Concerns over processed food and potential long-term health impacts have made organic baby food more desirable. Consumers are actively choosing options that are both safe and environmentally responsible. The increasing number of infants experiencing allergies and sensitivities has also played a role in this market trend, pushing demand for simpler ingredient profiles. Coupled with fast-paced urban living and changing family dynamics, there's a greater need for nutritious yet hassle-free feeding choices that cater to convenience without compromising quality.

Prepared organic baby food is emerging as the fastest-growing category and is forecasted to be valued at USD 4.2 billion by 2034, growing at 6.6% CAGR. This segment resonates well with today’s busy caregivers who prefer ready-to-serve meals in convenient formats like pouches, jars, and purees. These products offer the perfect balance of nutrition and ease, especially for working parents looking to save time. With more mothers rejoining the workforce, demand for this category has climbed. Innovations in packaging, such as resealable containers and eco-conscious materials, have further boosted its appeal by offering portability, preserving freshness, and aligning with sustainability values.

The grains and cereals segment held the dominant share in 2024 at 26.8% and is expected to grow at a CAGR of 6.1% through 2034. This segment continues to lead due to its nutritional profile and versatility in meal formats like porridge, infant cereals, bars, and teething snacks. Foods made with oats, millet, quinoa, and rice are high in energy, easily digestible, and suitable for early development. Their flexibility and foundational role in baby diets make them a consistent favorite for caregivers looking to nourish their children with wholesome, natural ingredients.

Asia Pacific Organic Baby Food Market held a 44.2% share in 2024. Countries such as Indonesia, China, and India are seeing a rise in birth rates alongside expanding middle-class populations. Heightened awareness about the risks of chemical additives in baby nutrition is influencing buying patterns across urban and semi-urban areas. Governments across the region are also raising food safety standards and enforcing stricter organic certification norms, which boost consumer trust. Moreover, increased internet access and e-commerce adoption are making premium organic baby food products available in more remote regions, helping grow the customer base.

The Global Organic Baby Food Market remains consolidated, with major players including Hero Group, Danone S.A., The Hain Celestial Group, Abbott Laboratories, and Nestlé S.A. To enhance their market position, leading companies in the organic baby food sector are focusing on expanding product portfolios through plant-based formulations, allergen-free variants, and fortified blends for specific developmental needs. Many are investing in sustainable farming partnerships and traceability technologies to meet clean-label expectations and enhance brand trust. Businesses are also capitalizing on the e-commerce boom to widen their distribution footprint, especially in emerging markets. Collaborations with pediatricians and nutritionists help drive product credibility, while innovative, eco-friendly packaging solutions support long-term sustainability goals.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Nestlé S.A.

- Danone S.A.

- Hero Group

- The Hain Celestial Group- Inc.

- Kraft Heinz Company

- Plum Organics (Campbell Soup Company)

- Once Upon a Farm

- HiPP GmbH & Co. Vertrieb KG

- Amara Organic Foods

- Babylife Organics

- Little Spoon

- Serenity Kids

- Sprout Organic Foods- Inc.

- Tiny Organics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 210 |

| Published | June 2025 |

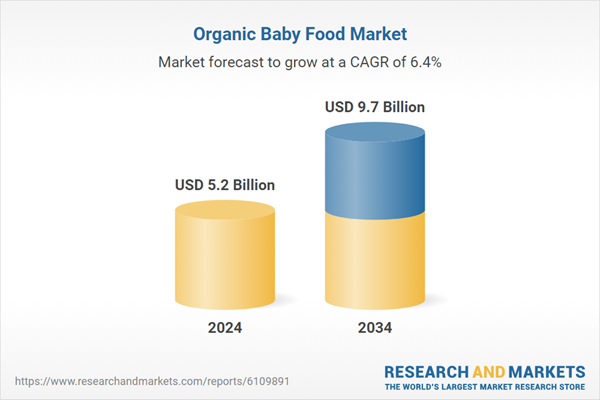

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 5.2 Billion |

| Forecasted Market Value ( USD | $ 9.7 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |