 2.1 billion in 2024 and is expected to reach USD 3.6 billion by 2034, growing at a CAGR of 5.5%. This regional dominance can be attributed to the high burden of NSAID-related complications and H. pylori cases. A well-established healthcare framework, better access to advanced medications, and increasing awareness regarding gastrointestinal care and preventive health all contribute to the region’s strong market position. Additionally, the active presence of leading pharmaceutical companies continues to support growth in this region.

Major players in the Global Peptic Ulcers Treatment Industry include Takeda, GlaxoSmithKline, Cadila Healthcare, Aurobindo Pharma, Ranbaxy Laboratories, Pfizer, Dr. Reddy’s Laboratories, Strides Pharma, Phathom Pharmaceuticals, Granules India, AstraZeneca, Sun Pharma, Eisai, and Azurity Pharmaceuticals. To solidify their market positions, key players in the peptic ulcer treatment space are focusing on diverse strategic initiatives. Many are investing heavily in R&D to develop new therapies with higher efficacy and lower side effects. Formulation improvements, especially around combination drug regimens, are aimed at increasing treatment adherence and minimizing recurrence.

Companies are also expanding their manufacturing capabilities and strengthening their global supply chains to ensure wider access to treatment. Additionally, firms are entering strategic partnerships and engaging in mergers and acquisitions to broaden their portfolios and geographical presence. Targeted awareness campaigns and physician education programs further enhance product visibility and brand credibility, especially in emerging healthcare markets where diagnostic and treatment rates are steadily climbing.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- AstraZeneca

- Aurobindo Pharma

- Azurity Pharmaceuticals

- Cadila Healthcare

- Dr. Reddy’s Laboratories

- Eisai

- GlaxoSmithKline

- Granules India

- Pfizer

- Phathom Pharmaceuticals

- Ranbaxy Laboratories

- Strides Pharma

- Sun Pharma

- Takeda

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

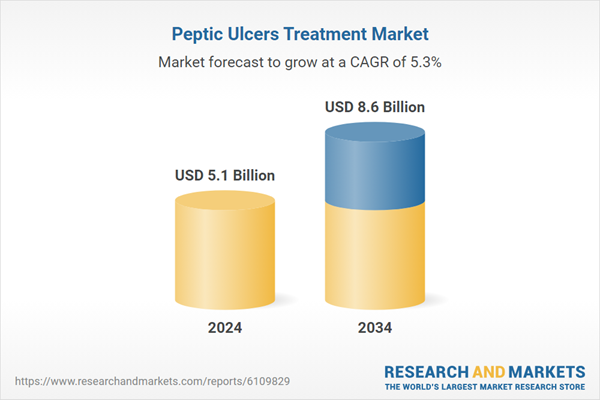

| Estimated Market Value ( USD | $ 5.1 Billion |

| Forecasted Market Value ( USD | $ 8.6 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |